NY DTF MT-903-I 2016 free printable template

Show details

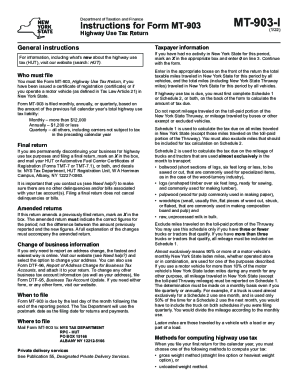

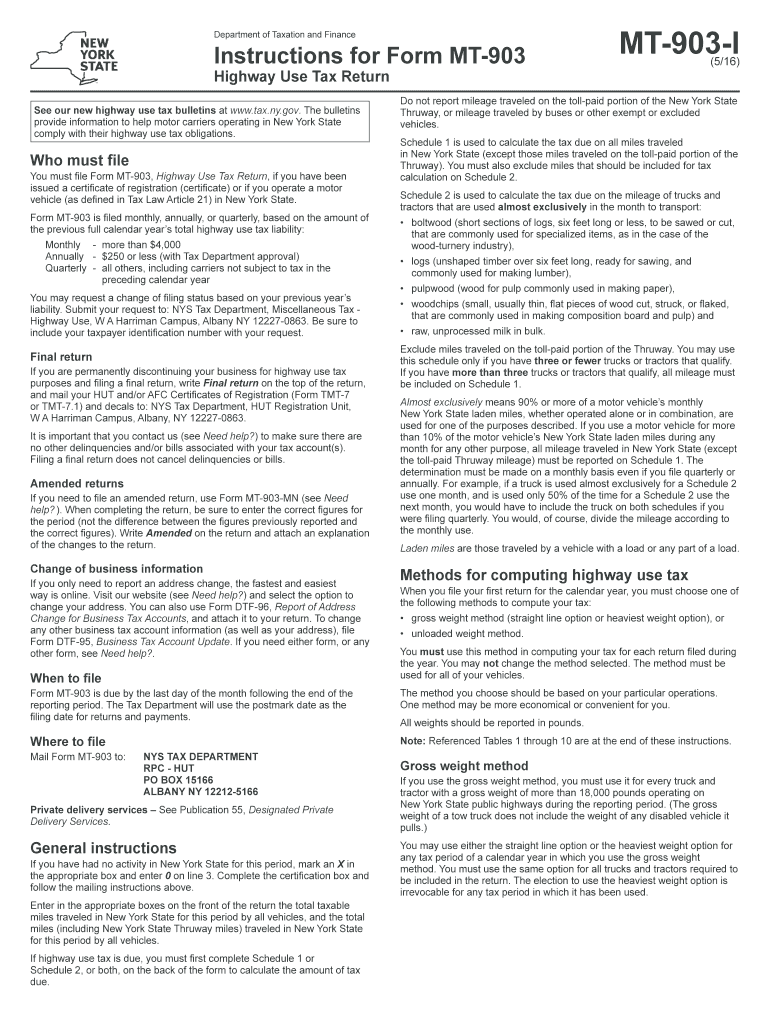

Department of Taxation and Finance Instructions for Form MT-903 MT-903-I Highway Use Tax Return See our new highway use tax bulletins at www. Filing a final return does not cancel delinquencies or bills. Amended returns If you need to file an amended return use Form MT-903-MN see Need help. Who must file You must file Form MT-903 Highway Use Tax Return if you have been issued a certificate of registration certificate or if you operate a motor vehicle as defined in Tax Law Article 21 in New...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF MT-903-I

Edit your NY DTF MT-903-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF MT-903-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF MT-903-I online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF MT-903-I. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF MT-903-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF MT-903-I

How to fill out NY DTF MT-903-I

01

Begin by obtaining the NY DTF MT-903-I form from the New York State Department of Taxation and Finance website or your local tax office.

02

Provide your name and address in the designated fields at the top of the form.

03

Indicate your Social Security Number (SSN) or Employer Identification Number (EIN) in the specified area.

04

Complete the income sections by reporting the relevant income amounts as required.

05

Fill out any adjustments, credits, or deductions that apply to your situation.

06

Review the form for accuracy and ensure that all sections are completed.

07

Sign and date the form at the bottom to affirm that the information provided is correct.

08

Submit the form according to the provided instructions, either electronically or by mailing it to the designated address.

Who needs NY DTF MT-903-I?

01

Individuals or businesses that have conducted sales or transactions that require reporting of taxes in New York State.

02

Taxpayers who have received income from sources that need to be documented for tax purposes.

03

Anyone eligible to claim certain tax credits or adjustments that require the completion of the NY DTF MT-903-I form.

Instructions and Help about NY DTF MT-903-I

Fill

form

: Try Risk Free

People Also Ask about

Is NYS accepting tax returns 2023?

The latest deadline for e-filing New York State Tax Returns is April 18, 2023.

Can you pay NYS income tax online?

Pay income tax through Online Services, regardless of how you file your return. You can pay, or schedule a payment for, any day up to and including the due date. If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date.

When can I file NY taxes 2023?

As a result, affected individuals and businesses will have until May 15, 2023, to file returns and pay any taxes that were originally due during this period. This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18.

What is the sales tax on online sales in NY?

Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax. The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

Does New York have online sales tax?

When it comes to sales tax laws, New York doesn't mess around. In fact, the state of New York was one of the first states with online sales tax laws requiring out-of-state sellers to remit sales tax to New York. Although this law was in place for decades, Supreme Court rulings prior to the South Dakota v. Wayfair Inc.

When can I file my taxes for 2023 USA?

For most taxpayers, Tuesday, April 18, 2023 was the deadline to pay taxes on income earned in 2022, also known as tax day. If you filed a tax extension, you should have paid already, but now have until Oct. 16 to file your tax return. Tax day is customarily on April 15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF MT-903-I for eSignature?

When your NY DTF MT-903-I is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I fill out NY DTF MT-903-I using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NY DTF MT-903-I and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out NY DTF MT-903-I on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your NY DTF MT-903-I. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is NY DTF MT-903-I?

NY DTF MT-903-I is a form used by taxpayers in New York State to report and claim a credit for taxes withheld on income from the state.

Who is required to file NY DTF MT-903-I?

Individuals or entities who have had New York State taxes withheld from their income and wish to claim a credit for those amounts are required to file NY DTF MT-903-I.

How to fill out NY DTF MT-903-I?

To fill out NY DTF MT-903-I, taxpayers must provide personal identifying information, report income details, specify amounts withheld, and provide any necessary documentation as required by the form.

What is the purpose of NY DTF MT-903-I?

The purpose of NY DTF MT-903-I is to enable taxpayers to claim a credit for taxes that have been withheld from their income by the state, ensuring they are not over-taxed.

What information must be reported on NY DTF MT-903-I?

The information that must be reported includes personal identification details, income information, amounts of state taxes withheld, and any other relevant financial information as specified on the form.

Fill out your NY DTF MT-903-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF MT-903-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.