Get the free et 706 2016 form - tax ny

Show details

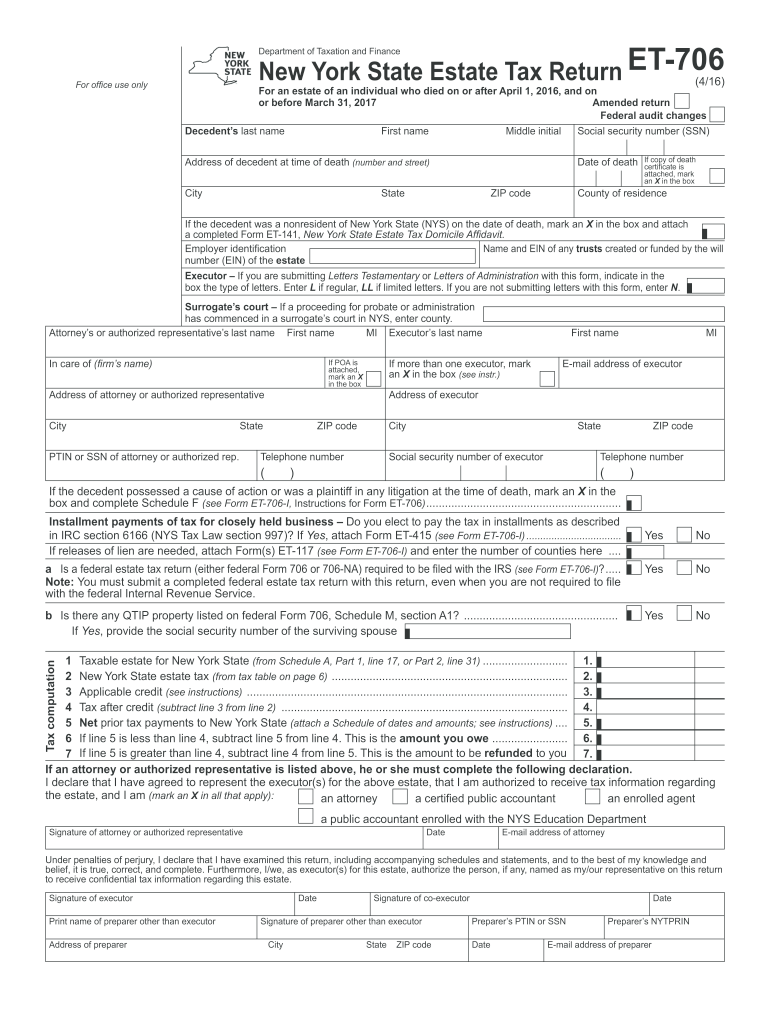

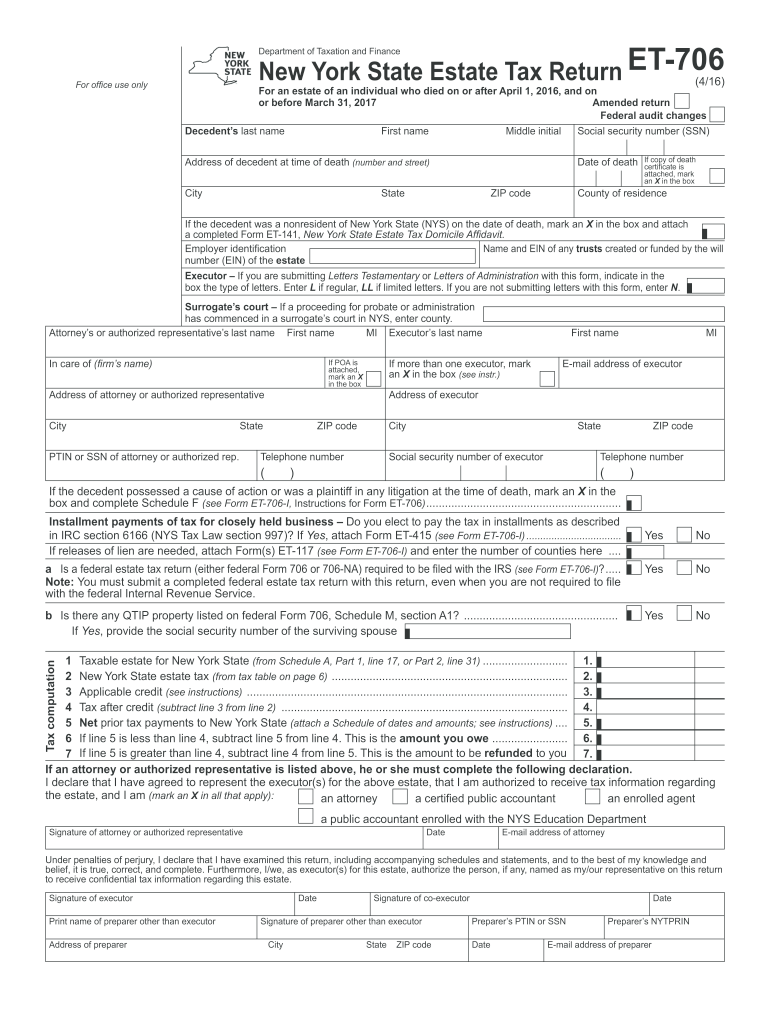

New York State Estate Tax Return ET-706 4/16 Department of Taxation and Finance For office use only For an estate of an individual who died on or after April 1 2016 and on or before March 31 2017 Amended return Federal audit changes Decedent s last name First name Middle initial Social security number SSN Address of decedent at time of death number and street City Date of death State ZIP code If copy of death certificate is attached mark an X in the box County of residence If the decedent was...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign et 706 2016 form

Edit your et 706 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et 706 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing et 706 2016 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit et 706 2016 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out et 706 2016 form

How to fill out NY DTF ET-706

01

Obtain the NY DTF ET-706 form from the New York State Department of Taxation and Finance website.

02

Fill out the taxpayer information section, including your name, address, and taxpayer identification number.

03

Determine the type of tax credit you are claiming and fill in the relevant sections.

04

Provide documentation supporting your claim, such as receipts or certifications.

05

Complete any additional required information specific to your situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form to the appropriate address as indicated in the instructions.

Who needs NY DTF ET-706?

01

Taxpayers applying for certain tax credits in New York State, such as the Empire State Child Credit or the Earned Income Tax Credit.

02

Individuals and businesses seeking to report adjustments or errors related to their tax credits.

Fill

form

: Try Risk Free

People Also Ask about

When must Form 706 be filed electing portability?

To qualify for relief for a late portability election, the estate's executor must complete and properly prepare Form 706 on or before the fifth anniversary of the decedent's date of death and must state at the top of Form 706 that it is “filed pursuant to Rev. Proc.

Do I need to file an estate tax return 706?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

What is 706 filing requirement?

You must file Form 706 to report estate and/or GST tax within 9 months after the date of the decedent's death. If you are unable to file Form 706 by the due date, you may receive an extension of time to file.

Is estate tax return 706 or 1041?

In the United States, we have two types of taxes as they relate to death–Form 706, often referred to as an estate tax return, and Form 1041, an income tax return for estates and trusts. These two forms serve different purposes and both, one, or neither may need to be filed when someone passes away.

What is the purpose of the 706 form?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit et 706 2016 form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including et 706 2016 form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send et 706 2016 form for eSignature?

et 706 2016 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit et 706 2016 form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign et 706 2016 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NY DTF ET-706?

NY DTF ET-706 is a tax form used in New York to report and claim an exemption from the state's estate tax.

Who is required to file NY DTF ET-706?

Any individual or estate that is claiming an exemption from New York estate tax may be required to file the NY DTF ET-706.

How to fill out NY DTF ET-706?

To fill out NY DTF ET-706, provide the decedent's personal information, details about the estate, and any relevant financial information as required by the form instructions.

What is the purpose of NY DTF ET-706?

The purpose of NY DTF ET-706 is to provide a declaration for the estate tax exemption and to determine the tax liability of the estate.

What information must be reported on NY DTF ET-706?

Information that must be reported on NY DTF ET-706 includes the decedent's name, date of death, property values, and any additional relevant financial details.

Fill out your et 706 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Et 706 2016 Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.