Get the free pdffiller

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pdffiller form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

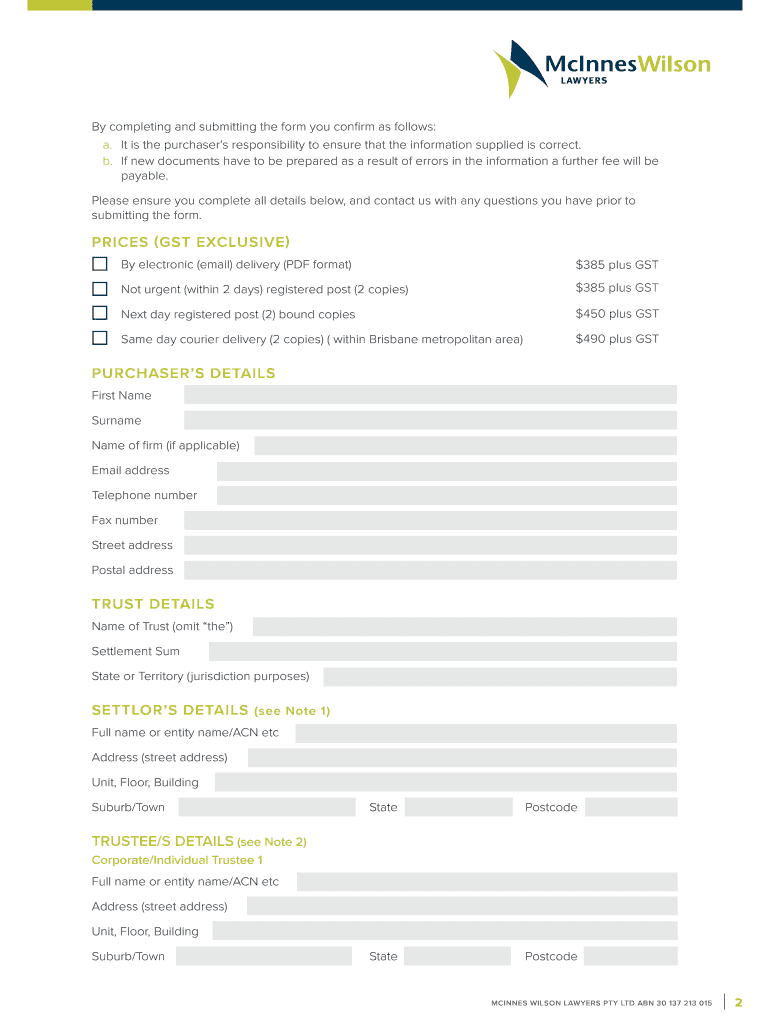

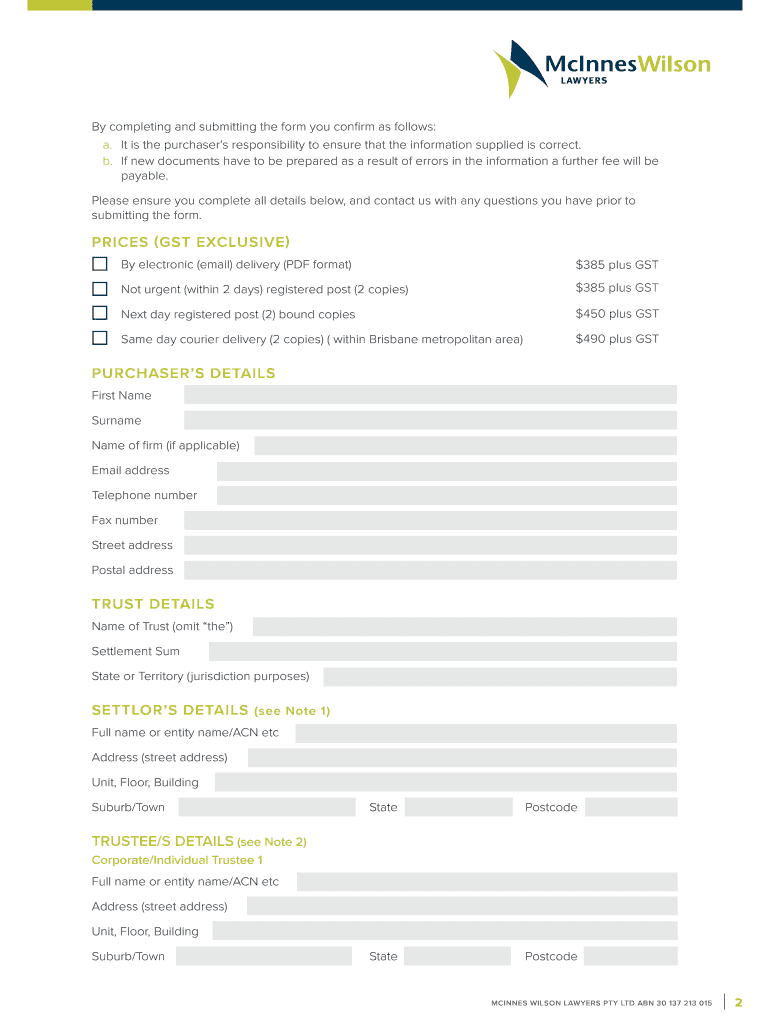

How to fill out discretionary trust deed:

01

Gather necessary information: Start by gathering all relevant information such as the names and addresses of the settlor (the person creating the trust), the trustees (those responsible for managing the trust), and the beneficiaries (those who will benefit from the trust).

02

Determine trust objectives: Clearly define the objectives of the trust, including the purpose of the trust, the assets included, and any restrictions or conditions.

03

Identify trust powers and provisions: Specify the powers and provisions that the trustees will have to administer the trust effectively. This may include investment powers, distribution guidelines, and decision-making authority.

04

Consider tax implications: Consult with a tax professional to understand any potential tax implications of the trust and ensure compliance with relevant tax laws.

05

Draft the trust deed: Use a template or consult with a legal professional to draft the trust deed. Include all necessary and agreed-upon provisions, terms, and clauses to protect the interests of the settlor, trustees, and beneficiaries.

06

Execute the deed: Sign and date the trust deed in the presence of witnesses as required by the applicable laws.

07

Register the trust (if necessary): Check with your local regulations to determine if there's a need to register the trust with any relevant authorities. Follow the necessary steps to complete the registration process.

Who needs discretionary trust deed:

01

High-net-worth individuals: Individuals with significant assets may utilize a discretionary trust to protect and manage their wealth, ensuring it is used and distributed according to their wishes.

02

Estate planning: Those seeking to plan for the smooth transfer of wealth to future generations often opt for discretionary trust deeds as part of their estate planning strategies.

03

Asset protection: Certain professionals or business owners who face potential liability risks may utilize a discretionary trust to protect their assets and limit exposure.

04

Charitable giving: Individuals interested in incorporating philanthropy within their financial planning may use discretionary trusts to allocate funds to charitable causes.

05

Family wealth management: Discretionary trusts can be used to manage and distribute family wealth, providing ongoing financial support to beneficiaries while safeguarding the assets from reckless spending or potential creditors.

In summary, filling out a discretionary trust deed involves gathering information, defining objectives, identifying trust powers, considering tax implications, drafting the deed, executing it, and potentially registering the trust. Various individuals or entities may benefit from having a discretionary trust deed, such as high-net-worth individuals, those engaged in estate planning, individuals seeking asset protection, those interested in charitable giving, and families looking to manage and distribute their wealth effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form for eSignature?

pdffiller form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out pdffiller form using my mobile device?

Use the pdfFiller mobile app to fill out and sign pdffiller form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out pdffiller form on an Android device?

Complete your pdffiller form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

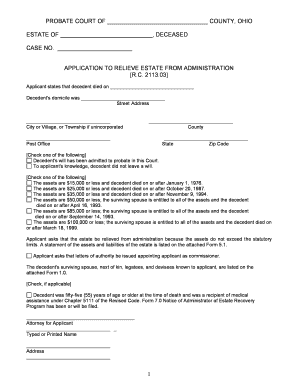

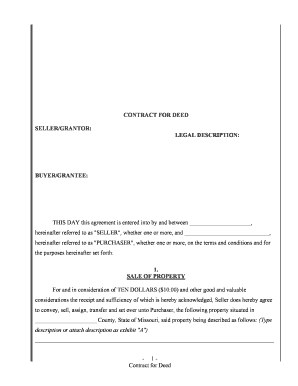

What is discretionary trust deed?

A discretionary trust deed is a legal document that establishes a trust where the trustee has the discretion to decide how the trust assets are distributed.

Who is required to file discretionary trust deed?

The settlor or trustee of the discretionary trust is required to file the trust deed.

How to fill out discretionary trust deed?

To fill out a discretionary trust deed, the settlor or trustee must provide detailed information about the trust assets, beneficiaries, and distribution instructions.

What is the purpose of discretionary trust deed?

The purpose of a discretionary trust deed is to provide flexibility in how trust assets are distributed, allowing the trustee to adapt to changing circumstances.

What information must be reported on discretionary trust deed?

The discretionary trust deed must include details of the trust assets, beneficiaries, trustee powers, and any specific instructions for asset distribution.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.