IRS 1120-H 2016 free printable template

Show details

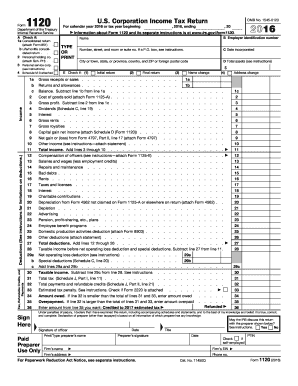

Form 1120-H Department of the Treasury Internal Revenue Service U.S. Income Tax Return for Homeowners Associations OMB No. 1545-0123 Information about Form 1120-H and its separate instructions is at www.irs.gov/form1120h. For calendar year 2016 or tax year beginning 2016 and ending Name TYPE OR PRINT Employer identification number Number street and room or suite no. Form 1120-H Department of the Treasury Internal Revenue Service U*S* Income Tax Return for Homeowners Associations OMB No*...1545-0123 Information about Form 1120-H and its separate instructions is at www*irs*gov/form1120h. For calendar year 2016 or tax year beginning 2016 and ending Name TYPE OR PRINT Employer identification number Number street and room or suite no. If a P. O. box see instructions. Date association formed City or town state or province country and ZIP or foreign postal code Check if Final return Name change Address change Amended return Check type of homeowners association Condominium management...association Residential real estate association Timeshare association A B Total exempt function income. Must meet 60 gross income test. See instructions. C Total expenditures made for purposes described in 90 expenditure test. See instructions. D Association s total expenditures for the tax year. See instructions. Tax-exempt interest received or accrued during the tax year. E Gross Income excluding exempt function income Dividends. Taxable interest. Gross rents. Gross royalties. Capital gain net...income attach Schedule D Form 1120. Net gain or loss from Form 4797 Part II line 17 attach Form 4797. Other income excluding exempt function income attach statement. Deductions directly connected to the production of gross income excluding exempt function income Salaries and wages. Repairs and maintenance. Rents. Taxes and licenses. Interest. Depreciation attach Form 4562. Other deductions attach statement. Total deductions. Add lines 9 through 15. Taxable income before specific deduction of...100. Subtract line 16 from line 8 Specific deduction of 100. Tax and Payments. Refunded 23g Under penalties of perjury I declare that I have examined this return including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. Date Signature of officer Paid Preparer Use Only Print/Type preparer s name Firm s name Preparer s...signature Sign Here Enter 30 0. 30 of line 19. Timeshare associations enter 32 0. 32 of line 19. Tax credits see instructions. Total tax. Subtract line 21 from line 20. See instructions for recapture of certain credits a 2015 overpayment credited to 2016 23a b 2016 estimated tax payments. 23b c Total 23c d Tax deposited with Form 7004. 23d e Credit for tax paid on undistributed capital gains attach Form 2439. 23e f Credit for federal tax paid on fuels attach Form 4136. 23f g Add lines 23c...through 23f. Amount owed* Subtract line 23g from line 22.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-H

How to edit IRS 1120-H

How to fill out IRS 1120-H

Instructions and Help about IRS 1120-H

How to edit IRS 1120-H

Editing IRS 1120-H requires careful attention to ensure all information remains accurate. Use pdfFiller's editing tools to modify any fields on the form directly. Ensure to save changes frequently to avoid data loss and maintain version control.

How to fill out IRS 1120-H

To fill out IRS 1120-H correctly, follow these steps:

01

Download the form from the IRS website or use pdfFiller to access it directly.

02

Provide the name and address of the homeowners association (HOA) at the top of the form.

03

Complete the sections detailing income and deductions relevant to the HOA.

04

Review the form for accuracy before submitting.

About IRS 1120-H 2016 previous version

What is IRS 1120-H?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-H 2016 previous version

What is IRS 1120-H?

IRS 1120-H is a tax form specifically designed for homeowners associations (HOAs) to report their income and deductions. This form allows HOAs that meet specific criteria to benefit from a simplified tax structure and potentially minimize their tax liability.

What is the purpose of this form?

The primary purpose of IRS 1120-H is to facilitate the tax filing process for homeowners associations by providing a streamlined means of reporting their financial activities to the IRS. This form ensures that eligible HOAs can report their income in a manner that reflects their tax-exempt status, as allowed under IRS regulations.

Who needs the form?

Homeowners associations with gross receipts of $100,000 or less and that meet IRS eligibility criteria must file IRS 1120-H. This form is specifically relevant for associations that want to maintain tax-exempt status while reporting income received from dues, assessments, and other sources.

When am I exempt from filling out this form?

Homeowners associations are exempt from filing IRS 1120-H if their annual gross receipts exceed $100,000 or if they fail to meet other IRS requirements. Additionally, if the association is classified as a 501(c)(7) organization with specific income types, it may also be exempt from this form.

Components of the form

IRS 1120-H consists of several key components, including sections for reporting income, allowable deductions, and determining the HOA's taxable income. Additionally, the form requires a declaration to affirm eligibility for the simplified reporting procedure associated with this form.

What are the penalties for not issuing the form?

Failing to file IRS 1120-H on time can result in penalties. The IRS imposes a late filing penalty, which can be a percentage of the unpaid tax, and may also lead to interest on any outstanding tax balance. It is crucial for associations to understand these implications to avoid such financial repercussions.

What information do you need when you file the form?

When filing IRS 1120-H, the homeowners association should gather essential information, including:

01

Name and address of the HOA

02

Total income received

03

Detailed deduction records

04

Information verifying eligibility for the simplified tax form

Is the form accompanied by other forms?

IRS 1120-H typically does not require accompanying schedules or forms unless specific deductions or additional reporting is necessary. However, associations must ensure that all information provided is accurate, which may necessitate documentation to support their claims.

Where do I send the form?

Completed IRS 1120-H forms must be sent to the appropriate IRS address specified in the instructions for the form. The submission address may vary based on the state of residence for the homeowners association, so it is important to verify the correct mailing location before sending.

See what our users say