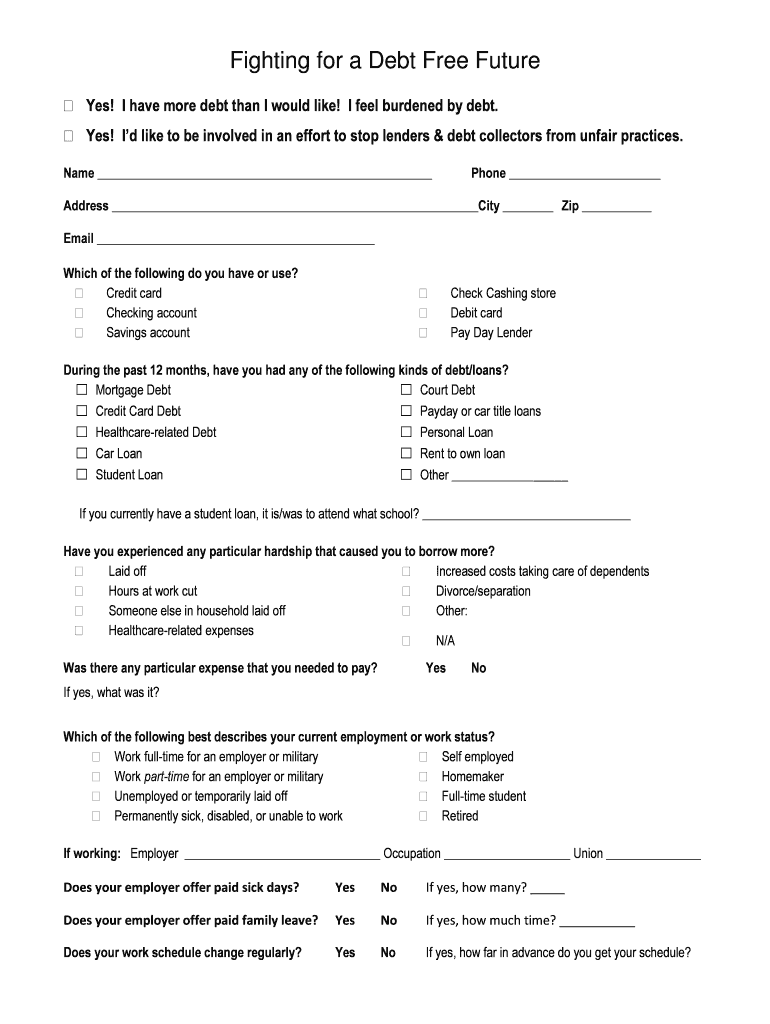

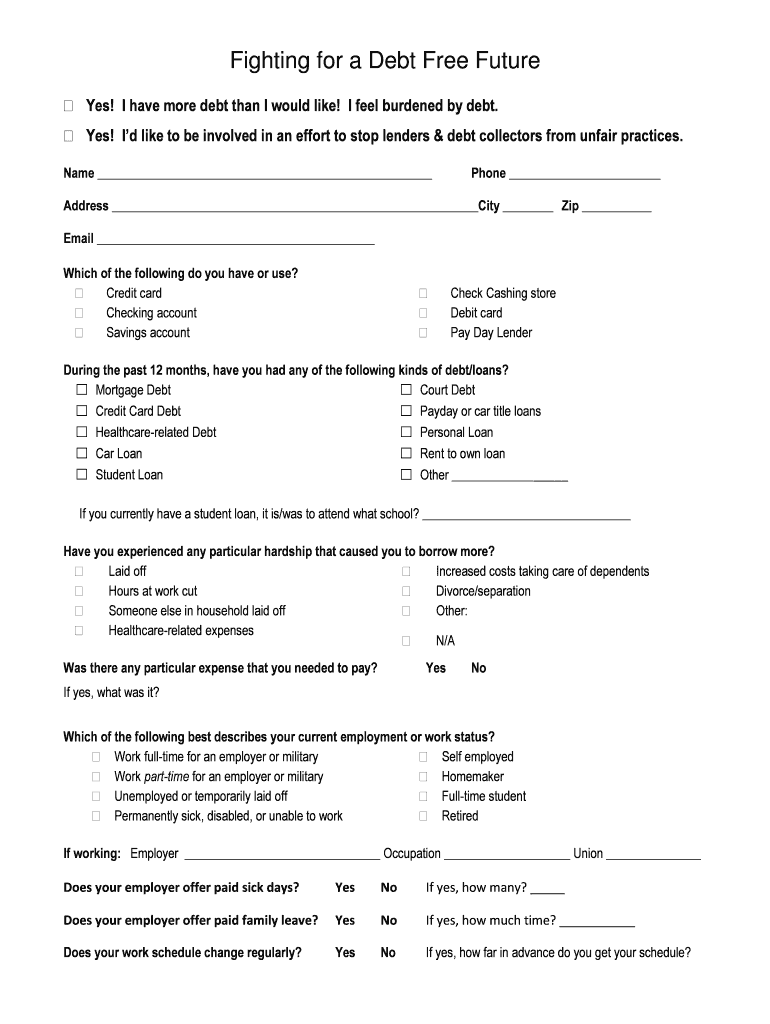

Get the Fighting for a Debt Free Future - aft

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fighting for a debt

Edit your fighting for a debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fighting for a debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fighting for a debt online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fighting for a debt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fighting for a debt

How to fill out fighting for a debt:

01

Gather all relevant documentation: Start by collecting all necessary documents related to the debt, including loan agreements, invoices, payment receipts, and any other correspondence related to the debt. These documents will serve as evidence during the dispute process.

02

Review the terms and conditions: Carefully go through the terms and conditions of the debt agreement to understand your rights and obligations. Pay attention to details such as interest rates, payment schedules, and any clauses that might be relevant to your case.

03

Communicate with the creditor: Before taking legal action, it's important to communicate with the creditor to address the issue. Contact them and explain your concerns or disputes regarding the debt. Keep a record of all conversations and correspondence for future reference. It's possible that the issue can be resolved amicably through negotiations or a payment plan.

04

Consult with a lawyer: If the dispute cannot be resolved through communication, it may be necessary to seek legal advice. Consult with a lawyer who specializes in debt collection or consumer law. They can guide you through the legal process, assess the strength of your case, and provide you with the best course of action.

05

File a formal complaint or dispute: If all attempts to resolve the debt issue fail, you may need to file a formal complaint or dispute with the applicable authority. This could involve submitting a complaint to a consumer protection agency, filing a dispute with a credit reporting agency, or initiating legal proceedings in court, depending on the nature of the debt.

Who needs fighting for a debt?

01

Individuals facing unjust or incorrect debt claims: Sometimes, individuals find themselves in a situation where they are being pursued for a debt they believe they do not owe or for an amount that is incorrect. These individuals may need to fight for their rights and protect themselves from unwarranted financial burdens.

02

Consumers experiencing harassment or unethical debt collection practices: Unfortunately, some debt collectors may engage in unethical practices, such as constant harassment, misleading statements, or threats. Consumers who face such treatment may choose to fight for their debt to ensure fair treatment and protection from abusive practices.

03

Businesses dealing with non-payment or breach of contract: Businesses can also find themselves in a position of fighting for a debt when customers fail to make payments or breach contractual obligations. In such cases, businesses may need to explore legal avenues to recover the debt owed to them and protect their own financial stability.

In summary, fighting for a debt requires gathering documentation, reviewing terms, communicating with the creditor, seeking legal advice if necessary, and filing a formal complaint or dispute. People who need to fight for a debt include those facing unjust claims, experiencing harassment from debt collectors, or businesses dealing with non-payment or breach of contract situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fighting for a debt in Chrome?

fighting for a debt can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my fighting for a debt in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your fighting for a debt and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit fighting for a debt on an Android device?

The pdfFiller app for Android allows you to edit PDF files like fighting for a debt. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your fighting for a debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fighting For A Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.