Get the free Choosing a super fund - Standard choice form - Hesta

Show details

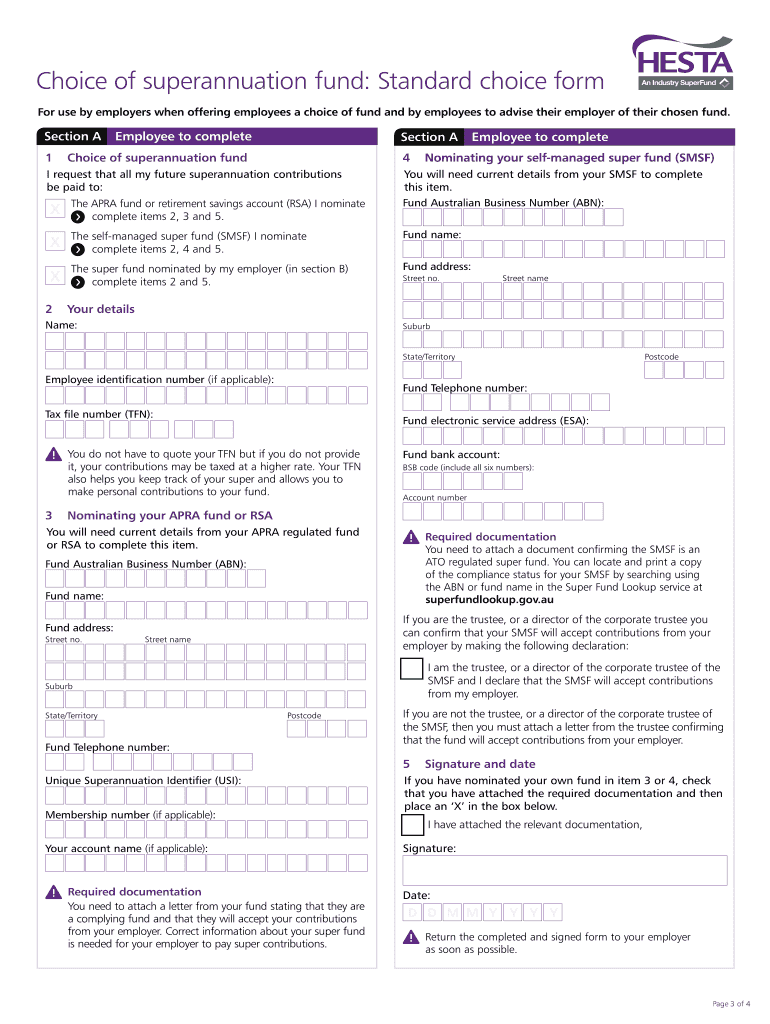

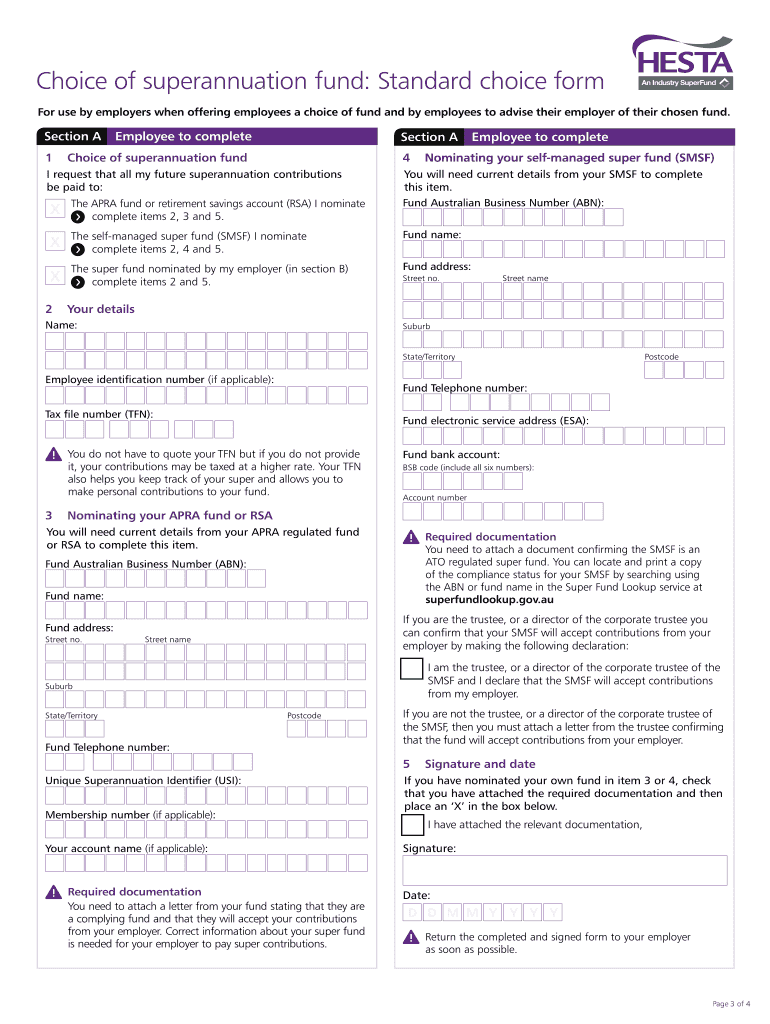

Use this form to advise an employer of your choice of super fund. ... known as your default fund, before giving the form to employees. .... at 1 March 2016.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign choosing a super fund

Edit your choosing a super fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your choosing a super fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing choosing a super fund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit choosing a super fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out choosing a super fund

How to Fill Out Choosing a Super Fund:

01

Research different super funds: Start by gathering information on different super funds available. Look into their fees, performance, investment options, insurance offerings, and other important factors.

02

Compare the features: Once you have a list of potential super funds, compare their features side by side. Consider factors like fees and charges, investment returns, customer service, and any additional benefits they may offer.

03

Assess your needs and goals: Consider your personal financial goals and needs when selecting a super fund. Think about your risk tolerance, investment timeframe, and desired retirement lifestyle. Consider whether a fund aligns with your investment objectives.

04

Consider insurance options: Check if the super fund offers insurance options like life insurance, total and permanent disability (TPD) insurance, and income protection insurance. Assess whether these coverages align with your needs and evaluate the associated costs.

05

Check the fund's performance: Review the historical performance of the super funds you are considering. Look at their average returns over different time periods and compare them to industry benchmarks. Remember, past performance does not guarantee future results.

06

Read the product disclosure statement (PDS): The PDS provides important information about the super fund's key features, fees, investment options, and any potential risks. Read it carefully before making a decision.

07

Seek professional advice if needed: If you are unsure or need personalized guidance, consider consulting a financial advisor or superannuation specialist. They can help you understand the complexities of choosing a super fund and provide personalized recommendations based on your circumstances.

Who needs choosing a super fund?

01

Individuals starting their careers: Choosing a suitable super fund is essential for individuals who have just started their careers. It allows them to begin saving for retirement early and take advantage of potential compound growth over time.

02

People changing jobs: Whenever you change jobs, you have the opportunity to choose a new super fund or continue with your existing one. It's important to consider the best fund for your current circumstances and make an informed decision.

03

Those wanting to consolidate their super: If you have multiple super accounts from different jobs, it may be beneficial to consolidate them into a single fund. This simplifies management and reduces unnecessary fees.

04

Self-employed individuals: Being self-employed means you are responsible for your own super contributions. It is crucial to choose a super fund that aligns with your needs and helps you plan for retirement effectively.

05

Individuals seeking better investment options: If you are dissatisfied with the investment options or performance of your current super fund, exploring other options can potentially improve your long-term financial outlook.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit choosing a super fund from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including choosing a super fund. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit choosing a super fund in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing choosing a super fund and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out choosing a super fund on an Android device?

On an Android device, use the pdfFiller mobile app to finish your choosing a super fund. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is choosing a super fund?

Choosing a super fund is the process of selecting a fund to invest your retirement savings in.

Who is required to file choosing a super fund?

Anyone who is eligible to choose a super fund is required to file.

How to fill out choosing a super fund?

You can fill out choosing a super fund by researching different funds, comparing their features, and selecting the one that best fits your retirement goals.

What is the purpose of choosing a super fund?

The purpose of choosing a super fund is to grow your retirement savings and provide financial security in your retirement years.

What information must be reported on choosing a super fund?

You must report your personal details, fund choice, investment options, and contribution details.

Fill out your choosing a super fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Choosing A Super Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.