Get the free eMortgage Glossary

Show details

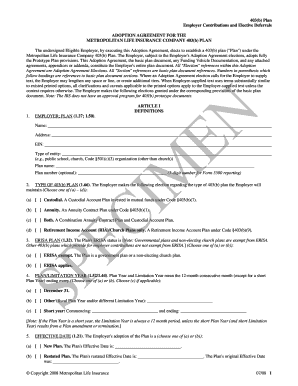

Mortgage Glossary1MISMO mortgage Glossary

Document StatusFinalDocument Date May 5, 2016EditorsRachael Sokolowski, Magnolia Technologies, rsokolowski×magnolia tech.comContributorsNancy Alley, Simplified

Marc

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign emortgage glossary

Edit your emortgage glossary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your emortgage glossary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing emortgage glossary online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit emortgage glossary. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out emortgage glossary

How to Fill Out an eMortgage Glossary:

01

Start by obtaining a copy of the eMortgage glossary. This can typically be found on the website or platform where you are completing your mortgage application.

02

Familiarize yourself with the terms and definitions listed in the glossary. Take the time to read through each term and make note of any unfamiliar concepts or jargon.

03

Cross-reference the glossary with your mortgage application. As you go through the application, identify any terms or phrases that are listed in the glossary.

04

For each term or phrase that you come across, refer to the glossary for its definition. Make sure you understand what the term means before proceeding with the application.

05

If there are any terms or definitions that are still unclear, conduct further research to gain a better understanding. You can utilize online resources, consult with a mortgage expert, or reach out to your lender for clarification.

06

As you fill out your mortgage application, use the eMortgage glossary as a reference guide. Double-check that you are using the appropriate terms and understand their meaning in the context of the application.

07

If there are any terms or definitions missing from the glossary that you encounter during the application process, consider reaching out to the platform or lender to request clarification or an updated glossary.

Who Needs an eMortgage Glossary?

01

Individuals applying for a mortgage: Whether you are a first-time homebuyer or a seasoned homeowner, an eMortgage glossary can be valuable in understanding the terminology used throughout the application process. It helps ensure that you are well-informed and can make informed decisions.

02

Mortgage brokers and lenders: Professionals in the mortgage industry often need to stay updated on the latest terminology and regulations. Having an eMortgage glossary readily available allows them to accurately communicate with clients and provide the necessary guidance.

03

Real estate agents and professionals: Professionals involved in real estate transactions can benefit from having an eMortgage glossary on hand. It helps them understand mortgage terminologies when assisting clients with their home buying needs.

04

Anyone interested in learning about mortgages: Even if you are not currently in the process of applying for a mortgage, having access to an eMortgage glossary can be informative. It allows you to expand your knowledge of the mortgage industry and better understand the terminology used in real estate transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute emortgage glossary online?

pdfFiller makes it easy to finish and sign emortgage glossary online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit emortgage glossary online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your emortgage glossary and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit emortgage glossary straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing emortgage glossary.

What is emortgage glossary?

Emortgage glossary is a document that defines and explains key terms and phrases related to electronic mortgages.

Who is required to file emortgage glossary?

Lenders and financial institutions are required to file emortgage glossary.

How to fill out emortgage glossary?

Emortgage glossary can be filled out by providing definitions and explanations for terms commonly used in electronic mortgage transactions.

What is the purpose of emortgage glossary?

The purpose of emortgage glossary is to ensure clarity and understanding in electronic mortgage transactions by defining key terms.

What information must be reported on emortgage glossary?

Emortgage glossary must report definitions for terms like eNote, eClosing, and eVault.

Fill out your emortgage glossary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Emortgage Glossary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.