Get the free IN TRUST

Show details

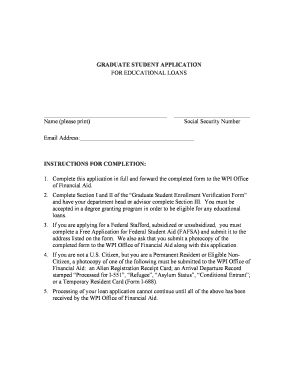

STANDARDIZED IN TRUST CALCULATION SPECIALISTS IN INSURANCE AGENCY ACCOUNTING AND CONSULTING SINCE 1977 Date: Agency: Prepared By: Reviewed By: Cash Premium Trust Accounts Receivable LESS: Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in trust

Edit your in trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in trust online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit in trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in trust

How to Fill Out a Trust:

01

Begin by gathering all the necessary information and documents. This may include the names and addresses of the trust creator(s), beneficiaries, and trustees, as well as any specific assets or properties involved.

02

Choose the type of trust you want to create. There are various types of trusts, such as revocable trusts, irrevocable trusts, or living trusts. Consider consulting with an attorney or financial advisor to determine which type best suits your needs.

03

Identify and name all the parties involved in the trust. This includes the trustor (the person creating the trust), the trustee (the person or institution responsible for managing the trust), and the beneficiaries (those who will benefit from the trust).

04

Clearly outline the terms and conditions of the trust. Specify how the trust assets should be managed and distributed, including any specific instructions or restrictions you wish to impose. This may include conditions for disbursement, such as age limits or educational requirements for beneficiaries.

05

Assign a successor trustee. It's important to designate someone who will take over managing the trust in the event that the original trustee is unable or unwilling to fulfill their duties. Make sure to discuss this responsibility with the designated successor and obtain their consent.

06

Review the trust document carefully for accuracy and clarity. Ensure that all necessary provisions have been included and that there are no inconsistencies or errors. Consider having an attorney or legal professional review the document as well to verify its validity.

Who Needs a Trust:

01

Individuals with significant assets may benefit from creating a trust to protect and preserve their wealth. A trust can offer asset protection from creditors, estate tax planning benefits, and control over how assets are distributed after the trustor's death.

02

Parents who want to ensure their minor children are provided for in the event of their untimely death can utilize a trust. By designating a trustee and outlining specific instructions for the management and distribution of assets, parents can have peace of mind knowing their children's financial needs will be met.

03

Individuals who wish to maintain privacy in their estate planning may opt for a trust. Unlike a will, which becomes public record upon probate, a trust allows for a more confidential and discreet transfer of assets.

Note: It is essential to consult with a qualified professional, such as an attorney or financial advisor, to ensure that creating a trust aligns with your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in trust for eSignature?

Once you are ready to share your in trust, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete in trust online?

pdfFiller makes it easy to finish and sign in trust online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit in trust on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign in trust right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is in trust?

In trust refers to the legal arrangement where one party holds assets on behalf of another party.

Who is required to file in trust?

Individuals or entities who hold assets on behalf of another party are required to file in trust.

How to fill out in trust?

To fill out in trust, one must provide detailed information about the assets being held and the parties involved.

What is the purpose of in trust?

The purpose of in trust is to ensure that assets are held and managed responsibly on behalf of another party.

What information must be reported on in trust?

Information such as the value of the assets, the identity of the parties involved, and the terms of the trust must be reported.

Fill out your in trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.