Get the free ANTI-MONEY LAUNDERING (AML) PROGRAM

Show details

12ANTIMONEY LAUNDERING (AML) PROGRAMofEvery MSB is required by law to have an effective Antimony Laundering (AML) Program. This program must:Bank Secrecy Act & Antimony Laundering (BSA/AML) TRUSTEE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering aml program

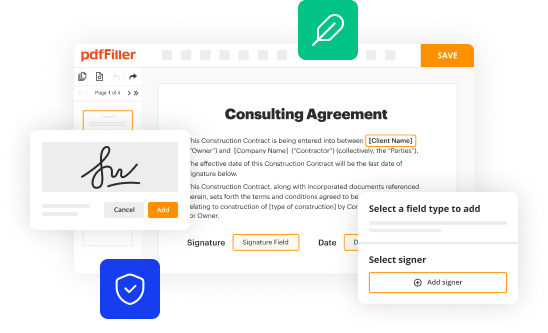

Edit your anti-money laundering aml program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering aml program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing anti-money laundering aml program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit anti-money laundering aml program. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering aml program

How to fill out an anti-money laundering (AML) program:

01

Conduct a risk assessment: Identify and evaluate the money laundering and terrorist financing risks your business may encounter. This includes assessing your customer base, products or services offered, and geographic locations of operation.

02

Develop written policies and procedures: Create comprehensive policies and procedures tailored to your business operations and risk profile. These should clearly outline your AML program, including customer due diligence, transaction monitoring, record-keeping, and reporting suspicious activities.

03

Appoint a designated compliance officer: Assign a responsible individual to oversee and implement your AML program. This person should possess knowledge of AML laws and regulations and ensure ongoing compliance.

04

Establish customer due diligence procedures: Develop procedures to verify the identity of your customers, including obtaining relevant identification documents, understanding the nature and purpose of customer relationships, and conducting ongoing monitoring for any unusual or suspicious activities.

05

Implement an ongoing monitoring system: Set up a system to continuously monitor customer transactions and activities for any signs of money laundering or illicit activities. This may involve using technological solutions or manual reviews depending on the size and complexity of your business.

06

Train employees: Provide appropriate AML training to all employees. They need to understand the risks, policies, and procedures outlined in your program. Regular training sessions should be conducted to keep your staff updated on emerging trends and regulatory changes.

07

Maintain proper record-keeping: Establish systems and processes to retain records of customer information, transactions, and internal AML reports. These records should be easily accessible for audit purposes and retained for the required period as outlined by regulations.

08

Conduct independent audits: Regularly assess the effectiveness of your AML program through independent audits or internal reviews. This helps identify any weaknesses or deficiencies that need to be addressed promptly.

Who needs an anti-money laundering (AML) program:

01

Financial institutions: Banks, credit unions, and other financial institutions are required by law to have robust AML programs to prevent money laundering and terrorist financing.

02

Money service businesses: Providers of money transfer, currency exchange, check cashing, prepaid cards, and other money services are subject to AML regulations and must implement appropriate programs.

03

Securities firms: Broker-dealers, investment advisors, and other participants in the securities industry must have AML programs to detect and report suspicious activities related to securities transactions.

04

Casinos and gaming establishments: Due to the nature of large cash transactions, casinos and gaming establishments are required to have AML programs to monitor and report suspicious activities.

05

Non-financial businesses: Some non-financial businesses, such as real estate agencies, jewelers, and precious metal dealers, may be considered high-risk for money laundering and should implement AML programs.

Note: The specific requirements for an AML program may vary depending on the jurisdiction and industry. It is essential to stay updated with local regulations and seek legal advice if necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit anti-money laundering aml program in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing anti-money laundering aml program and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out anti-money laundering aml program using my mobile device?

Use the pdfFiller mobile app to fill out and sign anti-money laundering aml program. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit anti-money laundering aml program on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as anti-money laundering aml program. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is anti-money laundering aml program?

Anti-money laundering (AML) program is a set of procedures and regulations designed to prevent the illegal generation of income.

Who is required to file anti-money laundering aml program?

Financial institutions such as banks, credit unions, and money service businesses are required to file AML programs.

How to fill out anti-money laundering aml program?

To fill out an AML program, one must adhere to the regulations set by the Financial Crimes Enforcement Network (FinCEN) and include necessary information such as customer identification procedures and suspicious activity reporting.

What is the purpose of anti-money laundering aml program?

The purpose of an AML program is to detect and prevent money laundering activities, terrorist financing, and other financial crimes.

What information must be reported on anti-money laundering aml program?

Information such as customer identities, transaction details, and any suspicious activities must be reported on an AML program.

Fill out your anti-money laundering aml program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Aml Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.