Get the free STANDARD LIFE GARS Pension - Standard Life Servicebox - servicebox standardlife

Show details

27. Del. 2010 ... November 2010 / NR. 12. Unfair née L sung f r Pensionsfonds: STANDARD LIFE GARS Pension.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard life gars pension

Edit your standard life gars pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard life gars pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standard life gars pension online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard life gars pension. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard life gars pension

How to fill out Standard Life GARS pension:

01

Begin by gathering all necessary documents, such as your identification, proof of age, and financial information.

02

Visit the Standard Life GARS pension website or contact their customer service for the application form.

03

Fill out the application form accurately and provide all required information, such as your personal details, employment history, and pension contributions.

04

If you have any additional pension schemes or savings, make sure to disclose them in the application form.

05

Ensure that you understand and choose the investment options that best align with your financial goals and risk tolerance.

06

If you have any questions or need assistance with the application, reach out to the Standard Life GARS pension customer service for guidance.

07

Double-check all the information before submitting the application to avoid any discrepancies or errors.

08

If necessary, consult with a financial advisor to ensure that your pension plan aligns with your long-term retirement goals.

09

Once the application is submitted, wait for a confirmation or acknowledgement from Standard Life GARS pension regarding the status of your application.

Who needs Standard Life GARS pension?

01

Individuals who are looking to secure their financial future and ensure a stable income stream during retirement may consider opting for Standard Life GARS pension.

02

Those who desire a pension plan that offers flexible investment options and potentially higher returns may find Standard Life GARS pension appealing.

03

Individuals who want to have control over their pension investments and prefer a self-invested approach may benefit from Standard Life GARS pension.

04

People who are eligible for workplace pensions but wish to have additional savings to supplement their retirement income may also find Standard Life GARS pension valuable.

05

Those who want the peace of mind of having a reputable and trusted company manage their pension funds may choose Standard Life GARS pension as their provider.

06

Individuals who are willing to commit to long-term savings and investment strategies to build a substantial retirement fund may explore Standard Life GARS pension.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my standard life gars pension directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your standard life gars pension and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit standard life gars pension from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your standard life gars pension into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute standard life gars pension online?

Easy online standard life gars pension completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is standard life gars pension?

Standard Life GARS Pension is a retirement savings plan offered by Standard Life for individuals to save for their retirement.

Who is required to file standard life gars pension?

Individuals who have a Standard Life GARS Pension account and are contributing to it are required to file the necessary documentation related to their pension plan.

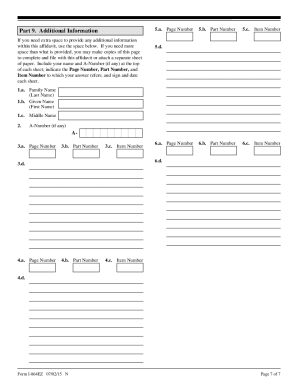

How to fill out standard life gars pension?

To fill out Standard Life GARS Pension, individuals need to provide personal information, contribution amount, investment choices, and beneficiary details on the required forms or online platform.

What is the purpose of standard life gars pension?

The purpose of Standard Life GARS Pension is to help individuals save for their retirement by providing a tax-efficient investment vehicle with potential growth over the long term.

What information must be reported on standard life gars pension?

Information such as personal details, contribution amounts, investment allocations, beneficiary information, and any changes to the pension plan must be reported on Standard Life GARS Pension documents.

Fill out your standard life gars pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Life Gars Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.