Get the free Budgeting and Personal Finances

Show details

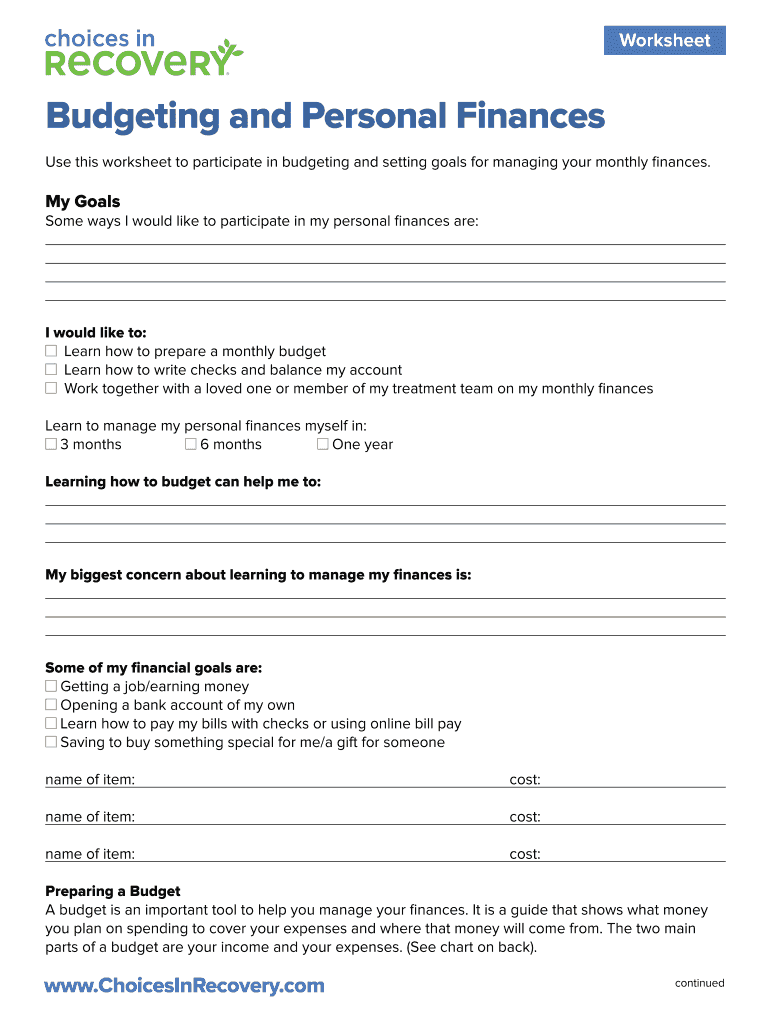

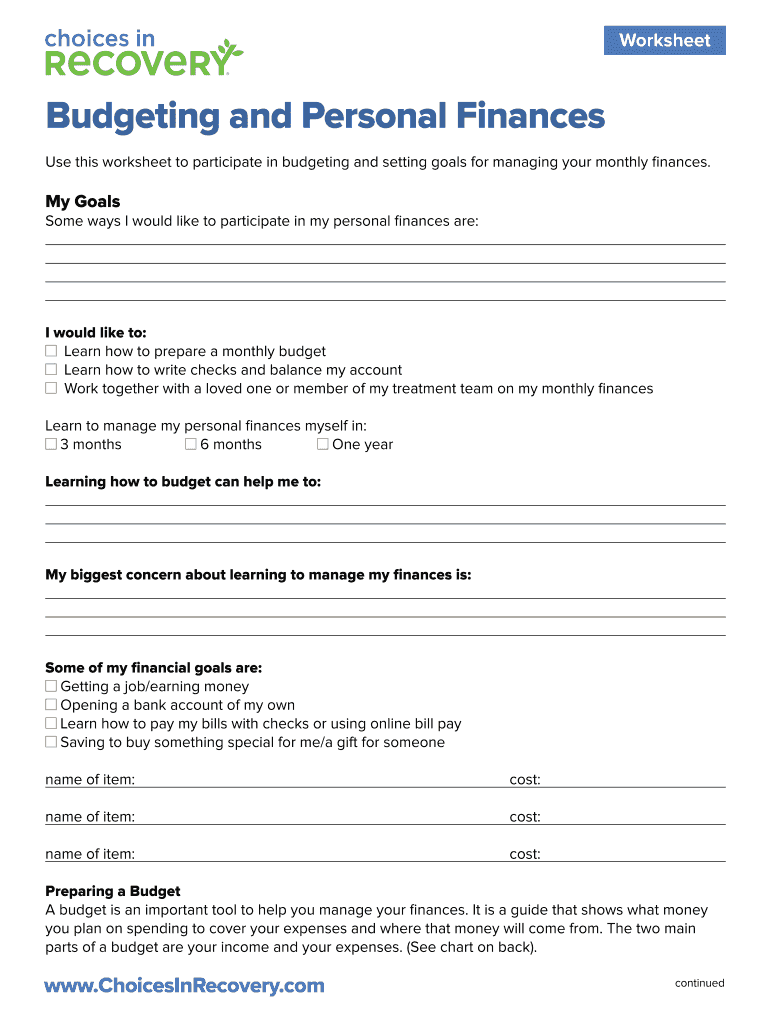

WorksheetBudgeting and Personal Finances

Use this worksheet to participate in budgeting and setting goals for managing your monthly finances. My Goals

Some ways I would like to participate in my personal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budgeting and personal finances

Edit your budgeting and personal finances form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budgeting and personal finances form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit budgeting and personal finances online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit budgeting and personal finances. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budgeting and personal finances

Point by point guide on how to fill out budgeting and personal finances:

01

Start by assessing your current financial situation: Take a close look at your income, expenses, and debts. Calculate your monthly income and identify all your expenses, including fixed expenses like rent or mortgage payments, utility bills, and insurance. Also, include variable expenses such as groceries, entertainment, and transportation costs. Don't forget to consider any outstanding debts you have.

02

Set clear financial goals: Determine what you want to achieve with your finances. It could be saving for a down payment on a house, paying off debt, or planning for retirement. Establish specific, realistic, and measurable goals that you can work towards.

03

Create a budget: Based on your income and expenses, create a budget that allocates your money effectively. Categorize your expenses into essential and non-essential items. Consider saving at least 20% of your income or as much as you can for emergencies or future financial goals. Prioritize your spending and make adjustments where necessary, ensuring that your expenses do not exceed your income.

04

Track your spending: Monitor your expenses regularly to ensure that you are sticking to your budget. Use technology tools like budgeting apps or spreadsheets to input and categorize your expenses. This will help you identify any areas where you may be overspending and allow you to make necessary adjustments to stay on track.

05

Reduce unnecessary spending: Review your expenses and identify areas where you can cut back. Look for subscriptions, memberships, or services that you no longer use or need. Consider reducing discretionary expenses such as dining out or entertainment. Cutting back on these expenses can free up more money to allocate towards your financial goals.

06

Pay off debts strategically: If you have outstanding debts, create a plan to pay them off. Prioritize high-interest debts first while making minimum payments on others. Consider strategies like the debt snowball method (paying off debts from smallest to largest) or the debt avalanche method (paying off debts with the highest interest rates first).

07

Build an emergency fund: Set aside money each month to build a financial safety net. Aim to save at least three to six months' worth of living expenses in case of unexpected emergencies or job loss. Having an emergency fund will prevent you from relying on credit cards or taking on additional debt in difficult times.

08

Seek professional advice when needed: If you are unsure about managing your finances or need help with complex financial matters, consider consulting with a financial advisor. They can provide guidance tailored to your specific situation and help you make informed decisions to achieve your financial goals.

Who needs budgeting and personal finances?

01

Individuals who want to take control of their financial situation and achieve their financial goals.

02

People who want to track their spending, reduce debt, and improve their financial habits.

03

Those who are planning for major life events such as buying a home, getting married, starting a family, or retiring.

04

Business owners or entrepreneurs who need to manage personal and business finances effectively.

05

Anybody looking to improve their financial literacy and make better financial decisions for themselves and their families.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my budgeting and personal finances in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your budgeting and personal finances and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute budgeting and personal finances online?

pdfFiller makes it easy to finish and sign budgeting and personal finances online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit budgeting and personal finances on an Android device?

You can make any changes to PDF files, such as budgeting and personal finances, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is budgeting and personal finances?

Budgeting and personal finances refer to the process of creating a plan for how to spend and save money, as well as managing expenses and income.

Who is required to file budgeting and personal finances?

Individuals are typically required to file budgeting and personal finances to track their financial status and make informed decisions about money management.

How to fill out budgeting and personal finances?

To fill out budgeting and personal finances, individuals need to gather information on their income, expenses, savings, debts, and financial goals, and create a detailed budget plan.

What is the purpose of budgeting and personal finances?

The purpose of budgeting and personal finances is to track spending, save money, avoid debt, and achieve financial goals.

What information must be reported on budgeting and personal finances?

Information such as income sources, expenses, savings, debts, and financial goals must be reported on budgeting and personal finances.

Fill out your budgeting and personal finances online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budgeting And Personal Finances is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.