Get the free STUDENT AID AND FISCAL RESPONSIBILITY ACT OF 2009 (SAFRA) - www2 ed

Show details

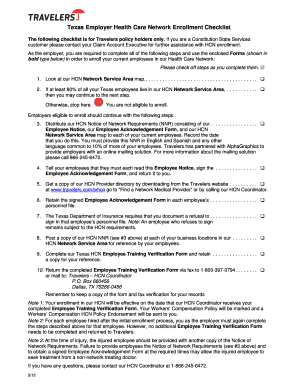

Archived Information U.S. Department of Education Washington, D.C. 202025335 APPLICATION FOR GRANTS UNDER THE STUDENT AID AND FISCAL RESPONSIBILITY ACT OF 2009 (SARA) CODA # 84.031B PR/Award # N/A

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student aid and fiscal

Edit your student aid and fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student aid and fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit student aid and fiscal online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit student aid and fiscal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student aid and fiscal

How to fill out student aid and fiscal:

01

Begin by gathering all the necessary documents such as your social security number, tax returns, and any other financial records required for the application.

02

Visit the official website of the financial aid office or organization providing the student aid. Look for the application form specifically designed for student aid and fiscal.

03

Carefully read the instructions provided on the application form. It will outline the required information and documents needed for a successful completion.

04

Start filling out the application form by providing your personal information accurately. This may include your name, address, contact details, and demographic information.

05

Next, you will be asked for your financial information. This may include details about your income, assets, expenses, and any other relevant financial details. Ensure that you provide accurate and up-to-date information to avoid any discrepancies.

06

If there are any specific questions or sections that you are unsure about, do not hesitate to reach out to the financial aid office or organization for clarification. They are there to assist and guide you through the process.

07

Review your completed application thoroughly before submitting it. Make sure all the information is correct, and there are no missing or incomplete sections that need attention.

08

Once you are satisfied with the accuracy of your application, submit it according to the instructions provided. This may involve mailing it to a designated address or submitting it online through a secure portal.

Who needs student aid and fiscal:

01

Students pursuing higher education: Student aid and fiscal assistance is primarily intended for individuals who are pursuing post-secondary education. This includes undergraduate and graduate students enrolled in colleges, universities, or vocational schools.

02

Individuals with limited financial resources: Student aid and fiscal assistance is often targeted towards individuals who come from low-income backgrounds. The aim is to provide financial support to those who may struggle to afford the expenses associated with higher education.

03

Students facing exceptional circumstances: Some students may be eligible for student aid and fiscal assistance due to exceptional circumstances such as a disability or being a single parent. These situations may warrant additional financial support to ensure equal access to education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my student aid and fiscal in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign student aid and fiscal and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out student aid and fiscal using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign student aid and fiscal and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out student aid and fiscal on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your student aid and fiscal. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is student aid and fiscal?

Student aid and fiscal refer to financial assistance provided to students to help them cover the costs of education.

Who is required to file student aid and fiscal?

Students who are seeking financial assistance for education are required to file student aid and fiscal forms.

How to fill out student aid and fiscal?

To fill out student aid and fiscal forms, students need to provide information about their financial situation, educational expenses, and other relevant details.

What is the purpose of student aid and fiscal?

The purpose of student aid and fiscal is to determine the amount of financial assistance a student is eligible to receive based on their financial need.

What information must be reported on student aid and fiscal?

Students must report their household income, assets, expenses, and other relevant financial information on student aid and fiscal forms.

Fill out your student aid and fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Aid And Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.