Get the free APPLICATION FOR INVOICE FINANCING

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for invoice financing

Edit your application for invoice financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for invoice financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for invoice financing online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for invoice financing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for invoice financing

How to fill out an application for invoice financing:

01

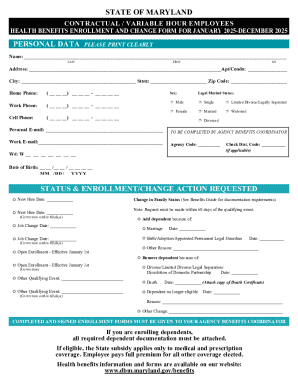

Start by gathering all the necessary information and documents required for the application. This may include details about your company, such as its name, address, and contact information, as well as financial statements, invoices, and any relevant legal documents.

02

Next, carefully review the application form provided by the invoice financing company. Make sure you understand all the questions and provide accurate and complete information. If there are any sections that you are unsure about, reach out to the financing company for clarification.

03

Fill in the requested details about your company, such as its legal structure, industry, and number of employees. Be prepared to provide a brief description of your business and its operations.

04

Provide financial information, including your company's annual revenue, net profit, and any outstanding debts. You may also need to disclose any pending legal or tax issues.

05

Include information about the invoices you wish to finance, such as their total value, due dates, and payment terms. The financing company will evaluate these invoices to determine the funding amount you may be eligible for.

06

Review the application thoroughly before submitting it. Double-check for any errors or missing information. Ensure that all supporting documents are attached and organized appropriately.

Who needs an application for invoice financing?

01

Small and medium-sized businesses: Small and medium-sized businesses often face cash flow challenges due to delayed payments from customers. Invoice financing can help them bridge the gap between invoicing and receiving payment, allowing them to cover expenses and invest in growth.

02

Startups: Startups often struggle to secure traditional financing due to their limited credit history or lack of collateral. Invoice financing can be a viable option for startups to access working capital quickly by using their outstanding invoices as collateral.

03

Businesses experiencing rapid growth: Companies experiencing sudden growth may face cash flow constraints as they wait for customer payments. Invoice financing can provide them with immediate funds, enabling them to take advantage of new opportunities and meet growing demands.

04

Businesses with unpredictable cash flow: Industries with irregular payment cycles, such as construction or consulting, can benefit from invoice financing. It allows them to maintain a steady cash flow by accessing funds tied up in unpaid invoices.

Note: It is recommended to consult with a financial advisor or invoice financing provider to determine if invoice financing is suitable for your specific business needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

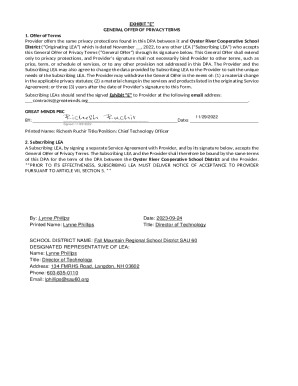

How can I send application for invoice financing to be eSigned by others?

application for invoice financing is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit application for invoice financing online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your application for invoice financing and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit application for invoice financing on an iOS device?

Use the pdfFiller mobile app to create, edit, and share application for invoice financing from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

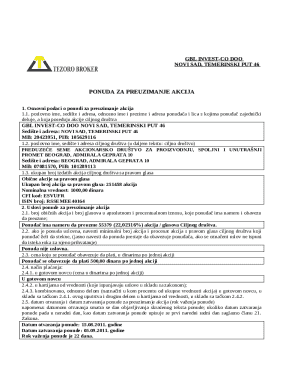

What is application for invoice financing?

Invoice financing application is a document used to apply for financial assistance based on unpaid invoices.

Who is required to file application for invoice financing?

Businesses looking to receive funds against their outstanding invoices are required to file an application for invoice financing.

How to fill out application for invoice financing?

To fill out an application for invoice financing, businesses need to provide information about their company, outstanding invoices, and financial details.

What is the purpose of application for invoice financing?

The purpose of the application for invoice financing is to request funds from a lender or financial institution in exchange for unpaid invoices.

What information must be reported on application for invoice financing?

Information such as company details, invoice details, amount requested, payment terms, and other financial information must be reported on the application for invoice financing.

Fill out your application for invoice financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Invoice Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.