Get the free Loan #:

Show details

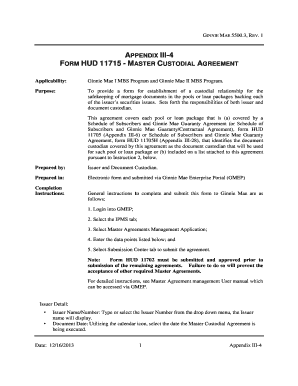

Construction Loan Draw Request Loan #: Date of request: Borrower Contact name: Property: Contact phone: Final draw? Yes No Contact email: Application is made for payment in connection with the following

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan

Edit your loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan

How to fill out a loan:

01

Gather necessary documents: Start by collecting all the required documents, such as identification proof, income statements, bank statements, and any other paperwork specified by the lender. This ensures you have all the information needed to complete the loan application accurately.

02

Choose the right loan type: Understand the different types of loans available and determine which one suits your needs. Whether it's a personal loan, mortgage, car loan, or business loan, selecting the appropriate loan type is crucial as each may have different requirements and terms.

03

Research and compare lenders: Shop around and research various lenders to find the best loan option. Compare interest rates, loan terms, repayment options, and any additional fees or charges associated with the loan. This step allows you to make an informed decision and choose a lender that meets your requirements.

04

Complete the loan application: Fill out the loan application form accurately and provide all the requested information. Double-check the application for any errors or missing details, as incorrect information may delay the loan approval process. Be sure to include all necessary supporting documents as well.

05

Understand the terms and conditions: Before signing any loan agreement, carefully read and understand the terms and conditions. Pay attention to interest rates, repayment schedules, penalties for late payments, and any other clauses that may impact the loan's cost or your ability to repay it.

06

Seek professional advice if needed: If you're unsure about any aspect of the loan application or terms, consider consulting with a financial advisor or loan officer. They can provide valuable guidance and help clarify any questions or concerns you may have.

Who needs a loan:

01

Individuals: Loans can be helpful for individuals who require financial assistance for various reasons such as education, home improvement, debt consolidation, emergencies, or purchasing high-ticket items.

02

Small business owners: Entrepreneurs and small business owners often rely on loans to fund business operations, expand their ventures, purchase equipment, or manage cash flow fluctuations.

03

Homebuyers: Many individuals and families seek mortgages to finance the purchase of a home. Loans allow people to become homeowners without having to pay the full purchase price upfront.

04

Students: Education loans are often used by students to cover tuition fees, purchase books and supplies, or support their living expenses during their academic journey.

05

Investors: Some investors may opt for loans to fund their investment opportunities, as leveraging can provide potential financial advantages.

Overall, anyone who requires financial assistance for a specific purpose or investment may consider applying for a loan after assessing their ability to repay it responsibly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your loan as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit loan from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your loan into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete loan on an Android device?

Use the pdfFiller mobile app to complete your loan on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is loan?

A loan is a sum of money that is borrowed from a financial institution or lender with the agreement to be paid back with interest.

Who is required to file loan?

Individuals or businesses seeking financial assistance and borrowing money from a financial institution are required to file for a loan.

How to fill out loan?

To fill out a loan application, you will need to provide personal or business information, financial details, and the purpose of the loan.

What is the purpose of loan?

The purpose of a loan is to provide individuals or businesses with financial assistance to meet specific needs or goals.

What information must be reported on loan?

The information required on a loan application includes personal or business details, financial statements, and the purpose of the loan.

Fill out your loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.