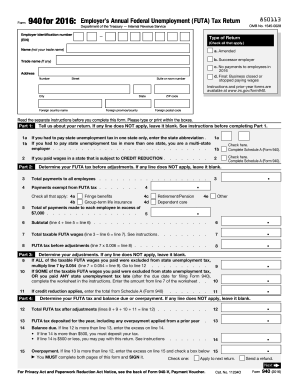

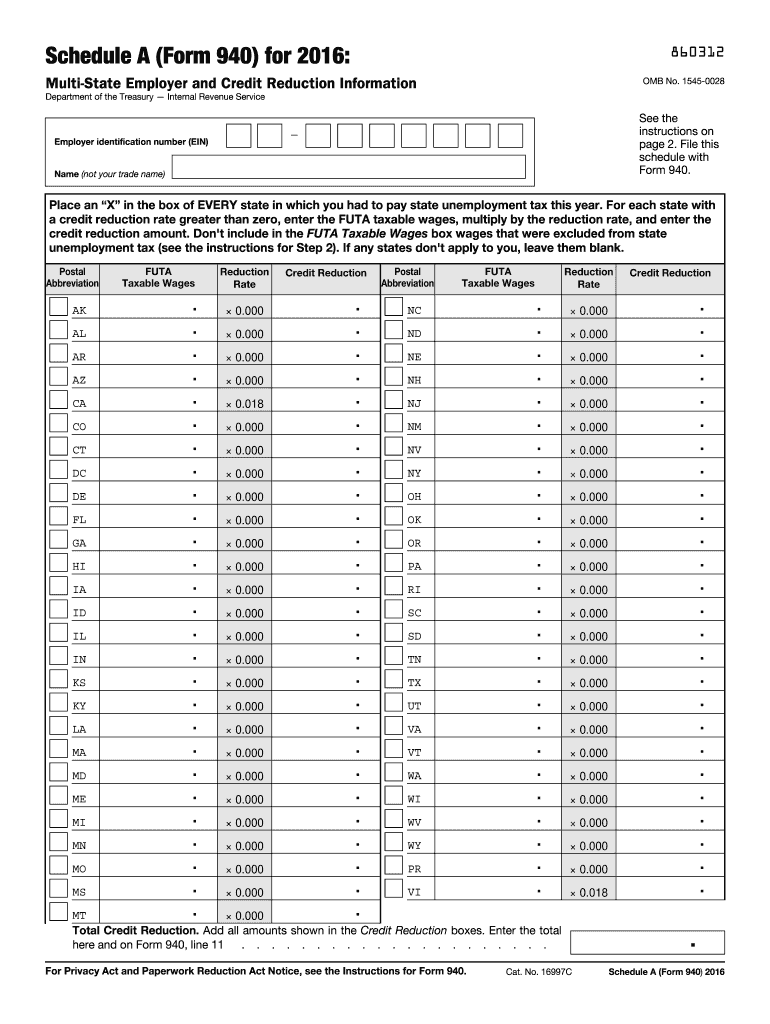

IRS 940 - Schedule A 2016 free printable template

Instructions and Help about IRS 940 - Schedule A

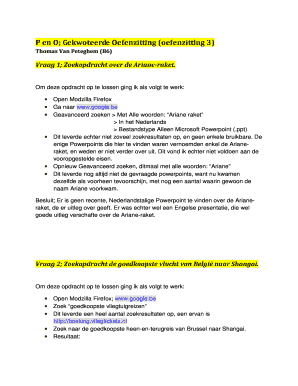

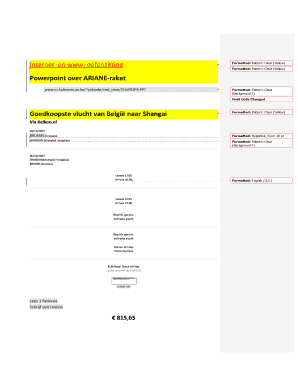

How to edit IRS 940 - Schedule A

How to fill out IRS 940 - Schedule A

About IRS 940 - Schedule A 2016 previous version

What is IRS 940 - Schedule A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

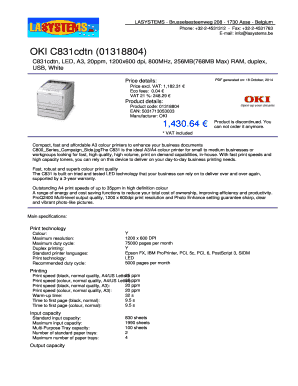

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 940 - Schedule A

What should I do if I realize I've made a mistake on my filed IRS 940 - Schedule A?

If you discover an error after submitting your IRS 940 - Schedule A, you can file an amended return using Form 940-X. Make sure to accurately detail the corrections needed and resubmit your amended form promptly to avoid potential penalties.

How can I check the status of my IRS 940 - Schedule A filing?

To track the status of your IRS 940 - Schedule A, use the IRS ‘Where's My Refund?’ tool online. If you filed electronically, you can typically verify processing status more readily, while paper submissions may take longer to update.

What common errors should I be aware of when submitting the IRS 940 - Schedule A?

Some common errors include incorrect EIN entries, failing to report all taxable wages, or overlooking the details on nonresidents/foreign payees. Double-checking all entries and ensuring alignment with IRS guidelines can significantly reduce the risk of mistakes.

What should I do if my IRS 940 - Schedule A gets rejected?

If your IRS 940 - Schedule A is rejected, carefully review the rejection notice for specific error codes. Correct the indicated issues and resubmit your form as soon as possible to ensure compliance and avoid further complications.

How long should I retain records related to my IRS 940 - Schedule A?

You should retain records related to your IRS 940 - Schedule A for at least four years after the tax year ends. This includes all supporting documentation to ensure you can address any questions or audits from the IRS if needed.

See what our users say