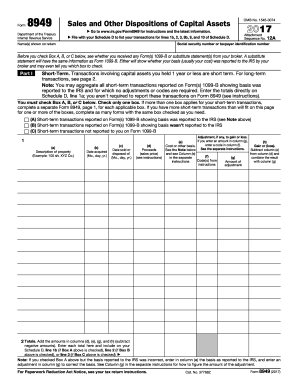

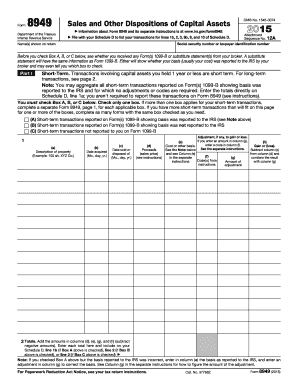

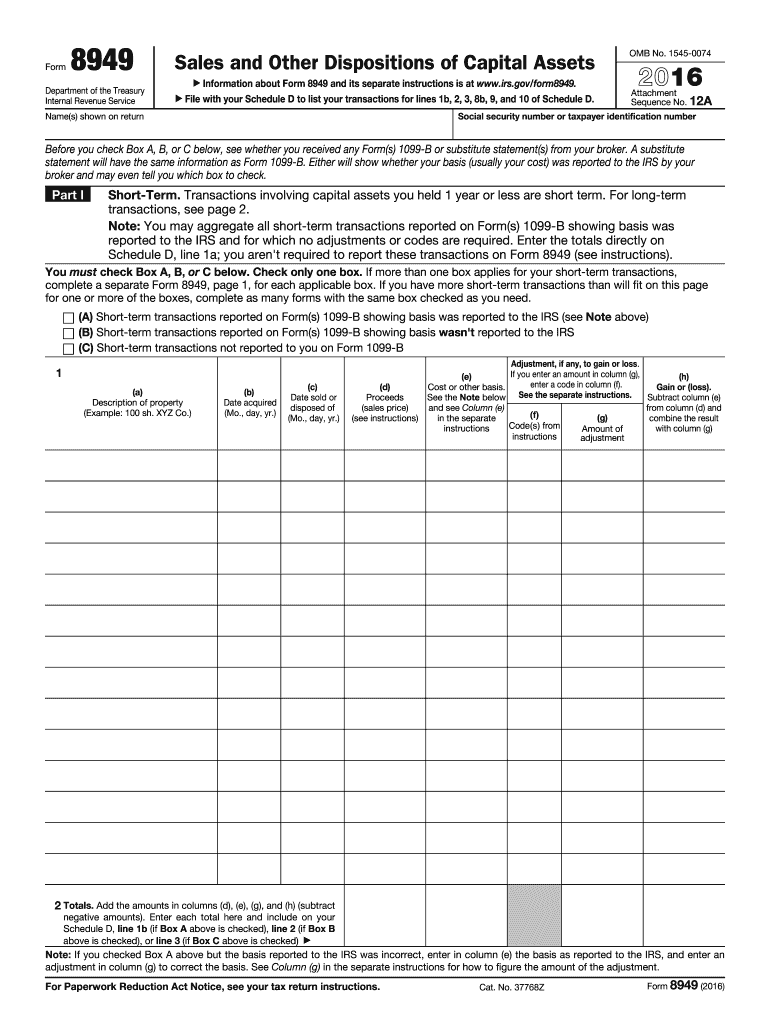

IRS 8949 2016 free printable template

Instructions and Help about IRS 8949

How to edit IRS 8949

How to fill out IRS 8949

About IRS 8 previous version

What is IRS 8949?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8949

What should I do if I realize I made a mistake on my IRS 8949 after submission?

If you discover an error on your IRS 8949 after filing, you can correct it by submitting Form 1040-X to amend your return. Be sure to include an explanation of the changes and attach any relevant documentation. It's important to address mistakes promptly to avoid penalties or complications with the IRS.

How can I check the status of my IRS 8949 after I have e-filed it?

To verify the status of your e-filed IRS 8949, you can use the IRS 'Where's My Refund?' tool or check your IRS online account. They provide updates on the processing status, which can help you confirm if your form has been received and is being processed.

What should I do if my e-filed IRS 8949 is rejected?

If your IRS 8949 is rejected after e-filing, you will receive a rejection notice detailing the issues. Correct the identified errors and re-file your form as soon as possible. Being proactive in fixing these errors can help prevent delays in your tax processing.

Can I file IRS 8949 on behalf of someone else?

Yes, you can file the IRS 8949 on behalf of someone else if you have obtained the proper authorization, typically through a Power of Attorney (POA) document. Ensure that the POA is properly executed and submitted to the IRS, as this grants you the legal authority to act on their behalf during the filing process.

See what our users say