IRS 1099-K 2017 free printable template

Show details

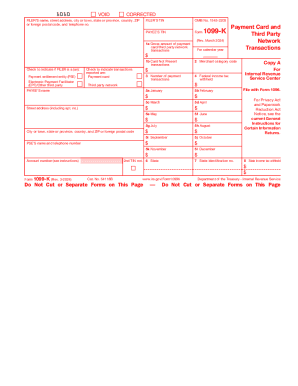

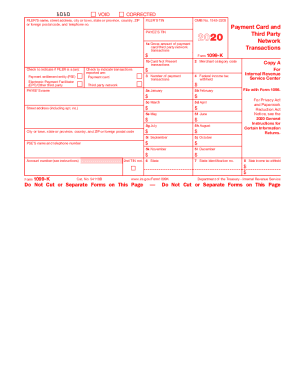

To be filed with the recipient s state income tax return when required. Copy 2 Copy C For FILER Settlement Entity or Electronic Payment Facilitator/Other Third Party To complete Form 1099-K use Returns and the 2017 Instructions for Form 1099-K. 1220. The IRS does not provide a fill-in form option. Need help If you have questions about reporting on Form 1099-K call the information reporting customer service site toll free at 1-866-455-7438 or 304-263-8700 not toll free. Boxes 6 8. Shows state...and local income tax withheld from the payments. Future developments. For the latest information about developments related to Form 1099-K and its instructions such as legislation enacted after they were published go to www.irs.gov/form1099k. 8 State income tax withheld Form 1099-K Cat. No. 54118B Do Not Cut or Separate Forms on This Page www.irs.gov/form1099k Department of the Treasury - Internal Revenue Service 6 State Copy 1 For State Tax Department CORRECTED if checked This is important tax...information and is being furnished to the Internal Revenue Service. FILER S federal identification no. OMB No. 1545-2205 PAYEE S taxpayer identification no. 1a Gross amount of payment card/third party network transactions Form 1b Card Not Present Payment settlement entity PSE Check to indicate transactions reported are Payment card Electronic Payment Facilitator EPF /Other third party Third party network 1099-K 2 Merchant category code 3 Number of payment 4 Federal income tax withheld 5a January...5b February PAYEE S name 5c March 5d April 5e May Street address including apt. no. 5f June 5g July 5h August 5i September City or town state or province country and ZIP or foreign postal code Copy A Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice see the 2017 General Certain Information Returns. Electronically FIRE system visit www. IRS.gov/FIRE or the IRS Affordable Care Act See IRS Publications 1141 1167 and 1179 for more information...about printing these tax forms. VOID CORRECTED FILER S name street address city or town state or province country ZIP or foreign postal code and telephone no. FILER S federal identification no. OMB No. 1545-2205 PAYEE S taxpayer identification no. 1a Gross amount of payment card/third party network transactions Form 1b Card Not Present Payment settlement entity PSE Check to indicate transactions reported are Payment card Electronic Payment Facilitator EPF /Other third party Third party network...1099-K 2 Merchant category code 3 Number of payment 4 Federal income tax withheld 5a January 5b February PAYEE S name 5c March 5d April 5e May Street address including apt. no. 5f June 5g July 5h August 5i September City or town state or province country and ZIP or foreign postal code Copy A Internal Revenue Service Center File with Form 1096. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed...version of Copy A of this IRS form is scannable but the online version of it printed from this website is not.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

How to fill out IRS 1099-K

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

To edit the IRS 1099-K form, first, obtain a copy of the form from the issuing party. Next, review the information for accuracy. You can use pdfFiller to make it easy to fill out or correct any information directly on the form. Ensure that any changes are reflected consistently in all copies if more than one is being utilized, as discrepancies can trigger inquiries from the IRS.

How to fill out IRS 1099-K

To fill out the IRS 1099-K form, gather all necessary information from payment processor reports. This includes the payee’s name, tax identification number (TIN), and the gross amount of reportable transactions. Follow these general steps:

01

Enter the payee’s name in the appropriate field.

02

Provide the payee’s TIN, which can be either a Social Security Number (SSN) or Employer Identification Number (EIN).

03

List the total gross payment amount received during the tax year.

04

Include any additional boxes required, such as total transactions if needed.

About IRS 1099-K 2017 previous version

What is IRS 1099-K?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-K 2017 previous version

What is IRS 1099-K?

IRS 1099-K is a tax form that reports payment card and third-party network transactions. This form is essential for tax compliance as it records the total income processed through payment facilitators for a specific calendar year. It helps the IRS track transactions that may not be reported through traditional means.

What is the purpose of this form?

The purpose of IRS 1099-K is to ensure accurate reporting of income received by businesses from services provided via payment cards or third-party networks, like PayPal. This form helps the IRS verify that taxpayers are reporting their income accurately. It includes comprehensive tracking of payment transactions to enhance transparency in financial reporting.

Who needs the form?

Businesses and individuals who receive payments exceeding certain thresholds must file IRS 1099-K. Specifically, if they have over $20,000 in gross payments and more than 200 transactions processed through third-party networks, they are required to report this income using the 1099-K form. Additionally, some states may have lower thresholds that also necessitate reporting.

When am I exempt from filling out this form?

Filers are exempt from submitting IRS 1099-K if they do not meet the required reporting thresholds. Additionally, individuals that do not receive payments through payment cards or third-party networks are not obligated to file the form. Some specific types of transactions, such as certain gift cards or refunds, may also be exempt from reporting.

Components of the form

IRS 1099-K includes several key components, such as the payer’s name and TIN, the payee’s name and TIN, and the total gross amount of payment transactions. It also features boxes for detailing the number of transactions and any adjustments made. Each part contributes to a comprehensive disclosure of income received throughout the tax year.

What are the penalties for not issuing the form?

The penalties for failing to issue IRS 1099-K can be significant. Late filings may incur a fine that escalates with the delay in submission, reaching up to $270 per form. If a business intentionally disregards the requirement to file, the penalty may increase to $550 per form. This can lead to increased scrutiny from the IRS and additional financial repercussions.

What information do you need when you file the form?

When filing IRS 1099-K, you will need the payee’s accurate name, TIN, and the total amount of reportable transactions for the year. It is also essential to gather any relevant documents that support the transactions reported, such as payment processor statements or transaction confirmations, to ensure accuracy in reporting.

Is the form accompanied by other forms?

IRS 1099-K may need to be filed alongside other forms depending on the taxpayer’s filing requirements. For example, if a taxpayer is self-employed, they may also need to submit a Schedule C or other relevant tax forms alongside the 1099-K. Combining forms helps ensure comprehensive reporting of all income received.

Where do I send the form?

IRS 1099-K forms must be sent to the IRS as well as to the payee. The IRS should receive the forms electronically or via mail at the address designated in the IRS instructions. Ensure to verify the appropriate mailing address as it may vary based on the filing method and the tax return address to avoid delays or penalties.

See what our users say