Get the free Dividend Rate Calculation - US Department of the Treasury - treasury

Show details

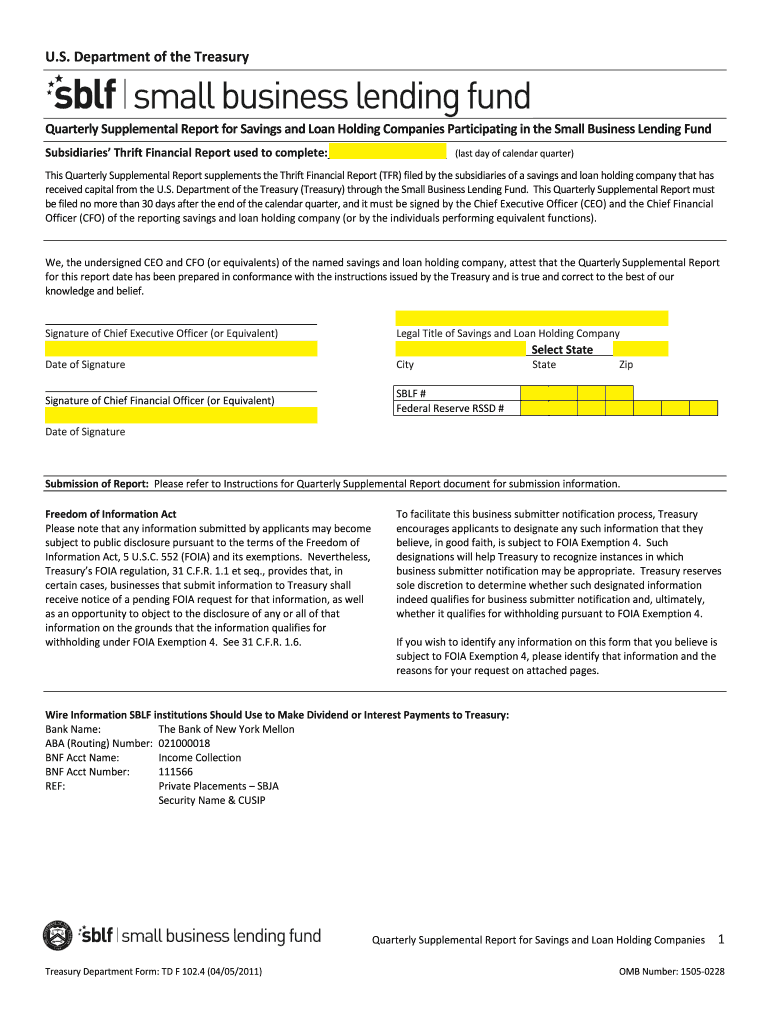

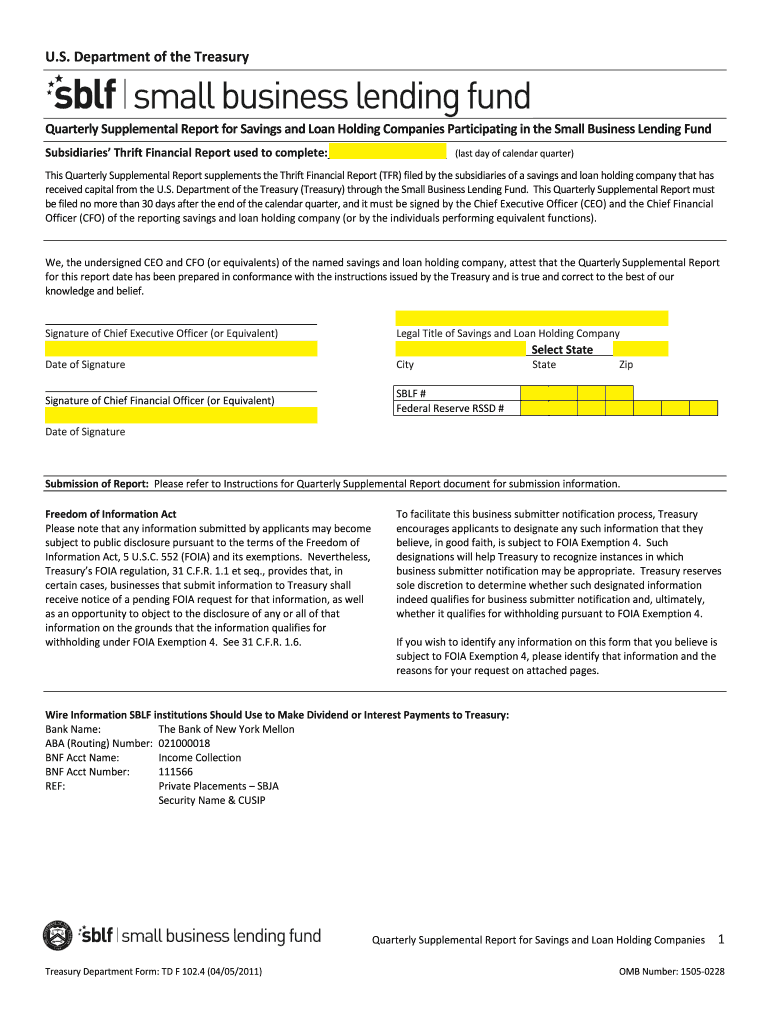

Treasury Department Form: TD F 102.4 (04/05/2011). OMB Number: 1505-0228. U.S. Department of the ... Signature of Chief Executive Officer (or Equivalent) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dividend rate calculation

Edit your dividend rate calculation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividend rate calculation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dividend rate calculation online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dividend rate calculation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dividend rate calculation

How to fill out dividend rate calculation:

01

Determine the dividend received: Start by identifying the total amount of dividends received from an investment. This can be found on the dividend payment statement or the company's financial reports.

02

Calculate the dividend per share: Divide the total dividend received by the number of shares held. This will give you the dividend per share. For example, if you received $500 in dividends and hold 100 shares, the dividend per share is $5.

03

Determine the stock price: To calculate the dividend rate, you need to know the current stock price. This information can be obtained from financial news websites or brokerage accounts.

04

Divide the dividend per share by the stock price: Divide the dividend per share by the stock price to get the dividend rate. For example, if the stock price is $50 and the dividend per share is $5, the dividend rate is 10%.

Who needs dividend rate calculation:

01

Investors: Dividend rate calculation is essential for investors as it helps them assess the profitability and return on their investment. By calculating the dividend rate, investors can compare it with other investments or industry standards to make informed decisions.

02

Financial analysts: Financial analysts use dividend rate calculations to evaluate the performance of a company and assess its attractiveness as an investment opportunity. The dividend rate is a key indicator of a company's financial health and its ability to generate consistent dividends for shareholders.

03

Stockbrokers and financial advisors: Dividend rate calculation is crucial for stockbrokers and financial advisors as they assist clients in making investment decisions. By analyzing the dividend rate, they can recommend suitable dividend-paying stocks that align with their clients' investment objectives and risk tolerance.

04

Dividend-focused funds: Mutual funds or exchange-traded funds (ETFs) that focus on dividend-paying stocks rely on dividend rate calculations to manage their portfolios. These funds aim to provide investors with regular income through consistent dividend payouts, and dividend rate calculations help them identify attractive stocks to include in their funds.

In conclusion, dividend rate calculation is important for investors, financial analysts, stockbrokers, financial advisors, and dividend-focused funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the dividend rate calculation form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign dividend rate calculation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit dividend rate calculation on an iOS device?

Create, edit, and share dividend rate calculation from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete dividend rate calculation on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your dividend rate calculation, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is dividend rate calculation?

Dividend rate calculation is the process of determining the percentage of earnings that a company distributes to its shareholders in the form of dividends.

Who is required to file dividend rate calculation?

Companies that pay dividends to their shareholders are required to file dividend rate calculations.

How to fill out dividend rate calculation?

To fill out a dividend rate calculation, companies must gather their financial information, calculate the percentage of earnings distributed as dividends, and report this information to the appropriate authorities.

What is the purpose of dividend rate calculation?

The purpose of dividend rate calculation is to provide transparency to shareholders and investors about the percentage of earnings being distributed as dividends.

What information must be reported on dividend rate calculation?

The dividend rate calculation should include the company's total earnings, the total amount of dividends paid to shareholders, and the resulting percentage of earnings distributed as dividends.

Fill out your dividend rate calculation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dividend Rate Calculation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.