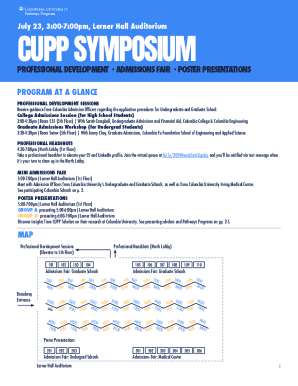

Get the free 2014-2015 Independent Income Verification

Show details

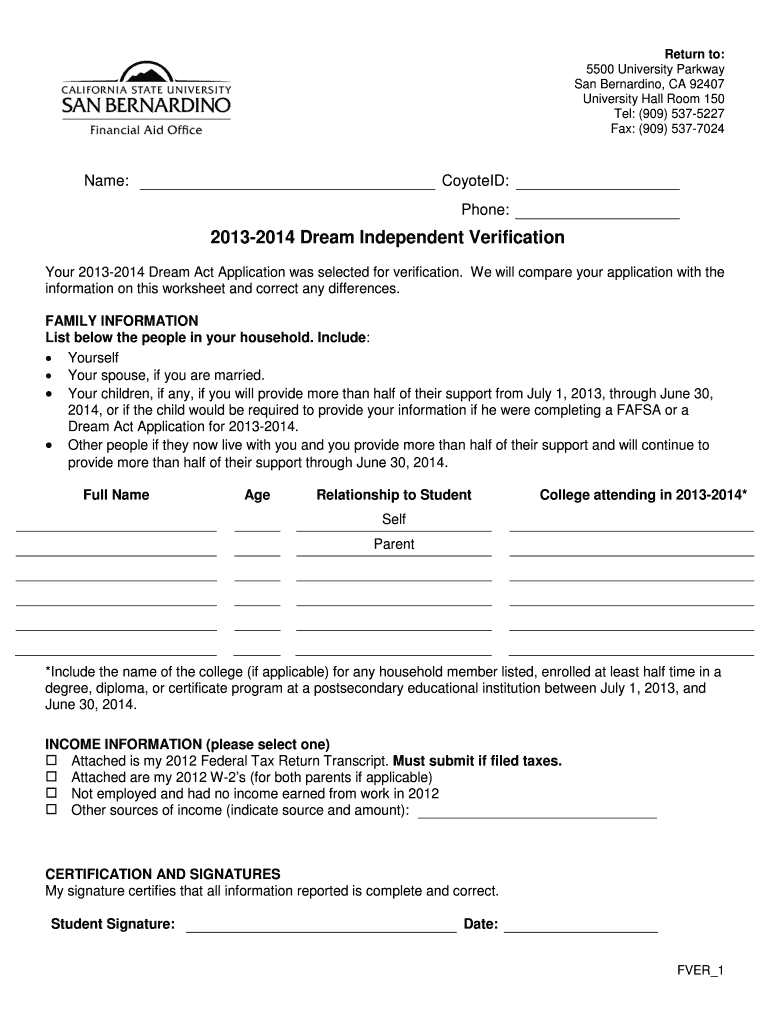

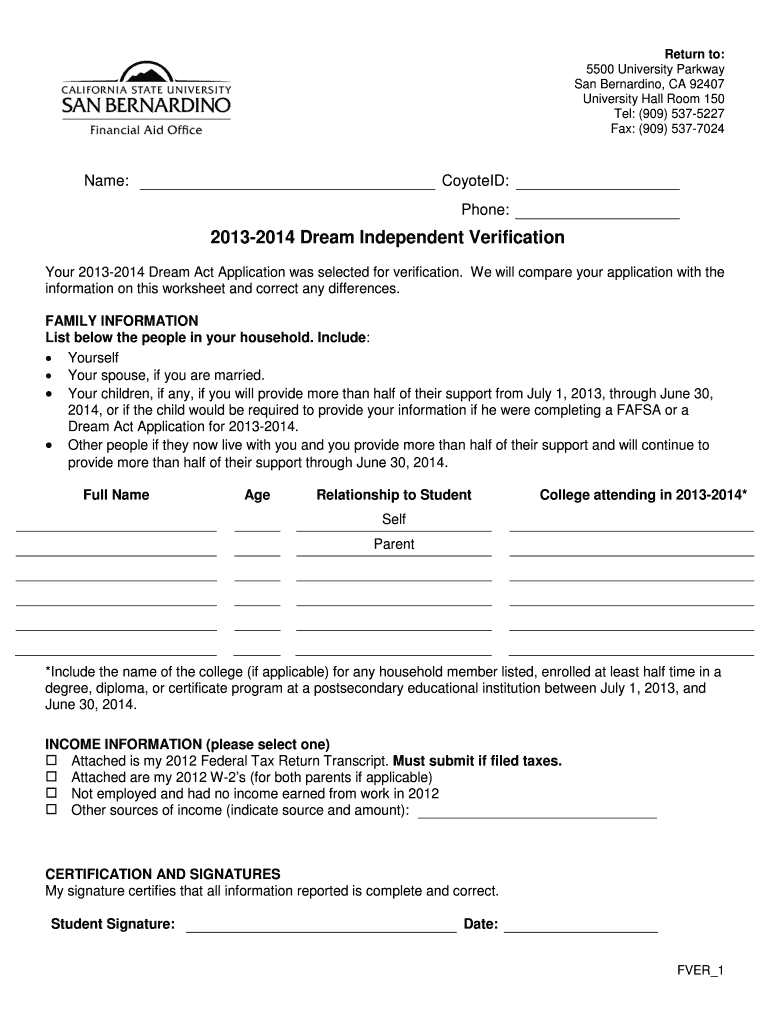

Return to: 5500 University Parkway San Bernardino, CA 92407 University Hall Room 150 Tel: (909) 5375227 Fax: (909) 5377024 Name: Coyote ID: Phone: 20132014 Dream Independent Verification Your 20132014

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014-2015 independent income verification

Edit your 2014-2015 independent income verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014-2015 independent income verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2014-2015 independent income verification online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2014-2015 independent income verification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014-2015 independent income verification

How to fill out 2014-2015 independent income verification:

01

Gather all relevant documents: Before beginning the process, make sure you have all the necessary documents handy. This typically includes your tax returns for the years 2014 and 2015, W-2 forms, 1099 forms, and any other income-related documents.

02

Start with personal information: Begin by providing your personal information. This may include your name, social security number, address, and contact information. Ensure that all the details provided are accurate and up to date.

03

Enter your income details: In the income section, you will need to provide a detailed breakdown of your income for the years 2014 and 2015. This includes wages, salary, bonuses, commissions, interest income, rental income, and any other sources of income. Make sure to accurately report all the required information.

04

Deduct allowable expenses: If applicable, you may be allowed to deduct certain expenses from your income. These deductions can include business expenses, educational expenses, or any other legitimate deductions. Carefully review the instructions provided and accurately report any deductions you qualify for.

05

Provide additional information, if required: Depending on your situation, you may be required to provide additional information. This can include details about any dependents you have, scholarships or grants received, or any other relevant information. Follow the instructions provided and provide the necessary information accurately.

06

Review and double-check: It's essential to review all the information you have provided before submitting the form. Double-check for any errors or omissions that may have occurred during the filling process. It's better to catch and correct any mistakes beforehand to avoid any delays or complications.

Who needs 2014-2015 independent income verification:

01

Students applying for financial aid: Students who are applying for financial aid for the academic years 2014-2015 may be required to submit the 2014-2015 independent income verification form. This helps the financial aid office determine the student's eligibility and award the appropriate aid packages.

02

Applicants for scholarships or grants: Individuals applying for scholarships or grants that require verification of their income for 2014-2015 may need to complete this form. It ensures that the scholarship or grant provider has accurate information to determine the recipient's eligibility.

03

Individuals applying for certain governmental assistance programs: Some governmental assistance programs, such as housing vouchers or food stamps, may require applicants to provide independent income verification for the years 2014-2015. This helps determine the individual's eligibility and the level of assistance they may qualify for.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2014-2015 independent income verification from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 2014-2015 independent income verification into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute 2014-2015 independent income verification online?

pdfFiller has made it easy to fill out and sign 2014-2015 independent income verification. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete 2014-2015 independent income verification on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 2014-2015 independent income verification. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is independent income verification?

Independent income verification is a process where an individual's income is verified by a third party to ensure accuracy and reliability.

Who is required to file independent income verification?

Individuals who are applying for loans, financial aid, or government assistance may be required to file independent income verification.

How to fill out independent income verification?

Independent income verification forms can typically be filled out online or by providing documentation such as pay stubs, tax returns, and bank statements.

What is the purpose of independent income verification?

The purpose of independent income verification is to confirm an individual's income to ensure they qualify for a specific financial product or service.

What information must be reported on independent income verification?

Independent income verification typically requires information such as employment status, income sources, and documentation to support reported income.

Fill out your 2014-2015 independent income verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014-2015 Independent Income Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.