Get the free Basic Life Beneficiary Form - slocounty ca

Show details

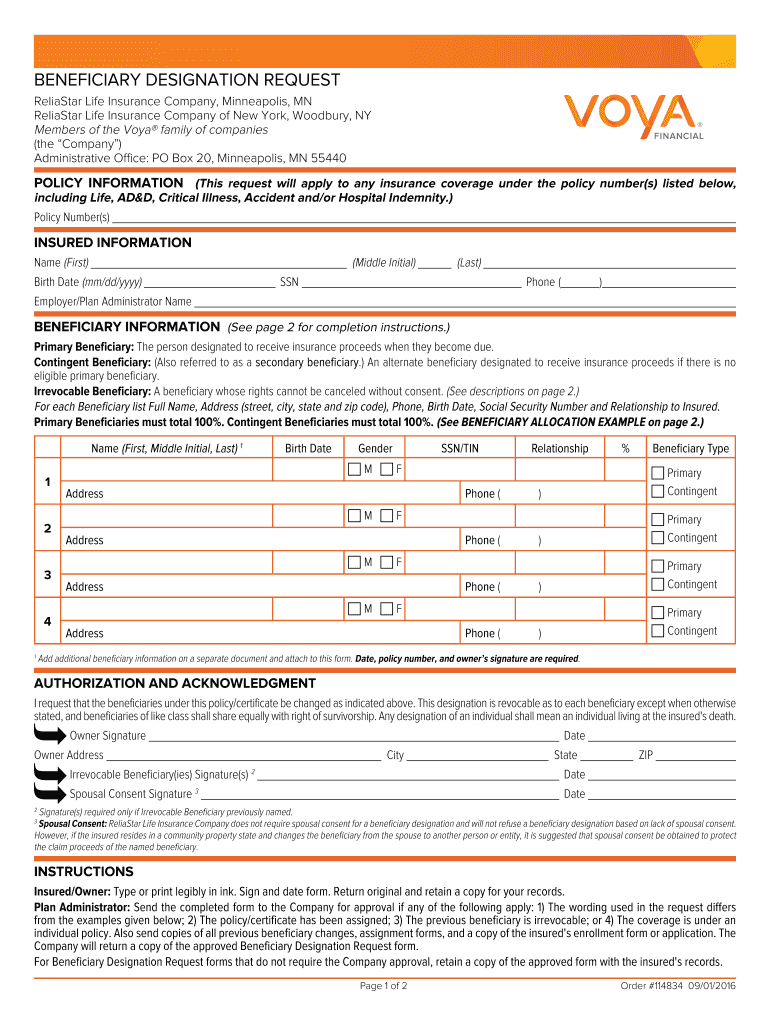

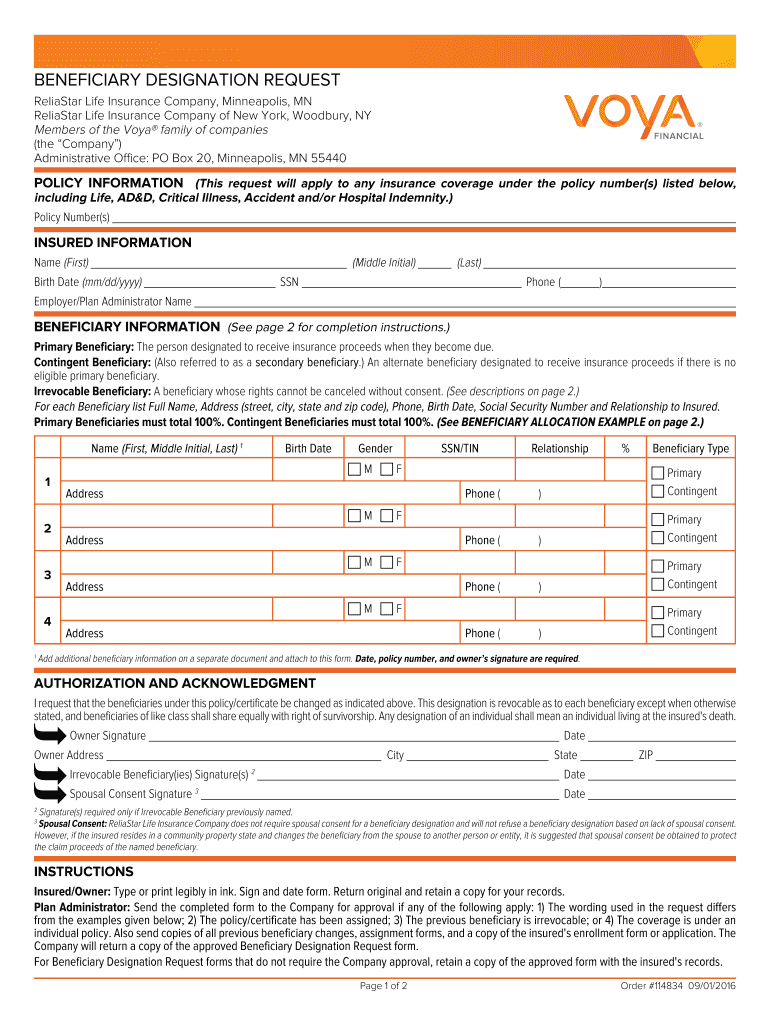

Page 1 of 2. Order #114834 09/01/2016. I request that the beneficiaries under this policy/certificate be changed as indicated above. ... ZIP. Primary Beneficiary: The person designated to receive

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign basic life beneficiary form

Edit your basic life beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your basic life beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit basic life beneficiary form online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit basic life beneficiary form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out basic life beneficiary form

01

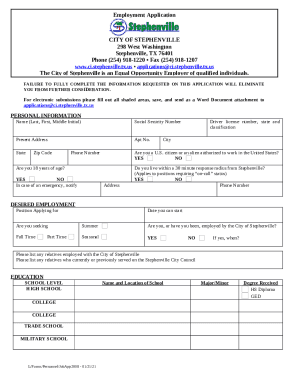

Start by gathering the necessary information. Before filling out the basic life beneficiary form, you will need to collect certain details such as your full name, date of birth, and contact information.

02

Identify the policyholder. The form may require you to provide information about the individual whose life is insured under the policy. This could be yourself or someone else, depending on the circumstances.

03

Specify the beneficiaries. Clearly list the beneficiaries who will receive the benefits upon the policyholder's death. Include their full names, dates of birth, relationship to the insured, and contact information.

04

Determine the allocation of benefits. Specify the percentage or amount of the policy's death benefit that each beneficiary will receive. You may allocate the benefits equally among multiple beneficiaries or in specific percentages based on your preference.

05

Consider contingency beneficiaries. Decide if you want to designate any secondary beneficiaries who would receive the benefits if the primary beneficiaries pass away before the policyholder. Attaching contingent beneficiaries gives you added control over the distribution of benefits.

06

Verify the accuracy of the form. Review the form carefully before submitting it to ensure all the entered information is accurate and up to date. Mistakes or inaccuracies can lead to complications and delays in the benefit distribution process.

07

Seek professional assistance if needed. If you are unsure about any aspect of filling out the basic life beneficiary form, or if your situation is complex, it may be beneficial to consult with an attorney or financial advisor who specializes in insurance matters.

Who needs a basic life beneficiary form?

Married individuals: If you have a life insurance policy and are married, it is essential to have a basic life beneficiary form. This ensures that your spouse will receive the death benefit, protecting their financial well-being in the event of your passing.

Parents: Parents who have life insurance policies may designate their children as beneficiaries in a basic life beneficiary form. This form provides peace of mind, knowing that the policy's death benefit would support the children financially if the parents were to pass away.

Business owners: If you have a life insurance policy that is tied to your business, you may need a basic life beneficiary form to specify how the death benefit should be distributed among business partners or other stakeholders.

Estate planners: Individuals who engage in estate planning typically require a basic life beneficiary form. This ensures that the life insurance benefits are distributed according to their wishes, aligning with their overall estate planning strategy.

Anyone with a life insurance policy: In general, anyone who holds a life insurance policy should have a basic life beneficiary form. It allows for clear instructions regarding the distribution of the death benefit, avoiding any potential disputes or uncertainties among potential beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete basic life beneficiary form online?

Filling out and eSigning basic life beneficiary form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit basic life beneficiary form in Chrome?

Install the pdfFiller Google Chrome Extension to edit basic life beneficiary form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit basic life beneficiary form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign basic life beneficiary form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

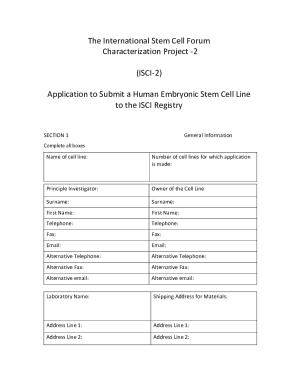

What is basic life beneficiary form?

The basic life beneficiary form is a legal document that designates who will receive the benefits of a basic life insurance policy in the event of the policyholder's death.

Who is required to file basic life beneficiary form?

The policyholder or insured individual is required to file the basic life beneficiary form.

How to fill out basic life beneficiary form?

The basic life beneficiary form can typically be filled out online, through the insurance company's website, or by contacting the insurance company directly.

What is the purpose of basic life beneficiary form?

The purpose of the basic life beneficiary form is to ensure that the life insurance benefits are paid out to the designated beneficiary upon the policyholder's death.

What information must be reported on basic life beneficiary form?

The basic life beneficiary form typically requires information such as the beneficiary's name, relationship to the policyholder, and contact information.

Fill out your basic life beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Basic Life Beneficiary Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.