IRS 1120-ND 2013-2025 free printable template

Show details

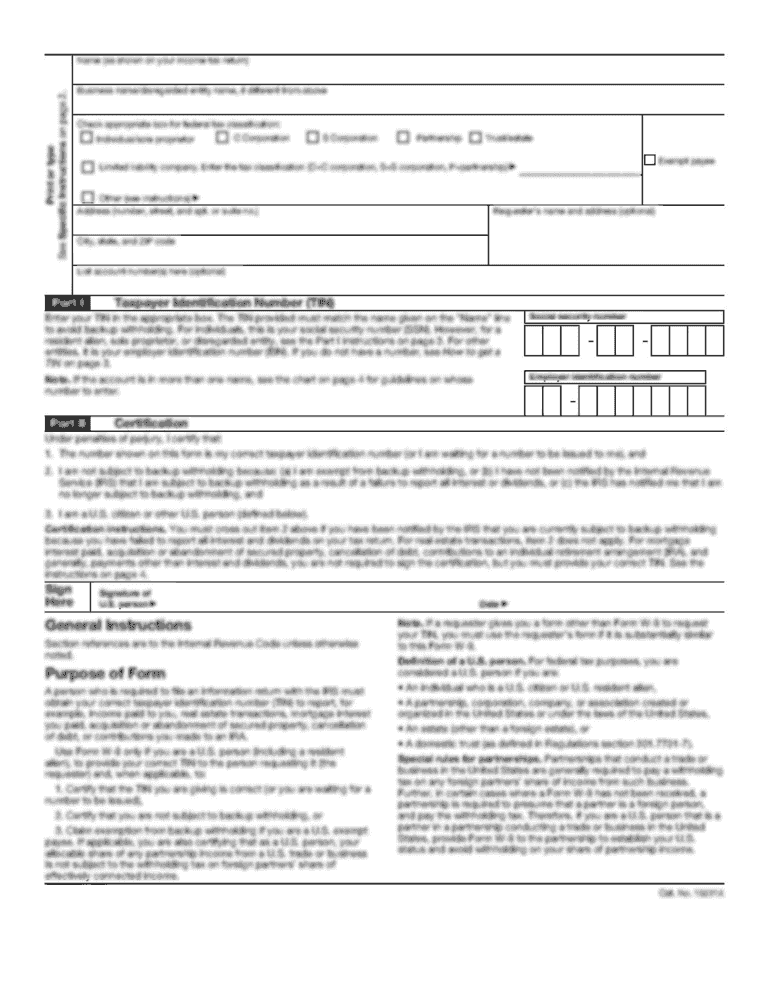

Form 1120-ND Return for Nuclear Decommissioning Funds and Certain Related Persons (Rev. October 2013) Department of the Treasury Internal Revenue Service Please Type or Print For calendar year 20

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-ND

How to edit IRS 1120-ND

How to fill out IRS 1120-ND

Instructions and Help about IRS 1120-ND

How to edit IRS 1120-ND

To edit IRS 1120-ND, use a set of tools that allow you to update the information accurately. Begin by opening the form in software that supports form editing, such as pdfFiller. Once the form is open, make necessary adjustments directly into the fields. Ensure you save the changes made to avoid losing any information.

How to fill out IRS 1120-ND

Filling out IRS 1120-ND involves several clear steps. First, gather all relevant financial data needed for accurate reporting. Then, fill out the form field-by-field, ensuring that all information is correct and aligns with existing records. To avoid mistakes, double-check entries and use resources if needed. Finally, review the completed form for accuracy before submission.

Latest updates to IRS 1120-ND

Latest updates to IRS 1120-ND

Check the IRS website for the most current updates regarding IRS 1120-ND. Updates can include changes in filing requirements, deadlines, or additional instructions provided by the IRS. Staying informed ensures compliance and helps avoid potential penalties.

All You Need to Know About IRS 1120-ND

What is IRS 1120-ND?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1120-ND

What is IRS 1120-ND?

IRS 1120-ND is a tax form used by corporations to report a notice of a deficiency in their taxes. This form is essential for ensuring that the IRS receives the correct information about any discrepancies in tax files. Accurate completion of this form aids in proper tax assessments and records management.

What is the purpose of this form?

The primary purpose of IRS 1120-ND is to provide the IRS with necessary information regarding a corporate tax deficiency. Corporations use this form to officially declare and explain discrepancies found in their tax filings. This form helps to maintain transparency and accuracy in corporate taxation.

Who needs the form?

Companies that receive a notice of deficiency from the IRS must file IRS 1120-ND. This typically includes corporations subject to federal income tax that need to report adjustments to previously filed returns. Failing to file this form could result in negative tax implications for the corporation.

When am I exempt from filling out this form?

Taxpayers are exempt from filling out IRS 1120-ND when there is no notice of deficiency issued by the IRS. Furthermore, if the corporation does not have any discrepancies to report regarding its tax obligations, there is no need to submit this form. Always keep records of IRS notifications to confirm your filing status.

Components of the form

IRS 1120-ND consists of several key components including identification details, a description of the tax deficiency, and any related adjustments. Each section must be completed accurately to ensure clarity in communication with the IRS. Understanding each component helps streamline the filing process.

What are the penalties for not issuing the form?

Failing to issue IRS 1120-ND when required can lead to substantial penalties. The IRS may impose fines and additional interest on the overdue taxes. Additionally, ignorance of filing requirements can complicate future dealings with the IRS and potentially lead to audits.

What information do you need when you file the form?

When filing IRS 1120-ND, necessary information includes the corporation's legal name, Employer Identification Number (EIN), details of income and deductions, and explanations for the deficiency. This information is critical for the IRS to assess the accuracy of the reported data efficiently.

Is the form accompanied by other forms?

IRS 1120-ND may need to include additional forms depending on the nature of the deficiency. Supporting documentation such as the original tax return, notices from the IRS, and any other relevant correspondence should accompany the form when filed. This helps substantiate the claims made in the form.

Where do I send the form?

IRS 1120-ND must be sent to the address specified in IRS instructions. This address may vary based on the corporation’s location and the type of deficiency being reported. Always refer to the latest IRS guidelines to ensure accurate submission.

See what our users say