Get the free Employee FSA/DCAP Enrollment - wcif

Show details

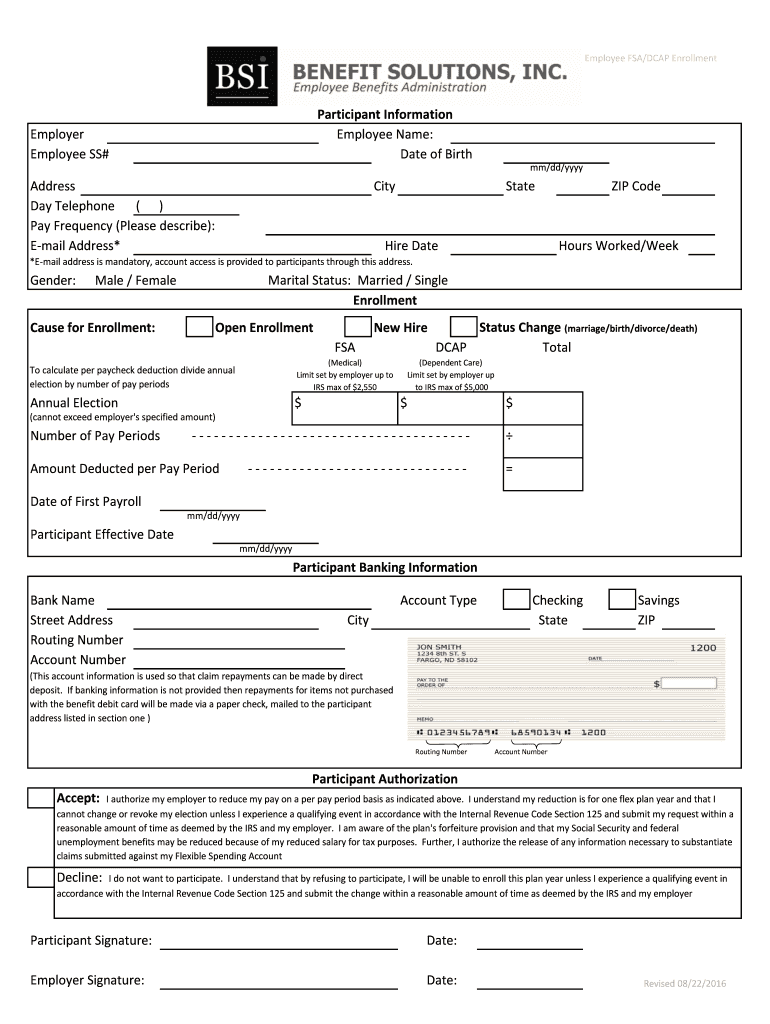

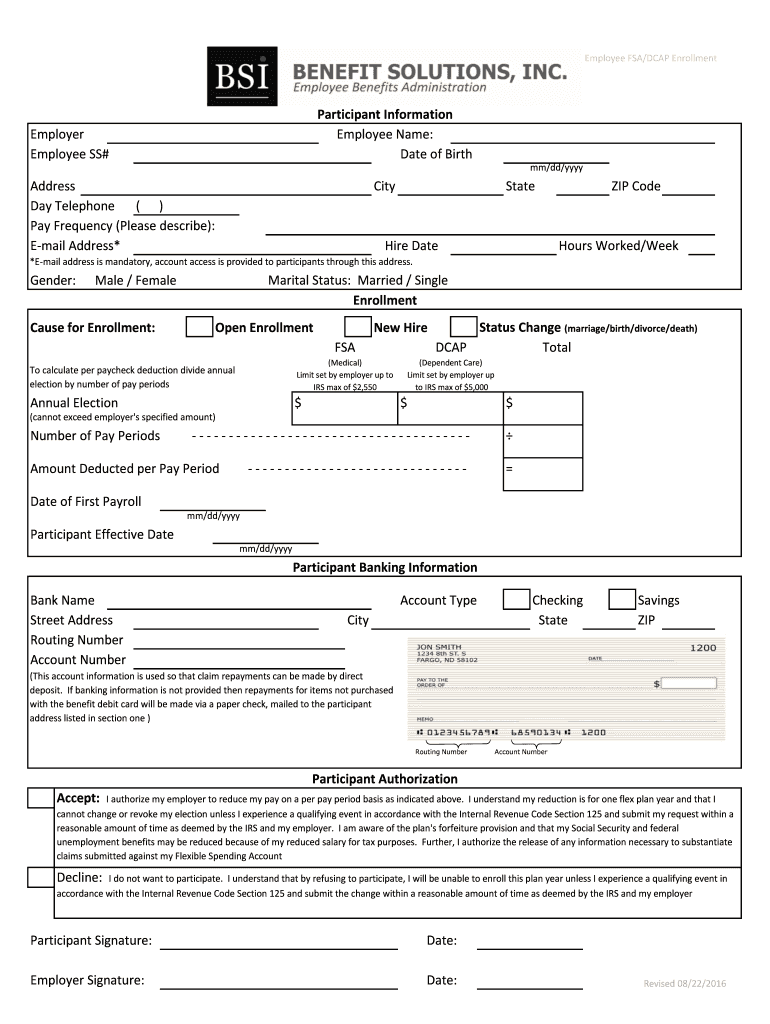

Employee FSA/CAP Enrollment Participant Information Employee Name: Date of Birth Employer Employee SS# mm/dd/YYY Address Day Telephone () Pay Frequency (Please describe): Email Address* City State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee fsadcap enrollment

Edit your employee fsadcap enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee fsadcap enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee fsadcap enrollment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employee fsadcap enrollment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee fsadcap enrollment

How to fill out employee fsadcap enrollment:

01

Obtain the necessary forms: To begin, you need to acquire the employee fsadcap enrollment forms from your employer or human resources department. It is important to fill out these forms accurately and completely.

02

Provide personal information: Start by entering your personal information, including your full name, address, social security number, and contact details. Make sure to double-check the accuracy of this information before moving forward.

03

Choose the enrollment options: In this section, you will be asked to select the fsadcap enrollment options that best suit your needs. This might include the type of plan you want to enroll in and the contribution amount you wish to make.

04

Determine your fsadcap contributions: Calculate the amount of money you want to set aside for your fsadcap contributions. You can choose to contribute a fixed amount per paycheck or a percentage of your income. Be aware of any maximum contribution limits set by the program.

05

Review the eligible expenses: Familiarize yourself with the eligible expenses that can be reimbursed through the fsadcap. This may include medical and dental expenses, child or dependent care services, or transportation costs. Make sure to understand which expenses are covered and any restrictions that may apply.

06

Identify your beneficiaries: If applicable, designate your beneficiaries. These are the individuals who would receive the fsadcap funds in case of your untimely demise. Consult with an attorney or financial advisor if you are unsure about this step.

07

Sign and submit: Once you have completed all the necessary sections, sign and date the form. It is crucial to submit the enrollment forms within the specified deadline to ensure your participation in the fsadcap program.

Who needs employee fsadcap enrollment?

01

Employees with eligible expenses: Any employee who has expenses that qualify for reimbursement through fsadcap can benefit from this enrollment. It allows individuals to set aside pre-tax dollars to cover various expenses such as medical bills, dependent care, or transportation costs.

02

Individuals looking for tax savings: Employee fsadcap enrollment provides a tax advantage by allowing you to contribute pre-tax income towards eligible expenses. This reduces your taxable income, resulting in potential tax savings.

03

Employees seeking financial flexibility: Fsadcap enrollment can provide employees with financial flexibility as it allows them to budget and allocate funds towards specific expenses. It ensures that money is set aside in advance, making budgeting and planning for qualified expenses easier.

Overall, employee fsadcap enrollment is beneficial for employees who want to optimize their tax savings, have eligible expenses to cover, and better manage their financial resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in employee fsadcap enrollment without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your employee fsadcap enrollment, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit employee fsadcap enrollment on an iOS device?

You certainly can. You can quickly edit, distribute, and sign employee fsadcap enrollment on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out employee fsadcap enrollment on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your employee fsadcap enrollment. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is employee fsadcap enrollment?

Employee fsadcap enrollment refers to the process of employees signing up for a flexible spending account dependent care assistance program.

Who is required to file employee fsadcap enrollment?

Employees who wish to participate in the flexible spending account dependent care assistance program are required to file employee fsadcap enrollment.

How to fill out employee fsadcap enrollment?

Employees can fill out the fsadcap enrollment form provided by their employer with their personal and dependent information, along with the contribution amounts.

What is the purpose of employee fsadcap enrollment?

The purpose of employee fsadcap enrollment is to allow employees to set aside pre-tax dollars to pay for eligible dependent care expenses.

What information must be reported on employee fsadcap enrollment?

Employee fsadcap enrollment typically requires information such as employee name, dependent information, contribution amounts, and contact details.

Fill out your employee fsadcap enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Fsadcap Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.