Get the free Form D: Calculating Your AOI and Amount Requested - sandiego

Show details

Date Of Land Evaluation Request. Name of Project ... For Corridor project use form NRCSCPA106). Maximum. Points. Site A. Site B. Site C. Site D. 1. Area Interurban Use. (15). 2. Perimeter In Nonurban

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form d calculating your

Edit your form d calculating your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form d calculating your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

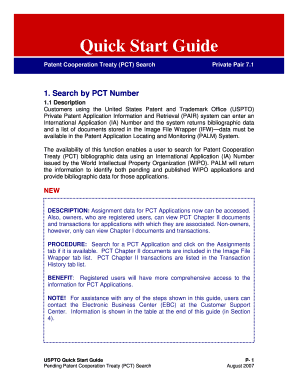

How to edit form d calculating your online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form d calculating your. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form d calculating your

How to fill out form D calculating your?

01

Start by gathering all the necessary information. Make sure you have the relevant financial data, such as income, expenses, and assets.

02

Begin filling out the form by providing your personal information. This includes your name, address, social security number, and other required details.

03

Move on to the income section. Here, you will need to list all your sources of income, such as salary, dividends, rental income, etc. Ensure you accurately report the amounts and provide any supporting documentation if needed.

04

Proceed to the expenses section. This is where you will detail your regular monthly expenses, including housing, utilities, transportation, healthcare, and any other relevant costs. Be thorough and include as much detail as possible.

05

If you have any assets, such as property or investments, you will need to disclose them in the asset section. Provide accurate valuations and any supporting documentation to back up your claims.

06

After completing the form, review all the information to ensure its accuracy and completeness. Double-check that you have not missed any details or made any errors.

Who needs form D calculating your?

01

Individuals or businesses involved in financial planning: Form D is useful for individuals or businesses that need to assess their financial situation accurately. By calculating your income, expenses, and assets, you can gain insights into your financial health and make informed decisions.

02

Investors and lenders: Lenders and investors often require a thorough understanding of an individual or business's financial situation before providing loans or making investment decisions. Form D can provide them with the necessary information to assess the viability of the venture.

03

Financial advisors and accountants: Financial advisors and accountants use form D in their day-to-day work to help clients with financial planning, tax preparation, and investment strategies. By analyzing the calculations provided in form D, they can offer valuable advice and guidance.

In summary, form D calculating your is essential for individuals, businesses, lenders, investors, financial advisors, and accountants. It helps in accurately assessing financial situations, making informed decisions, and providing valuable insights for financial planning and management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form d calculating your?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific form d calculating your and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in form d calculating your?

The editing procedure is simple with pdfFiller. Open your form d calculating your in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit form d calculating your straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form d calculating your.

What is form d calculating your?

Form D is used for reporting sales of securities that are exempt under Regulation D of the Securities Act of 1933.

Who is required to file form d calculating your?

Issuers of securities offering exemptions under Regulation D are required to file Form D.

How to fill out form d calculating your?

Form D can be filled out electronically through the SEC's EDGAR system.

What is the purpose of form d calculating your?

The purpose of Form D is to provide the SEC with information about the securities being offered under Regulation D exemptions.

What information must be reported on form d calculating your?

Form D requires information about the issuer, the securities being offered, the exemption being claimed, and the amount of money raised from the offering.

Fill out your form d calculating your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form D Calculating Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.