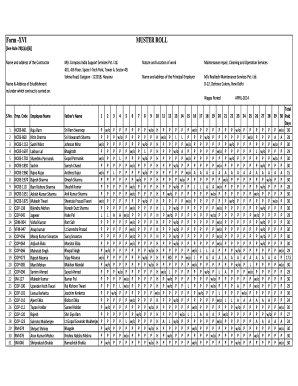

India Form XI - Register of Wages free printable template

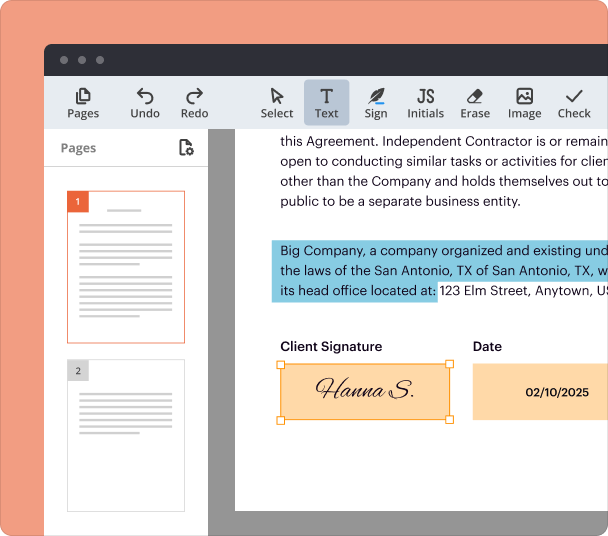

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

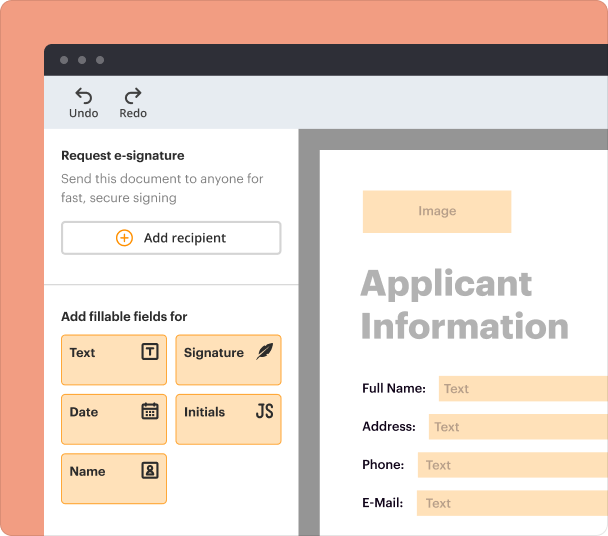

Create professional forms

Simplify data collection

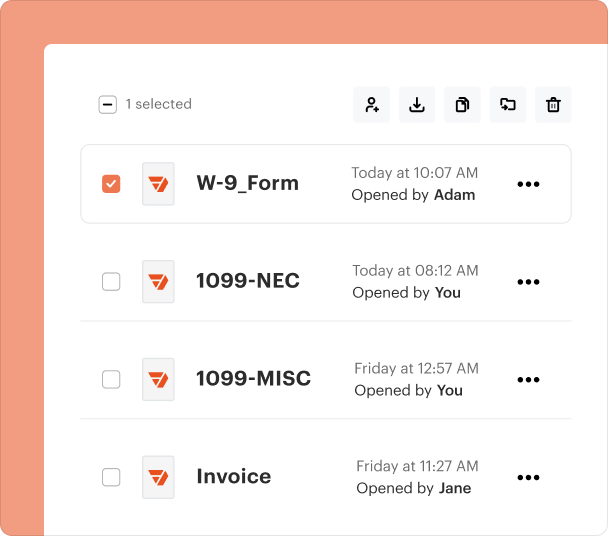

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

PF Form : Comprehensive Guide to Understanding and Filling Out the Form

Filling out the PF Form XI can be a straightforward process when you know what to expect. This guide will provide the essential steps and key components needed to complete this form correctly and efficiently.

What is PF Form ?

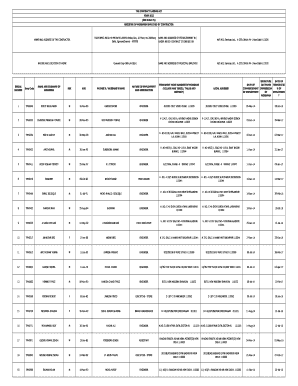

PF Form XI is a document used within India for the Employee Provident Fund (EPF) scheme, aimed at formalizing wage payments and ensuring compliance with labor laws. It serves as a critical tool for maintaining employee records and tracking contributions to the pension scheme. Understanding the importance of maintaining a Register of Wages is vital for organizations navigating the EPF regulations.

What are the key components of PF Form ?

-

This section requires the official name of your organization.

-

It is crucial to provide the full name of the employee for accurate identification.

-

Providing this can help in verifying the identity of the employee.

-

Enter the legally required minimum wage for the employee's position.

-

Document the exact wages that were disbursed to the employee.

-

These are used to calculate the employee's attendance and working hours.

-

List any necessary deductions from wages, such as taxes.

-

This final amount reflects what the employer owes the employee.

-

It is necessary for validating the document.

How do you fill out PF Form step-by-step?

-

Collect all relevant information about the employee’s wage and employment details.

-

Start by entering the establishment and employee details accurately.

-

Make sure to input the correct wage amounts and any deductions.

-

Cross-check the attendance records before finalizing the form.

-

Review all entries for accuracy and have the employee sign.

What supporting documents are required?

-

This can include a government-issued ID or Aadhar card.

-

Relevant documents may help in establishing an employee's wage history.

-

Invoices or payment slips can serve as validation.

What common mistakes should you avoid?

-

Double-check all fields to ensure there are no mistakes.

-

Ensure the employee’s signature is obtained to validate the form.

-

Missing deductions can lead to compliance issues.

Why are compliance notes important?

Filing PF Form XI correctly is not just about completion; it’s also about adhering to legal standards. Incorrect submissions can have grave implications, including penalties and disputes. Regularly reviewing the Register of Wages ensures your records are always up-to-date and compliant with EPF regulations.

How can pdfFiller assist with PF Form ?

pdfFiller streamlines the process of filling out PF Form XI with its cloud-based features. Users can easily edit PDF forms online, utilize collaborative tools for teamwork, and electronically sign documents, allowing for a seamless document management experience from anywhere, as emphasized in pdfFiller's positioning statement.

Frequently Asked Questions about wages register in excel format

What happens if the form is filled incorrectly?

Submitting an incorrectly filled PF Form XI can result in penalties and additional scrutiny by regulatory bodies. It's essential to double-check all entries before submission to avoid complications.

Who is responsible for maintaining the form?

The employer is primarily responsible for maintaining PF Form XI and ensuring its accuracy. This includes keeping the Register of Wages updated and compliant with legal standards.

How often should PF Form XI be updated?

PF Form XI should be updated whenever there are changes in employee wages or employment status. Regular updates help ensure compliance and accuracy in employee records.

What are the possible consequences of non-compliance?

Non-compliance with EPF regulations can lead to hefty fines, workplace disputes, and a tarnished reputation. It's crucial to understand the legal implications of any inaccuracies in your documentation.

pdfFiller scores top ratings on review platforms