Get the free Beneficiary Information for Trust Accounts (PDF, 279KB) - NAB

Show details

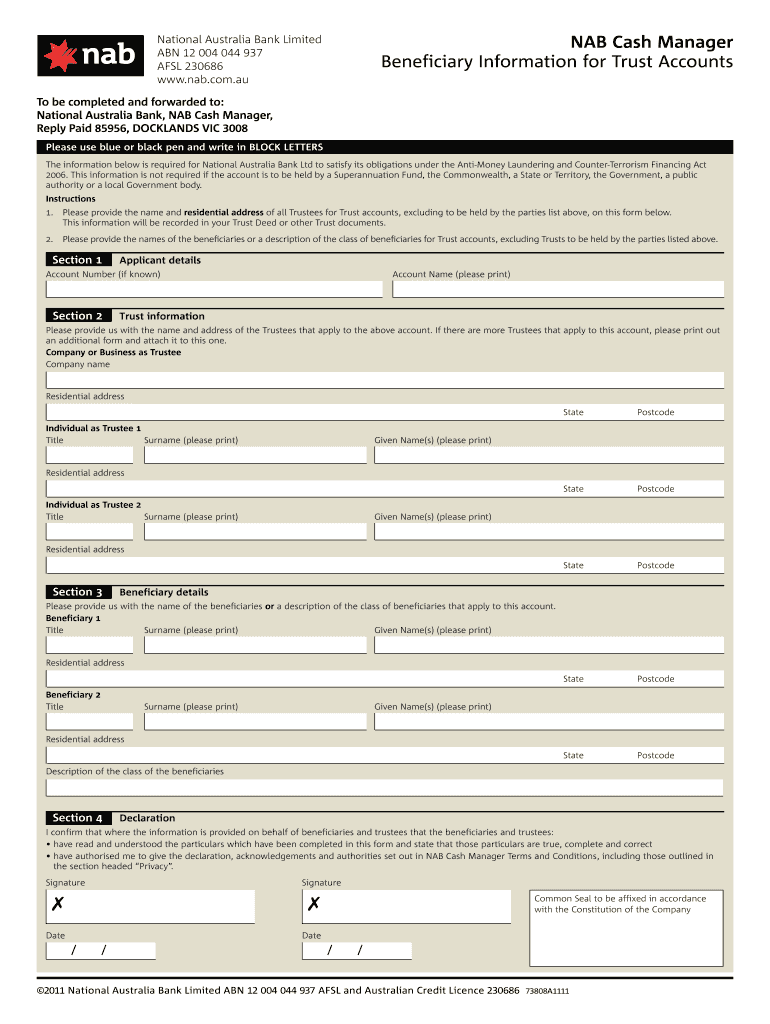

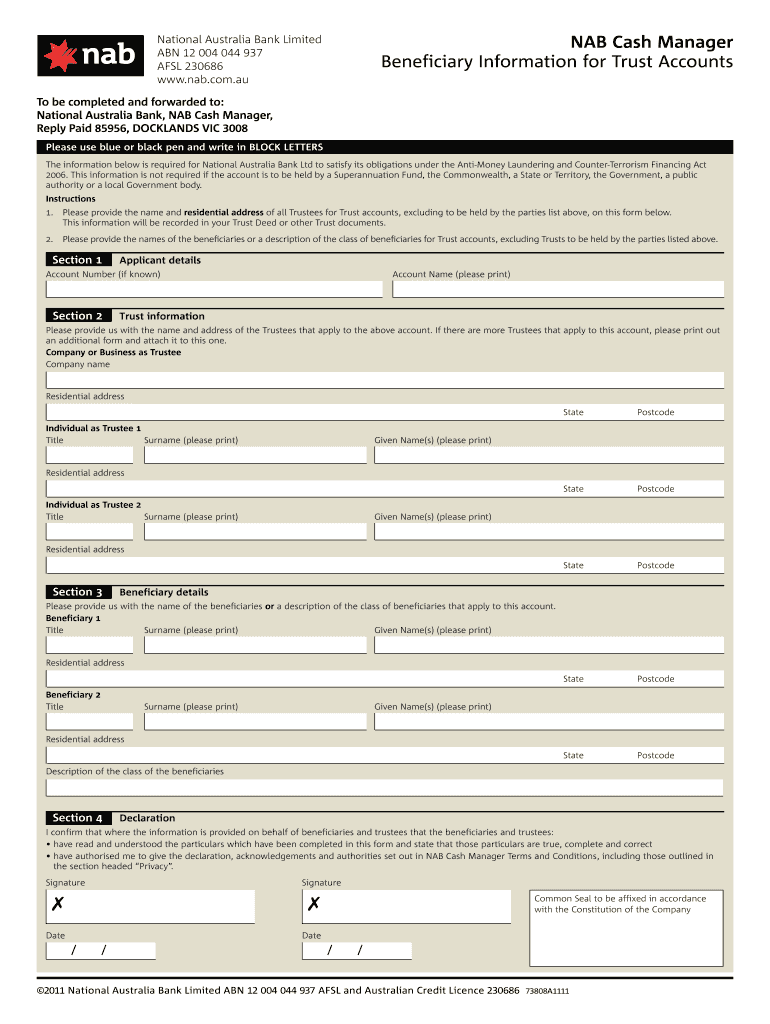

NAB Cash Manager Beneficiary Information for Trust Accounts National Australia Bank Limited ABN 12 004 044 937 ADSL 230686 www.nab.com.au To be completed and forwarded to: National Australia Bank,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficiary information for trust

Edit your beneficiary information for trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary information for trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficiary information for trust online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit beneficiary information for trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary information for trust

How to fill out beneficiary information for trust:

01

Gather all necessary documents: Before starting the process, gather all the necessary documents, such as the trust agreement, any amendments to the trust, and any other relevant paperwork.

02

Identify the beneficiaries: Determine who the beneficiaries of the trust are and gather their essential information, including their full legal names, addresses, and any relevant contact details.

03

Specify the beneficiaries' interests: Determine the specific interests or shares each beneficiary has in the trust. This could include percentages, specific assets, or other forms of distribution.

04

Provide the beneficiaries' Social Security numbers or Tax ID numbers: It is essential to include the beneficiaries' identification numbers to ensure proper tax reporting and compliance.

05

Appoint successor beneficiaries: In case a primary beneficiary is unable to receive their share in the trust, it is wise to designate alternate or successor beneficiaries. Provide their names and related information as well.

06

Consult with an attorney or financial advisor: If you have any doubts or concerns regarding the beneficiary information or the overall process, it is advisable to consult with an attorney or financial advisor who specializes in trust administration to ensure accuracy and compliance.

Who needs beneficiary information for trust?

01

Grantor: The person who establishes the trust and decides its terms will need the beneficiary information to properly distribute the assets according to their wishes.

02

Trustee: The trustee is responsible for managing and distributing the trust's assets. They require the beneficiary information to fulfill their responsibilities and keep accurate records.

03

Beneficiaries: The beneficiaries of the trust should have their information included to ensure they receive their rightful distribution from the trust. Providing their details helps facilitate communication and proper administration.

04

Legal and financial professionals: Attorneys, accountants, or financial advisors who are involved in the administration of the trust should have access to beneficiary information for legal and compliance purposes.

Remember, filling out beneficiary information for a trust is a crucial step in ensuring the proper distribution of assets and adhering to the terms of the trust. It is always recommended to consult with professionals to ensure accuracy, compliance, and the fulfillment of the grantor's intentions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get beneficiary information for trust?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the beneficiary information for trust. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the beneficiary information for trust electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your beneficiary information for trust in seconds.

How do I complete beneficiary information for trust on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your beneficiary information for trust by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is beneficiary information for trust?

Beneficiary information for trust is the details of individuals or entities who are entitled to receive benefits from the trust.

Who is required to file beneficiary information for trust?

The trustee or the person responsible for managing the trust is required to file beneficiary information for trust.

How to fill out beneficiary information for trust?

Beneficiary information for trust can be filled out by providing the names, addresses, and relationship to the trust of all beneficiaries.

What is the purpose of beneficiary information for trust?

The purpose of beneficiary information for trust is to keep records of who benefits from the trust and ensure transparency in its management.

What information must be reported on beneficiary information for trust?

The information that must be reported on beneficiary information for trust includes the names, addresses, and relationship to the trust of all beneficiaries.

Fill out your beneficiary information for trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Information For Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.