Get the free Independent Contractor/Consultant Form

Show details

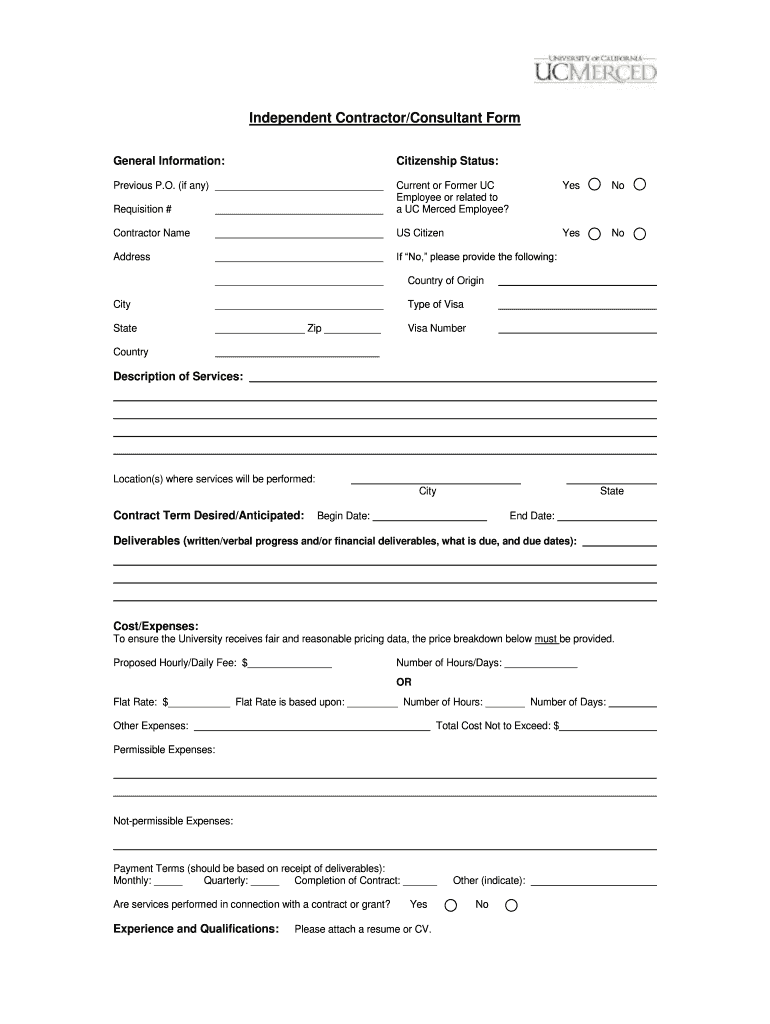

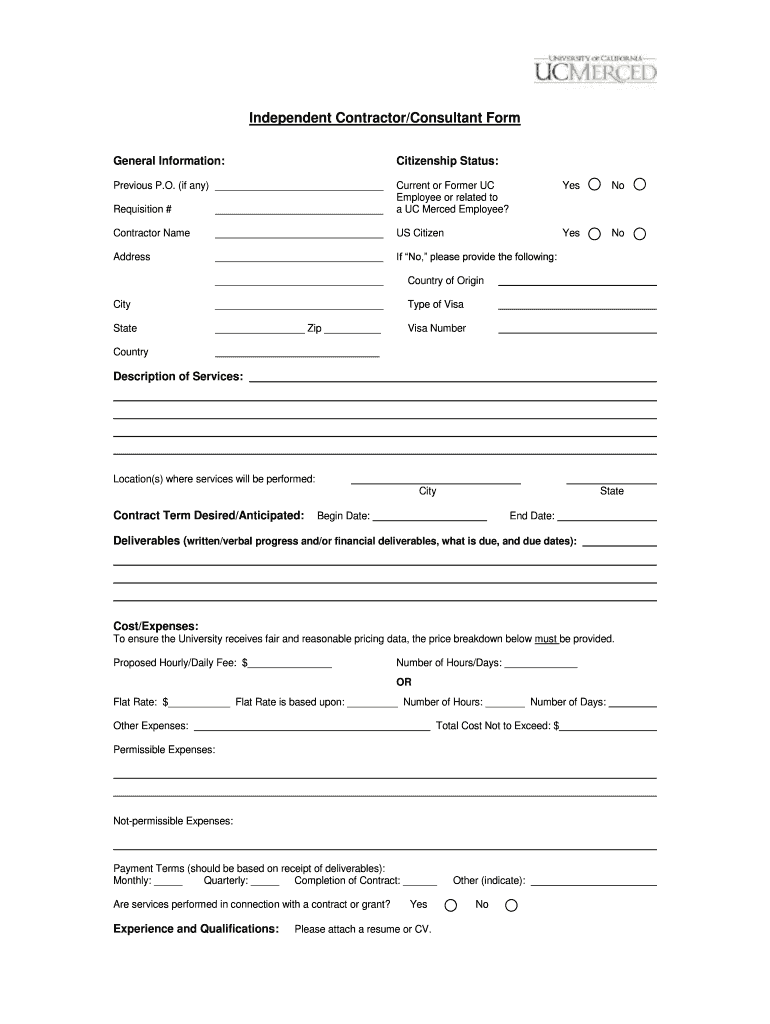

Independent Contractor/Consultant Form General Information: Citizenship Status: Previous P.O. (if any) Yes No Requisition # Current or Former UC Employee or related to a UC Merced Employee? Contractor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractorconsultant form

Edit your independent contractorconsultant form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractorconsultant form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractorconsultant form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit independent contractorconsultant form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractorconsultant form

How to fill out an independent contractor/consultant form:

01

Obtain the form: The first step is to acquire the independent contractor/consultant form. You can often find this document on the website or platform that you are providing your services through, or request it from the company or organization you will be working with.

02

Read the instructions: Carefully read through the instructions provided with the form. This will ensure that you understand the requirements and can accurately fill out the necessary information.

03

Personal information: Begin by filling out your personal information section on the form. This typically includes your full name, address, phone number, email address, and social security number or tax identification number.

04

Business information: If applicable, provide your business information, including your business name, address, and any relevant licenses or certifications.

05

Nature of services: Indicate the nature of the services you will be providing as an independent contractor/consultant. This could include a description of the services, the anticipated duration, and any specific deliverables or milestones.

06

Payment terms: Specify the payment terms, such as the rate, frequency, and method of payment. You may also want to include any additional expenses or reimbursement arrangements.

07

Independent contractor status: Confirm your status as an independent contractor. This section may require you to certify that you are not an employee of the company or organization, and that you will be responsible for your own taxes and benefits.

08

Sign and date: Review the form, ensuring that all the fields are filled out accurately. Sign and date the form as required.

Who needs an independent contractor/consultant form?

01

Companies or organizations: Any company or organization that hires independent contractors or consultants may require them to fill out this form. It helps in establishing the terms of the contract and clarifies the relationship between the parties involved.

02

Independent contractors or consultants: As an independent contractor or consultant, you may need to fill out this form to provide necessary information about your services and payment terms. This form ensures both parties are on the same page and have a clear understanding of the agreement.

03

Freelancers or self-employed individuals: If you are a freelancer or self-employed individual offering your services to clients, filling out an independent contractor/consultant form can help establish a professional relationship, outline the terms of your engagement, and protect your rights and responsibilities.

Remember, it's important to consult with a legal professional or tax advisor to ensure compliance with applicable laws and regulations when entering into any independent contractor/consultant agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit independent contractorconsultant form on an iOS device?

Create, modify, and share independent contractorconsultant form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete independent contractorconsultant form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your independent contractorconsultant form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out independent contractorconsultant form on an Android device?

Complete your independent contractorconsultant form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is independent contractor/consultant form?

The independent contractor/consultant form is a document used to report payments made to non-employees for services provided to a business.

Who is required to file independent contractor/consultant form?

Businesses or individuals who have paid $600 or more to a non-employee contractor or consultant during the tax year are required to file the form.

How to fill out independent contractor/consultant form?

The form typically requires the payer's information, the payee's information, and the total amount paid to the contractor or consultant. Specific instructions can be found on the form provided by the IRS.

What is the purpose of independent contractor/consultant form?

The form helps the IRS track payments made to non-employees and ensures that taxes are properly reported.

What information must be reported on independent contractor/consultant form?

The form typically requires the name, address, and taxpayer identification number of the contractor or consultant, as well as the total amount paid.

Fill out your independent contractorconsultant form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractorconsultant Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.