Get the free Home Ownership

Show details

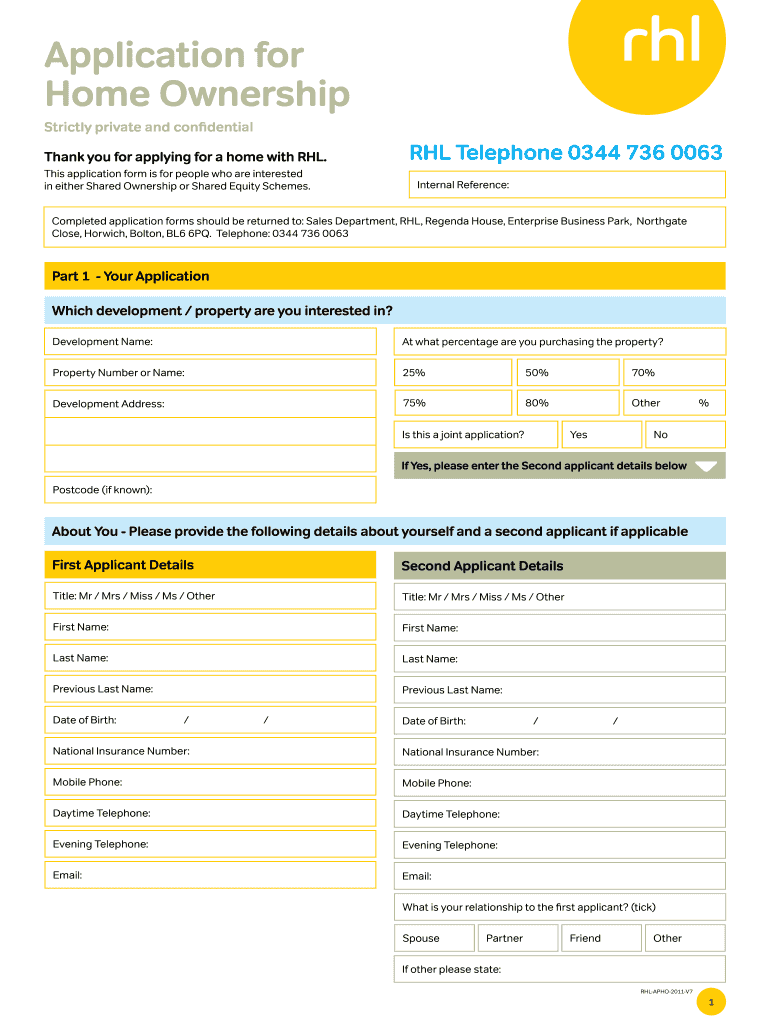

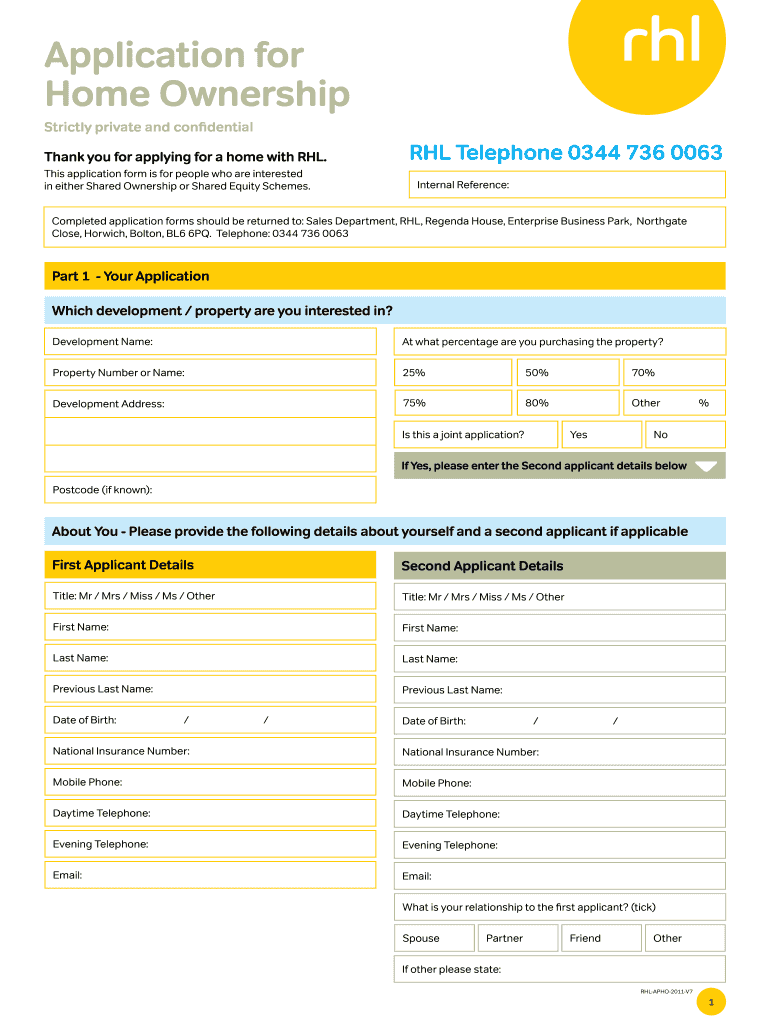

Application for Home Ownership Strictly private and confidential Thank you for applying for a home with OHL. This application form is for people who are interested in either Shared Ownership or Shared

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home ownership

Edit your home ownership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home ownership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home ownership online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit home ownership. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home ownership

How to fill out home ownership:

01

Determine your financial readiness: Assess your financial situation and evaluate if you are prepared for the responsibility of owning a home. Consider factors like your credit score, income stability, and savings for a down payment.

02

Research and compare mortgage options: Understand the different types of mortgages available and evaluate which one suits your financial goals and circumstances the best. Compare interest rates, terms, and conditions from various lenders to make an informed decision.

03

Save for a down payment: Start saving early for a down payment on your home. The larger the down payment, the lower your monthly mortgage payments will be. Aim to save at least 20% of the home's purchase price to avoid private mortgage insurance (PMI).

04

Determine your housing needs: Consider your current and future housing needs when looking for a home. Evaluate factors like location, size, number of bedrooms, amenities, and proximity to essential facilities like schools, hospitals, and transportation.

05

Begin house hunting: Use online listings, real estate agents, and referrals to find potential homes that meet your criteria. Visit different properties, attend open houses, and ask relevant questions to gather information and make an informed decision.

06

Get a home inspection: Once you find a home that you are interested in, hire a professional home inspector to assess its overall condition. This will help you identify any potential issues or repairs needed before purchasing the property.

07

Secure financing: Apply for a mortgage loan from a reputable lender. Provide all the necessary documentation, such as proof of income, employment verification, and tax returns. Work closely with your lender to complete the mortgage application process smoothly.

08

Negotiate the purchase price: Negotiate the price of the home with the seller based on market conditions, property condition, and comparable sales in the area. Consider conducting a comparative market analysis to have a better understanding of the property's value.

09

Complete the necessary paperwork: Work with your real estate agent and/or attorney to complete all the paperwork required for the home purchase. This may include a purchase agreement, disclosures, and other legal documents.

10

Close the deal: Schedule a closing meeting with all relevant parties involved, including the seller, your real estate agent, and the lender. Review and sign all the required documents, pay any remaining closing costs, and officially become a homeowner.

Who needs home ownership?

01

Individuals or families seeking stability: Homeownership provides stability and a sense of belonging. It allows you to put down roots, establish a community, and have control over your living space.

02

People looking to build equity: Owning a home can be a long-term investment that allows you to build equity over time. As you pay off your mortgage, the value of your home may appreciate, providing a potential source of wealth.

03

Those seeking tax benefits: Homeowners often enjoy benefits such as mortgage interest deductions and property tax deductions, which can help reduce the overall tax burden.

04

Individuals with specific housing needs: Owning a home allows you to tailor the space to your specific needs. Whether it's accommodating a growing family or having the freedom to make renovations, homeownership provides more flexibility than renting.

05

Those seeking financial security: Owning a home can provide a sense of financial security, as it removes the uncertainty of rising rent prices and provides a tangible asset that can be leveraged for future financial needs.

06

Investors looking for rental income: Homeownership can also be an attractive option for individuals looking to invest in real estate. By purchasing a property, one can generate rental income and potentially build a real estate portfolio.

Remember, homeownership is a significant commitment and financial responsibility. Before embarking on this journey, thoroughly assess your personal circumstances and weigh the advantages and challenges associated with owning a home.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the home ownership in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your home ownership in seconds.

How can I edit home ownership on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing home ownership, you need to install and log in to the app.

How do I complete home ownership on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your home ownership. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is home ownership?

Home ownership is the legal right to possess, control, and enjoy a property or dwelling.

Who is required to file home ownership?

Individuals or families who own a home or property are required to file home ownership.

How to fill out home ownership?

Home ownership can be filled out by providing accurate and up-to-date information about the property, including ownership details, property value, and any mortgages or liens.

What is the purpose of home ownership?

The purpose of home ownership is to establish legal ownership of a property, protect rights and interests of the owner, and maintain accurate property records.

What information must be reported on home ownership?

Information such as property details, ownership information, property value, mortgage details, and any changes in ownership or property status must be reported on home ownership.

Fill out your home ownership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Ownership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.