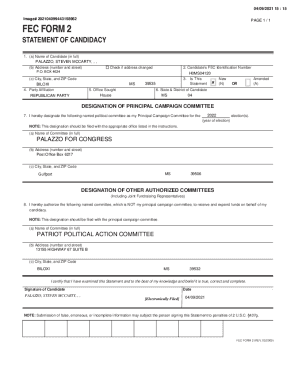

Get the free Bank Of America Checking Reconciliation Form. bank of america checking reconciliatio...

Show details

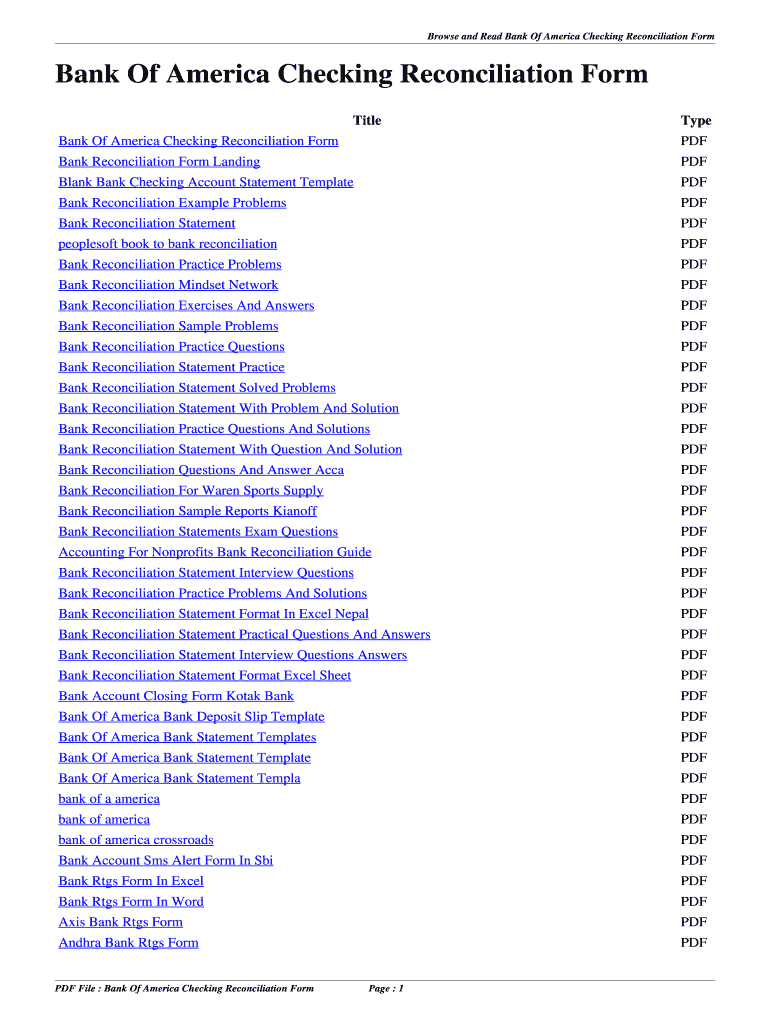

Browse and Read Bank of America Checking Reconciliation Form. Title Type Accounts Reconciliation Interview Questions PDF a summary of the economic and tax relief ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank of america checking

Edit your bank of america checking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank of america checking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank of america checking online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bank of america checking. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank of america checking

How to fill out bank of america checking

01

Step 1: Gather all necessary documents, such as identification, Social Security number, and proof of address.

02

Step 2: Visit the Bank of America website or go to a local branch to open a checking account.

03

Step 3: Choose the type of checking account you want to open, such as a basic checking or an interest-earning checking account.

04

Step 4: Fill out the required application form with accurate personal information.

05

Step 5: Provide any additional information or documents requested by the bank.

06

Step 6: Review the terms and conditions of the account and any associated fees.

07

Step 7: Fund your new checking account with an initial deposit.

08

Step 8: Wait for the bank to process your application and open your account.

09

Step 9: Once your account is open, you can start using your Bank of America checking account by depositing or withdrawing money, writing checks, or using online banking services.

10

Step 10: Regularly monitor your account activity and keep track of your finances to ensure it remains in good standing.

Who needs bank of america checking?

01

Individuals who want a secure and convenient way to manage their finances

02

Individuals who need to deposit their paychecks or receive regular direct deposits

03

Individuals who want access to a network of ATMs and branches across the country

04

Individuals who prefer online and mobile banking services for easy account management

05

Individuals who want to take advantage of features like online bill payment and mobile check deposits

06

Individuals who want a checking account that offers various features and benefits depending on their needs

07

Individuals who want to build a relationship with a well-established bank

Fill

form

: Try Risk Free

People Also Ask about

How to do a bank reconciliation example?

To reconcile a bank statement cash balance, add back deposits in transit and deduct uncleared checks. Next, add interest to the cash balance in a company's books and subtract bank fees and rejected checks. Finally, add or deduct any other items or errors to match the bank and book cash balances.

What is bank of America reconcile?

Charges can be reconciled anytime during a billing cycle as soon as they are posted to the card. Any charges available to be reconciled will show under pending. Billing cycles will end around the 15th of each month and all charges need to be reconciled and approved by the 25th of the same month.

How do I reconcile my checking account online?

Step-by-step guide to reconcile your bank statement Compare balances. Gather your accounting records for the time period covered by the bank statement. Identify differences. Resolve any issues. Adjust balances. Compare balances. Book adjusting journal entries.

What documents are needed for bank reconciliation?

The two primary documents are the bank statement and the check register.

How do I fill out a checking account reconciliation form?

How to complete a bank reconciliation procedure Get bank records. Gather your business records. Find a place to start. Go over your bank deposits and withdrawals. Check the income and expenses in your books. Adjust the bank statements. Adjust the cash balance. Compare the end balances.

What is an example of account reconciliation?

What Is an Example of Reconciliation in Accounting? An example of reconciliation would be the purchase of certain assets for a business used to generate revenue and ensuring that the purchase reflects correctly on both the balance sheet and the income statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in bank of america checking without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your bank of america checking, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the bank of america checking electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete bank of america checking on an Android device?

Use the pdfFiller Android app to finish your bank of america checking and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is bank of america checking?

Bank of America checking is a type of personal checking account offered by Bank of America.

Who is required to file bank of america checking?

Individuals who have a Bank of America checking account are required to file it.

How to fill out bank of america checking?

You can fill out a Bank of America checking account application online or at a Bank of America branch.

What is the purpose of bank of america checking?

The purpose of Bank of America checking is to provide individuals with a secure and convenient way to manage their finances.

What information must be reported on bank of america checking?

Information such as account holder's name, address, social security number, and account balance must be reported on Bank of America checking.

Fill out your bank of america checking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Of America Checking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.