Get the free TAX RETURN PREPARED FOOD & BEVERAGE TAX - charmeck

Show details

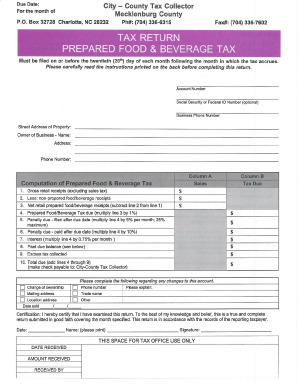

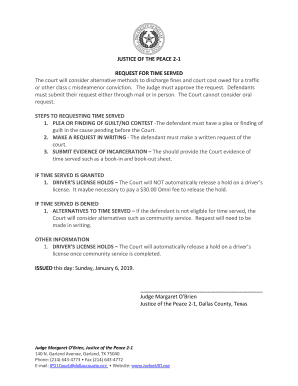

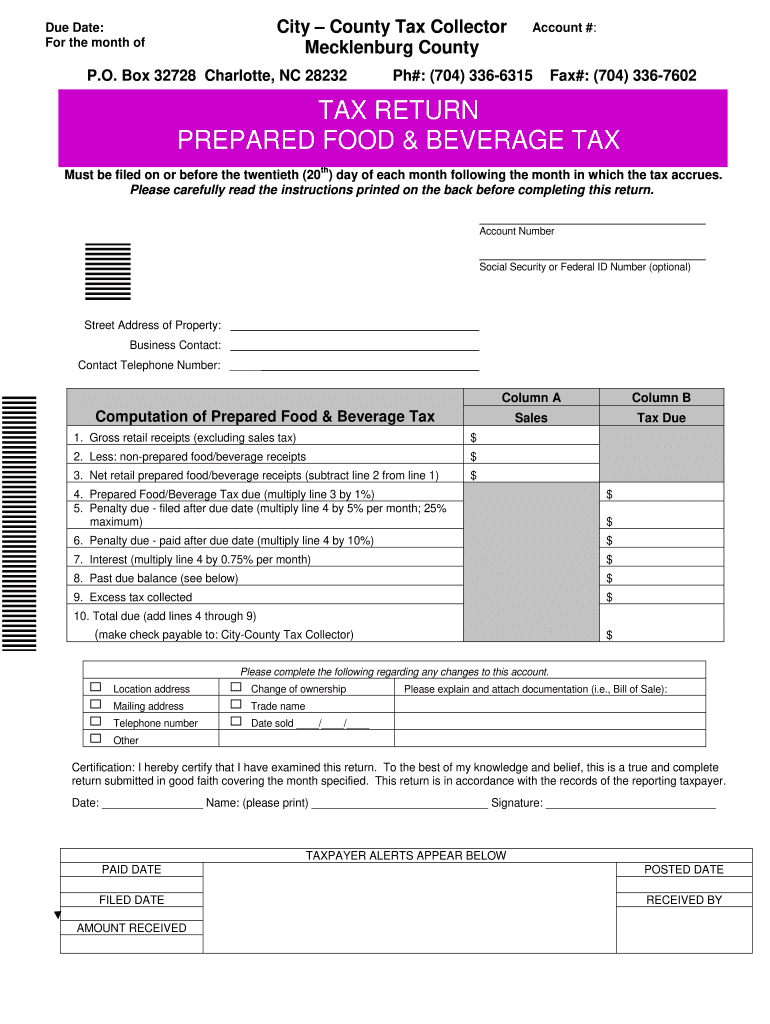

City County Tax Collector Mecklenburg County Due Date: For the month of P.O. Box 32728 Charlotte, NC 28232 Account #: pH#: (704) 3366315 Fax#: (704) 3367602 TAX RETURN PREPARED FOOD & BEVERAGE TAX

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax return prepared food

Edit your tax return prepared food form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax return prepared food form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax return prepared food online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax return prepared food. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax return prepared food

How to fill out NC Tax Return Prepared Food & Beverage

01

Gather all necessary documents, including sales records and purchase invoices.

02

Obtain the NC Tax Return Prepared Food & Beverage form from the NC Department of Revenue website.

03

Fill in your business information, including name, address, and tax identification number.

04

Report total sales of prepared food and beverages for the reporting period.

05

Calculate the tax due based on the applicable tax rate for prepared food and beverages.

06

Complete any additional required sections, such as deductions or credits if applicable.

07

Review your completed return for accuracy.

08

Submit the form by the due date, either electronically or by mail.

Who needs NC Tax Return Prepared Food & Beverage?

01

Businesses that sell prepared food and beverages for consumption, including restaurants, cafés, and catering services.

02

Any entity that is required to collect and remit sales tax on prepared food and beverage sales in North Carolina.

Fill

form

: Try Risk Free

People Also Ask about

Is prepared food taxable in California?

To-go sales of hot prepared food products are taxable, unless they are considered hot baked goods. Hot beverages such as coffee and tea are not taxable if sold to-go, but soda and alcoholic beverages are always taxable. For more information, see publication 22, Dining and Beverage Industry.

Why is cold food not taxable?

A cold food product is not “suitable for consumption on the premises” if it requires further processing by the customer, or is sold in a size not ordinarily consumed by one person. For example, the sale of a frozen pizza is not taxable because it requires further processing by the customer.

What is the prepared food tax in NC?

Prepared Meals Tax in North Carolina is a 1% tax that is imposed upon meals that are prepared at restaurants. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. The provision is found in G.S. 105-164.3(28) and reads as follows: 28) Prepared food.

Is there sales tax on prepared food in Texas?

Food products are not taxable. Food products include flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries. Nontaxable food products also include food that is: typically reheated before eating; or.

Is cold food to-go taxable in California?

California Constitution, Article XIII, Section 34. (a) In General. Tax does not apply to sales of food products for human consumption except as provided in Regulations 1503, 1574, and 1603.

Is to-go food taxed in California?

Food Deliveries If you make deliveries of food, it is considered food sold "to-go". Hot prepared food is taxable including any delivery fees you may charge. However, if the food product is not taxable, such as cold sandwiches, then the delivery charge is also not taxable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax return prepared food without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your tax return prepared food into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit tax return prepared food in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tax return prepared food, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out tax return prepared food using my mobile device?

Use the pdfFiller mobile app to fill out and sign tax return prepared food on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is NC Tax Return Prepared Food & Beverage?

NC Tax Return Prepared Food & Beverage is a tax form used by businesses that sell prepared food and beverages in North Carolina to report and remit applicable sales tax.

Who is required to file NC Tax Return Prepared Food & Beverage?

Businesses and vendors that sell prepared food and beverages in North Carolina are required to file the NC Tax Return Prepared Food & Beverage.

How to fill out NC Tax Return Prepared Food & Beverage?

To fill out the NC Tax Return Prepared Food & Beverage, businesses must gather sales data, complete the form accurately reporting total sales, compute the appropriate tax owed, and submit it to the North Carolina Department of Revenue.

What is the purpose of NC Tax Return Prepared Food & Beverage?

The purpose of the NC Tax Return Prepared Food & Beverage is to ensure that businesses selling prepared food and beverages comply with sales tax regulations and properly report their sales for tax assessment.

What information must be reported on NC Tax Return Prepared Food & Beverage?

The information that must be reported includes total gross sales of prepared food and beverages, total exemptions, tax deductions, and the total sales tax due.

Fill out your tax return prepared food online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Return Prepared Food is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.