Get the free IRS Form I-9 - paradigmos.com

Show details

ISBN 9789619384213 (PDF) .... (http://www.ibogaine.desk.nl/SofTInitiationProtocol .html), in do sedan JE bills to, pole ..... the update, k ever JE dopiness Audi paradigm o many Evans code (Flakes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form i-9

Edit your irs form i-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form i-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form i-9 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form i-9. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form i-9

How to Fill Out IRS Form I-9:

01

Obtain the form: The IRS Form I-9 can be found on the official website of the U.S. Citizenship and Immigration Services (USCIS). You can download it as a PDF or obtain a physical copy from your employer.

02

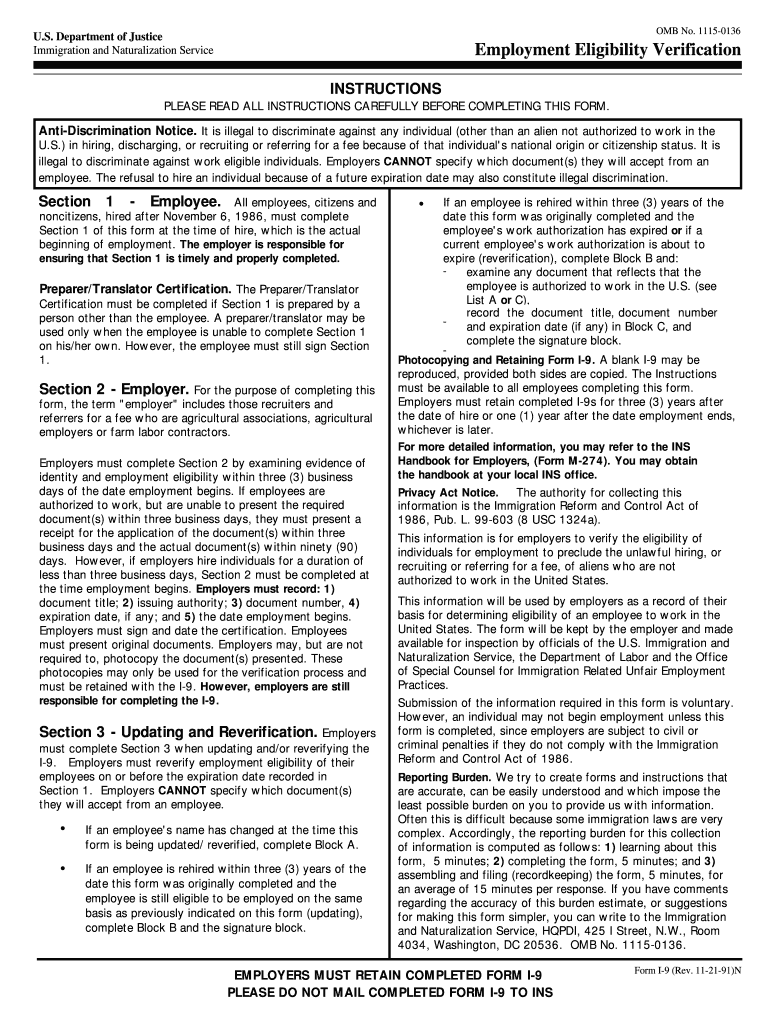

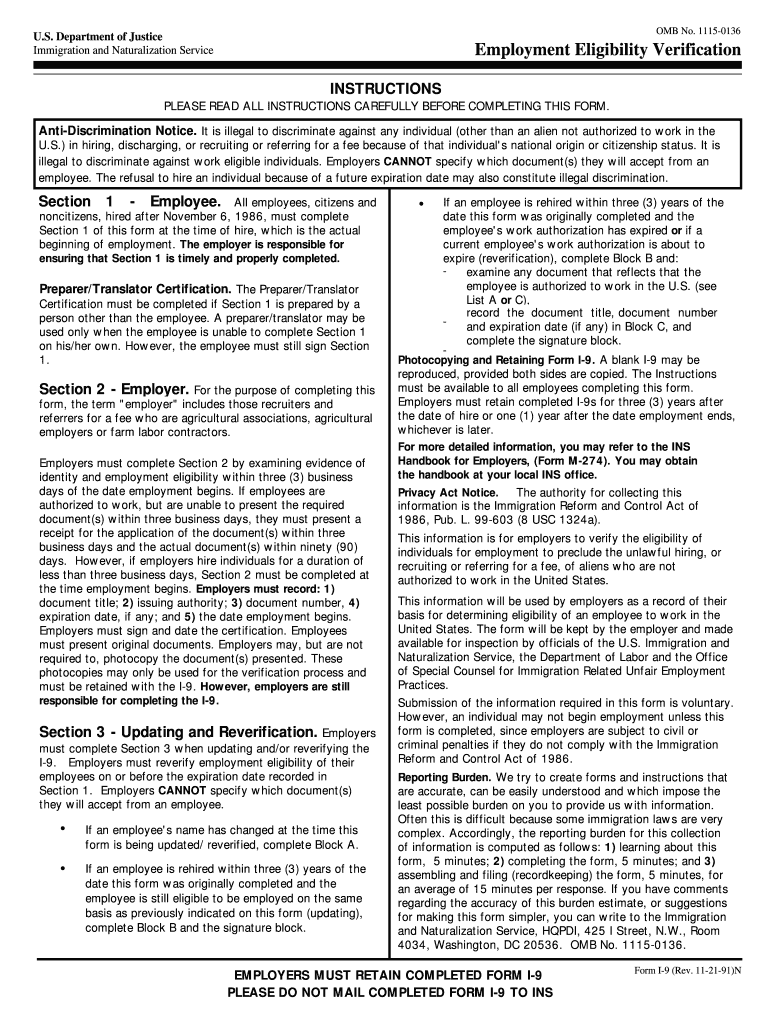

Read the instructions: Before filling out the form, carefully read the instructions provided. This will help you understand the purpose of each section and the information required.

03

Section 1: Employee Information and Attestation: As an employee, you need to complete this section by providing personal details such as your full name, address, date of birth, and Social Security number (if applicable). Additionally, you must attest to your employment authorization status by selecting the appropriate option.

04

Section 2: Employer or Authorized Representative Review and Verification: This section is to be completed by your employer or their authorized representative. After reviewing your documents, they will fill in their information, attest to the authenticity of the documents, and record the document title, number, expiration date (if applicable), and the date of verification.

05

Supporting documents: Along with the form, you will need to provide supporting documents to prove your identity and employment eligibility. These documents can include a valid passport, driver's license, Social Security card, birth certificate, or other acceptable forms listed on the form's instructions.

06

Signature and date: After completing the relevant sections, sign and date the form to affirm the accuracy of the information provided.

Who needs IRS Form I-9?

01

Employers: Any individual or organization that hires employees for wages or gives away anything of value in exchange for labor needs to use IRS Form I-9. This includes both for-profit and non-profit employers.

02

Newly hired employees: Every person, whether a citizen or non-citizen, who begins working for an employer in the United States must complete IRS Form I-9. This includes U.S. citizens, permanent residents, refugees, and asylees, among others.

03

Remote hires: Even if an employee is hired remotely or works from a location other than the physical workplace, both the employer and employee must complete the IRS Form I-9.

In conclusion, filling out IRS Form I-9 requires accurately providing personal information, attesting to employment authorization, and presenting valid supporting documents. This form is necessary for employers who hire individuals for wages and for all newly hired employees in the United States.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irs form i-9 online?

Filling out and eSigning irs form i-9 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the irs form i-9 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your irs form i-9 in seconds.

How do I edit irs form i-9 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing irs form i-9.

What is irs form i-9?

IRS Form I-9 is used for verifying the identity and employment authorization of individuals hired for employment in the United States.

Who is required to file irs form i-9?

All employers in the United States must complete and retain Form I-9 for each individual they hire for employment.

How to fill out irs form i-9?

Form I-9 must be filled out by both the employee and the employer. The employee must provide their personal information and documentation to verify their employment eligibility, while the employer must review and verify the documents provided.

What is the purpose of irs form i-9?

The purpose of IRS Form I-9 is to verify the identity and eligibility of individuals hired for employment in the United States, in order to comply with immigration laws.

What information must be reported on irs form i-9?

Form I-9 requires information such as the employee's name, address, date of birth, Social Security number, and documentation to establish their eligibility to work in the United States.

Fill out your irs form i-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form I-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.