Get the free Flood Insurance

Show details

WEST VIRGINIA BANKERS ASSOCIATION Presents Flood Insurance: Compliance Issues and Enforcement Topics that Continue to Plague Lenders A web-based seminar Tuesday, April 17th, 2012 Program Content:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flood insurance

Edit your flood insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flood insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flood insurance online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit flood insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flood insurance

How to Fill Out Flood Insurance:

01

Begin by gathering all necessary information and documents, such as property details, property value, and information about previous flood claims, if any.

02

Contact an insurance provider or agent who offers flood insurance coverage. This can be done either online, over the phone, or in person at their office.

03

Provide accurate information about the property, including its location and any relevant details about the flood risk in the area.

04

Determine the coverage amount you need for the property. This can be based on the property's value or the amount needed to rebuild or repair in case of flood damage.

05

Discuss the available options for flood insurance policies with the insurance provider. Ensure they are providing the coverage that suits your needs and budget.

06

Carefully review all policy details, terms, and conditions. Understand the deductibles, limitations, and exclusions associated with the flood insurance coverage.

07

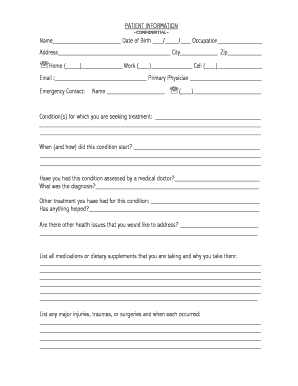

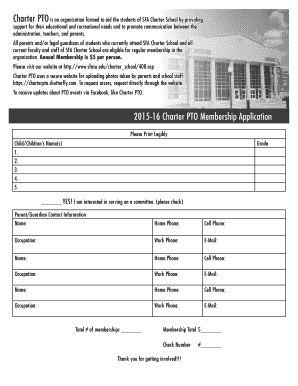

Fill out the necessary paperwork, including the application form for flood insurance. Provide accurate and complete information while filling out the form.

08

Pay the required premiums for the flood insurance policy. The premium amount may vary based on the property's location, value, and the level of flood risk.

09

Review the completed application and policy before signing any documents. Seek clarification from the insurance provider if there are any doubts or queries.

10

Submit the filled-out application form and other required documents to the insurance provider. Ensure to keep a copy of all the submitted documents for your reference.

Who Needs Flood Insurance:

01

Homeowners living in areas prone to flooding should strongly consider having flood insurance. This includes properties located near bodies of water, in coastal areas, or in regions with high rainfalls.

02

Business owners, especially those operating in flood-prone regions, should also obtain flood insurance coverage. This includes businesses located in flood zones or areas susceptible to heavy rains or hurricanes.

03

Renters should also consider obtaining flood insurance for their personal belongings. While the landlord's insurance may cover the building's structure, it might not provide coverage for the tenant's possessions in case of a flood.

04

Even if a property is not located in a high-risk flood zone, it does not guarantee safety from flooding. Therefore, homeowners and business owners across all regions should assess their flood risk and consider acquiring flood insurance if needed.

05

Additionally, individuals who have taken out a mortgage or loan on a property located in a government-mapped flood zone may be required by their lender to carry flood insurance.

Remember, individual circumstances and risk levels may vary, so consulting with an insurance professional is important to determine the specific need for flood insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is flood insurance?

Flood insurance is a type of insurance coverage that protects a property owner from financial losses due to flooding events.

Who is required to file flood insurance?

Property owners located in high-risk flood zones are usually required to purchase flood insurance as a condition of their mortgage. However, anyone can purchase flood insurance to protect their property.

How to fill out flood insurance?

To fill out flood insurance, property owners must provide information about their property, including its location, value, and any previous flood damage. This information is used to determine the coverage and premiums.

What is the purpose of flood insurance?

The purpose of flood insurance is to provide financial protection to property owners in case of damage caused by flooding events, which are not typically covered by standard homeowners insurance policies.

What information must be reported on flood insurance?

Information such as property location, value, previous flood damage, and desired coverage limits must be reported on flood insurance applications.

How can I modify flood insurance without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your flood insurance into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I fill out flood insurance on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your flood insurance. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit flood insurance on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share flood insurance on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your flood insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flood Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.