WI DoR PW-2 2016 free printable template

Show details

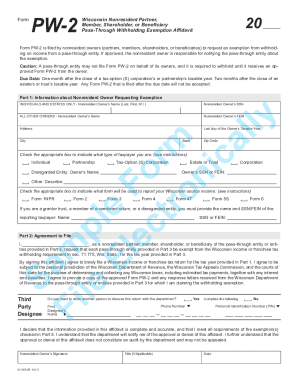

FormPW22016Wisconsin Nonresident Partner,

Member, Shareholder, or Beneficiary

Withholding Exemption AffidavitNote: This form is due within one month or two months after the close of the pass-through

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR PW-2

Edit your WI DoR PW-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR PW-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI DoR PW-2 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WI DoR PW-2. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR PW-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR PW-2

How to fill out WI DoR PW-2

01

Obtain the WI DoR PW-2 form from the official Wisconsin Department of Revenue website or local office.

02

Fill out your personal information including your name, address, and Social Security number at the top of the form.

03

Provide details regarding your income sources such as wages, business income, and any other sources.

04

Input any deductions or credits you are eligible for in the respective sections.

05

Review the completed form for accuracy and ensure all necessary information is included.

06

Sign and date the form at the bottom before submission.

07

Submit the form following the instructions provided, either by mail or electronically, as required.

Who needs WI DoR PW-2?

01

Individuals residing in Wisconsin who have a filing requirement for state income taxes.

02

Taxpayers who are claiming specific deductions or credits relevant to their income situation.

03

Residents needing to report their income and determine their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

How many exemptions should I claim Wisconsin?

If employees claim more than 10 exemptions or claim complete exemption from withholding and earn more than $200 per week, employers are required to mail a copy of their Form WT-4 to the Wisconsin Department of Revenue (DOR).

Do I need a Wisconsin withholding tax number?

Every employer who is required to withhold Wisconsin income tax must register with the Wisconsin Department of Revenue for a Wisconsin withholding tax account number.

How do I know if I am exempt from Wisconsin withholding?

Employee is a resident of a state with which Wisconsin has a reciprocity agreement. Wisconsin currently has reciprocity agreements with Illinois, Indiana, Kentucky, and Michigan. If you employ residents of those states, you are not required to withhold Wisconsin income taxes from wages paid to such employees.

How do I find my Wisconsin withholding number?

Find Your Wisconsin Tax ID Numbers and Rates Look up your Department of Revenue Tax Number online by selecting “Look up account number and filing frequency.” Locate your Department of Revenue Tax Number on any previously filed quarterly tax return (WT-6). Call the Department of Revenue at 608-266-2776.

What is Wisconsin pw 2?

Member, Shareholder, or Beneficiary. Pass-Through Withholding Exemption Affidavit. Form. Form PW-2 is filed by nonresident owners (partners, members, shareholders, or beneficiaries) to request an exemption from withhold- ing on income from a pass-through entity.

What is Wisconsin withholding exemption certificate?

LINE 3: Exemption from withholding – You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax for last year, and you expect to incur no liability for income tax for this year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WI DoR PW-2 for eSignature?

WI DoR PW-2 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in WI DoR PW-2?

The editing procedure is simple with pdfFiller. Open your WI DoR PW-2 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit WI DoR PW-2 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing WI DoR PW-2, you can start right away.

What is WI DoR PW-2?

WI DoR PW-2 is a form used in Wisconsin for reporting worker's compensation insurance information.

Who is required to file WI DoR PW-2?

Employers in Wisconsin who are required to provide worker's compensation coverage must file the WI DoR PW-2.

How to fill out WI DoR PW-2?

To fill out WI DoR PW-2, gather required business and insurance details, then enter them into the designated fields on the form, following the instructions provided.

What is the purpose of WI DoR PW-2?

The purpose of WI DoR PW-2 is to report information about worker's compensation insurance coverage to the Wisconsin Department of Revenue.

What information must be reported on WI DoR PW-2?

The information reported on WI DoR PW-2 includes the employer's name, address, worker's compensation insurance policy number, effective dates, and any changes to coverage.

Fill out your WI DoR PW-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR PW-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.