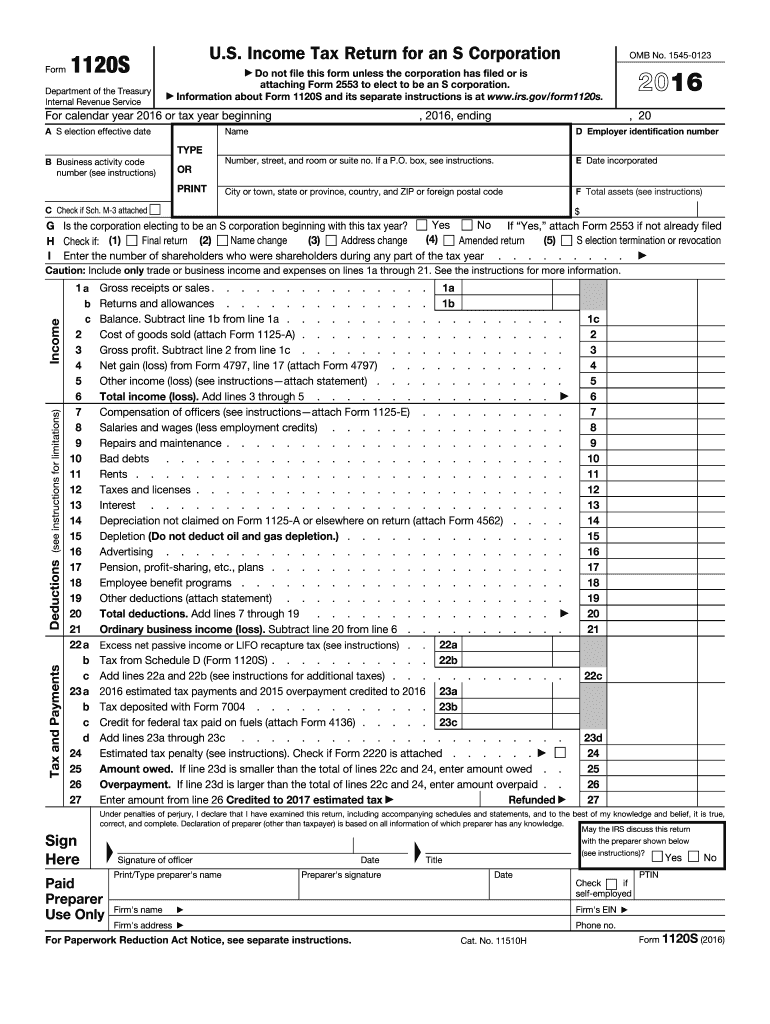

IRS 1120S 2016 free printable template

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

About IRS 1120S 2016 previous version

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S

What should I do if I notice an error after filing my IRS 1120S?

If you find a mistake after submitting your IRS 1120S, you should file an amended return. Use Form 1120S, check the box for an amended return, and provide the corrected information. Ensure this form is filed as soon as the error is discovered to minimize potential issues.

How can I check the status of my IRS 1120S submission?

To verify the receipt and processing status of your IRS 1120S, you can use the IRS's e-file status tool or contact the IRS directly. Keep your confirmation numbers or relevant details handy, as it will help expedite the process. Tracking your submission ensures that you address any issues promptly.

What are some common errors made when filing the IRS 1120S?

Common mistakes include misreporting income, incorrectly calculating deductions, and failing to sign the form. Double-checking numbers and ensuring all required sections are completed can help you avoid these issues and ensure your IRS 1120S is filed correctly.

Can I e-file my IRS 1120S using tax preparation software?

Yes, many reputable tax preparation software programs support the e-filing of IRS 1120S. Ensure the software is updated and compliant with the latest IRS requirements to avoid compatibility issues during filing. This method also offers convenience and quicker processing times.

What should I do if I receive a notice from the IRS regarding my 1120S?

If you receive a notice from the IRS related to your IRS 1120S, read it carefully to understand the issue being raised. Respond promptly, providing any required documentation or clarifications mentioned in the notice. Keeping organized records can facilitate an effective response to IRS inquiries.

See what our users say