IRS 4562 2016 free printable template

Show details

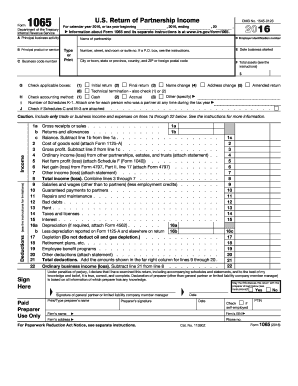

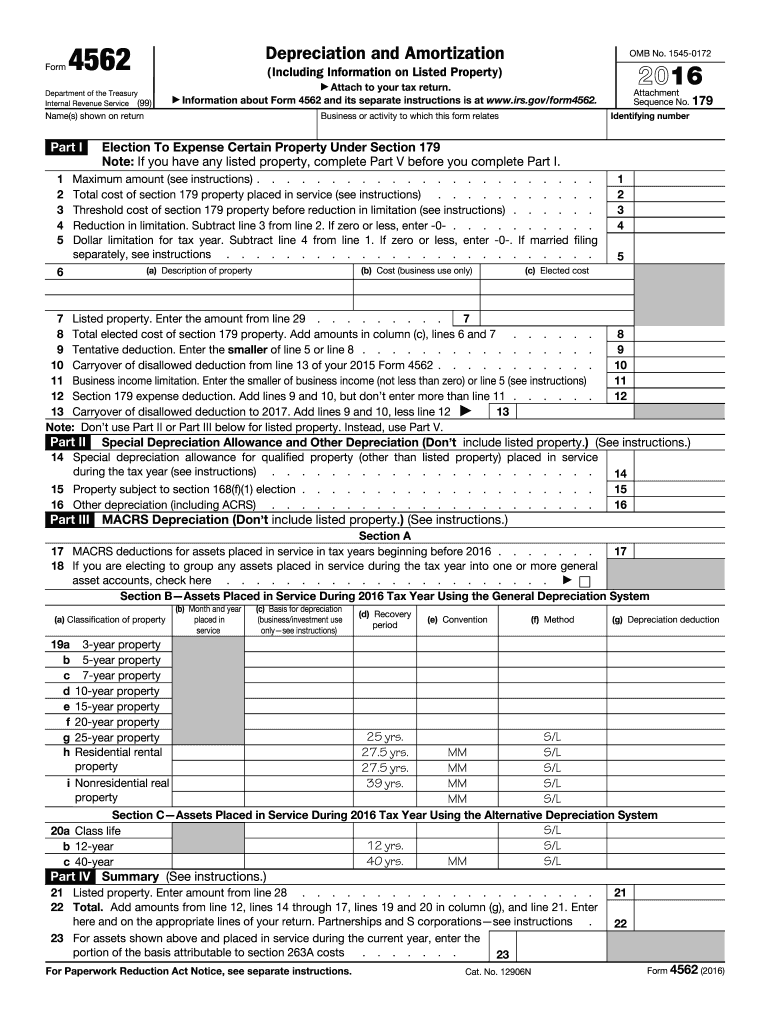

Cat. No. 12906N Form 4562 2016 Page 2 used for entertainment recreation or amusement. Part V Note For any vehicle for which you are using the standard mileage rate or deducting lease expense complete only 24a 24b columns a through c of Section A all of Section B and Section C if applicable. Form Depreciation and Amortization Attach Information to your tax return* about Form 4562 and its separate instructions is at www*irs*gov/form4562. Name s shown on return Attachment Sequence No* 179...Identifying number Business or activity to which this form relates Election To Expense Certain Property Under Section 179 Note If you have any listed property complete Part V before you complete Part I. Maximum amount see instructions. Total cost of section 179 property placed in service see instructions. Threshold cost of section 179 property before reduction in limitation see instructions. Reduction in limitation* Subtract line 3 from line 2. If zero or less enter -0-. Dollar limitation for...tax year. Subtract line 4 from line 1. If zero or less enter -0-. If separately see instructions. Including Information on Listed Property Department of the Treasury Internal Revenue Service 99 Part I OMB No* 1545-0172 a Description of property b Cost business use only. married. filing c Elected cost 7 Listed property. Enter the amount from line 29. 8 Total elected cost of section 179 property. Add amounts in column c lines 6 and 7. 9 Tentative deduction* Enter the smaller of line 5 or line 8....10 Carryover of disallowed deduction from line 13 of your 2015 Form 4562. 11 Business income limitation* Enter the smaller of business income not less than zero or line 5 see instructions 12 Section 179 expense deduction* Add lines 9 and 10 but don t enter more than line 11. Note Don t use Part II or Part III below for listed property. Instead use Part V. Part II Special Depreciation Allowance and Other Depreciation Don t include listed property. See instructions. 14 Special depreciation...allowance for qualified property other than listed property placed in service during the tax year see instructions. 15 Property subject to section 168 f 1 election. 16 Other depreciation including ACRS. Part III MACRS Depreciation Don t include listed property. See instructions. Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2016. 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts...check here. Section B Assets Placed in Service During 2016 Tax Year Using the General Depreciation System a Classification of property b Month and year placed in service c Basis for depreciation business/investment use only see instructions 19a b c d e f g h 3-year property Residential rental property i Nonresidential real d Recovery period 25 yrs. 39 yrs. e Convention f Method MM S/L 20a Class life b 12-year 40 yrs. c 40-year Part IV Summary See instructions. 22 Total* Add amounts from line 12...lines 14 through 17 lines 19 and 20 in column g and line 21. Enter here and on the appropriate lines of your return* Partnerships and S corporations see instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4562

How to edit IRS 4562

How to fill out IRS 4562

Instructions and Help about IRS 4562

How to edit IRS 4562

Editing IRS 4562 involves ensuring accurate information on depreciation and amortization of assets. Use tools like pdfFiller to modify the form easily. This includes correcting any errors or updating figures that may have changed after the original filing. After making edits, verify that all entries align with IRS guidelines.

How to fill out IRS 4562

Filling out IRS 4562 requires a systematic approach to ensure all relevant sections are completed accurately. Begin by gathering necessary documentation regarding depreciated assets, such as purchase receipts or prior tax returns that detail asset dispositions. Use the following steps:

01

Identify assets that qualify for depreciation or amortization.

02

Gather details including asset type, cost, and dates of acquisition.

03

Complete the applicable sections of the form, such as Part I for Section 179 and Part III for MACRS.

04

Review for accuracy and ensure all calculations are correct.

About IRS 4 previous version

What is IRS 4562?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4 previous version

What is IRS 4562?

IRS 4562 is the form used to report depreciation and amortization of assets. It provides a mechanism for taxpayers to claim deductions for the exhaustion of property over time, thus reflecting a decrease in the asset’s value. This form is crucial for business owners and self-employed individuals who own depreciable assets.

What is the purpose of this form?

The primary purpose of IRS 4562 is to allow taxpayers to claim deductions related to the depreciation of business assets. It outlines the methods of depreciation including the Modified Accelerated Cost Recovery System (MACRS), Section 179 deduction, and other related calculations. This ensures that taxpayers can reduce their taxable income based on their asset utilization.

Who needs the form?

Taxpayers who own business property or equipment and wish to deduct depreciation or amortization must complete IRS 4562. This includes sole proprietors, partnerships, and corporations that acquire eligible assets. If your business claims depreciation on more than $2,500 of an asset's cost, this form must be filed.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 4562 if your total cost for the assets does not exceed $2,500, as you can write these off as current expenses rather than depreciable assets. Additionally, if you are not claiming depreciation or Section 179 expense for the tax year, the form is unnecessary.

Components of the form

IRS 4562 consists of several parts, each designated for different types of property or deductions. Key components include:

01

Part I: Election to expense certain property under Section 179.

02

Part II: Special depreciation allowance.

03

Part III: MACRS depreciation.

04

Part IV: Summary of deductions.

05

Part V: Listed property for business use.

What are the penalties for not issuing the form?

Failure to file IRS 4562 when required may result in penalties, including disallowance of depreciation deductions. Additionally, if the IRS determines that the taxpayer willfully neglected to report relevant assets, additional penalties may apply, potentially affecting future tax filings.

What information do you need when you file the form?

When filing IRS 4562, you need to gather essential information such as:

01

Details of all depreciable assets, including description and acquisition dates.

02

The cost of each asset and any prior depreciation taken.

03

Information about special elections, such as Section 179 or bonus depreciation.

04

Business use percentage for any listed property.

Is the form accompanied by other forms?

IRS 4562 may need to be accompanied by other forms depending on the specifics of your tax situation. For instance, if claiming Section 179, you should ensure it aligns with Form 1040 or Form 1065 filings for sole proprietors or partnerships, respectively. Consult the current IRS instructions for details on any additional documentation requirements.

Where do I send the form?

The destination for sending IRS 4562 depends on your specific tax situation, such as filing a personal or business return. Typically, you would include it with your complete tax return mailed to the appropriate IRS service center as specified in the instructions for your tax form. Ensure you check the latest IRS guidelines for clarity on the correct mailing address.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Would like to have known upfront that the trial was not free

I found it relatively easy to use, it would be nice if it had an undo selection. And getting the right size font was not easy. Had to wait for print out to see.

This is the easiest PDF Filler that I have found. LOVE IT!

So Far I am impressed with the easy to use features and cannot believe what you can do on the most complicated to simply documents. Highly recommend!!

Great service. Have used more than I thought I would!

Great, easy to use, but WAY TOO expensive for someone who only needs it for a few docs...

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.