Get the free 4797 instructions 2016 form - irs

Show details

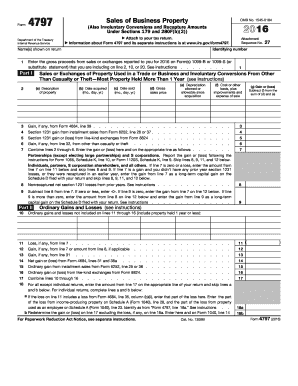

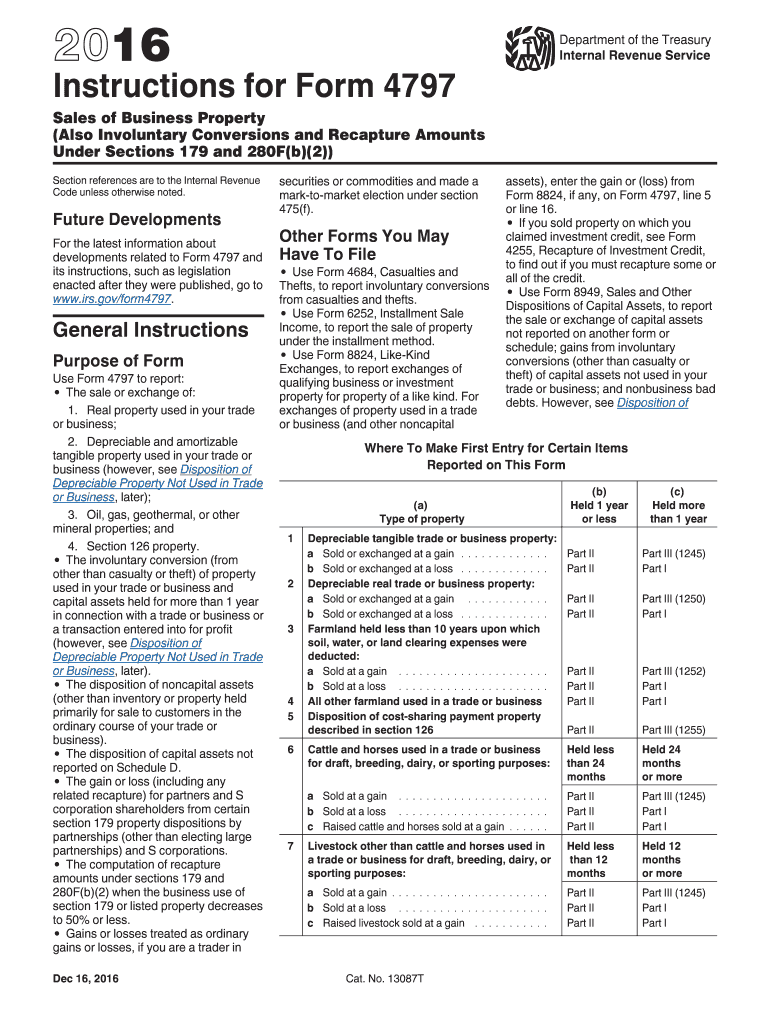

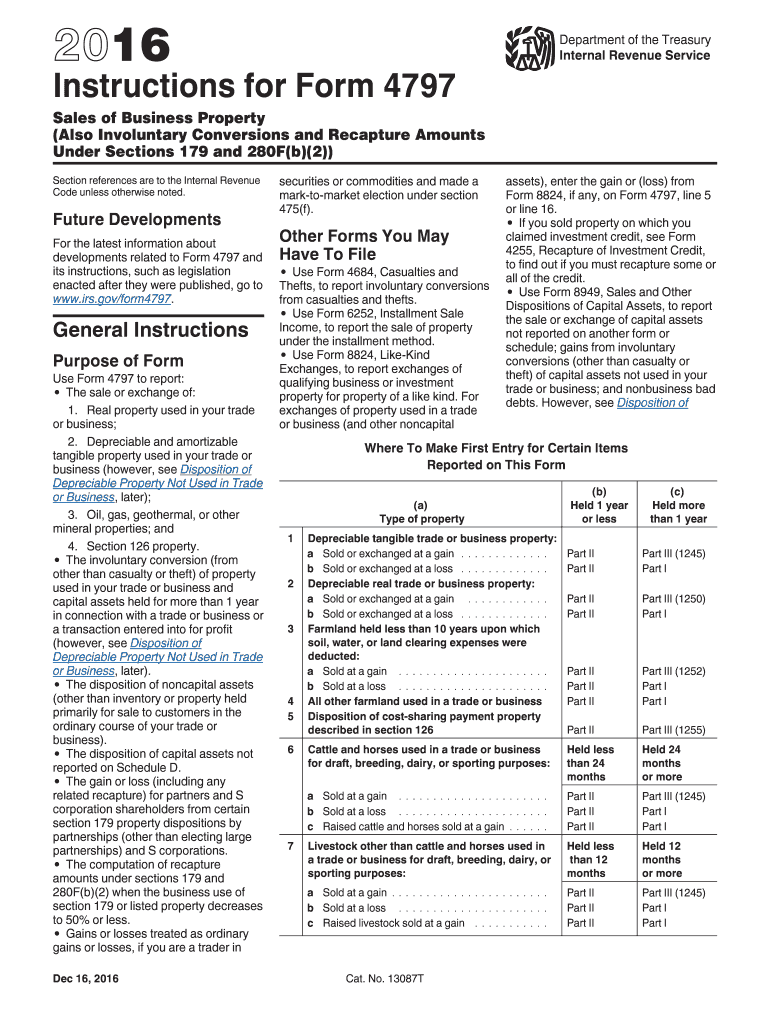

See the instructions for Form 4797 Part III. If the total gain for the recapture amount the excess is reported on Form 8949. General Instructions Purpose of Form Use Form 4797 to report The sale or exchange of 1. Real property used in your trade or business 2. Department of the Treasury Internal Revenue Service Instructions for Form 4797 Sales of Business Property Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F b 2 Section references are to the Internal Revenue...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 4797 instructions 2016 form

Edit your 4797 instructions 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 4797 instructions 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 4797 instructions 2016 form online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 4797 instructions 2016 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 4797 instructions 2016 form

How to fill out IRS Instruction 4797

01

Obtain IRS Form 4797 from the IRS website or through your tax preparation software.

02

Enter your name and taxpayer identification information at the top of the form.

03

Complete Part I for sales of business property and list each property sold, including the date sold and the sales price.

04

Provide the cost or adjusted basis for each property sold in Part I.

05

If applicable, complete Part II for like-kind exchanges, including details of the properties exchanged.

06

For any involuntary conversions, fill out Part III, providing details on the events that led to the conversion.

07

Complete Part IV if you are reporting the sale of a partnership interest, and provide the necessary transaction details.

08

Review all entries for accuracy, ensuring that the totals correctly match your records.

09

Transfer the calculated amounts to your main Form 1040 or other relevant tax return forms as instructed.

Who needs IRS Instruction 4797?

01

Individuals or businesses that have sold business property.

02

Taxpayers reporting gains or losses from the sale of assets used in a trade or business.

03

Persons involved in like-kind exchanges of real or personal property.

04

Taxpayers who experienced involuntary conversions of property due to theft or natural disasters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 4797 instructions 2016 form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 4797 instructions 2016 form in minutes.

Can I create an electronic signature for signing my 4797 instructions 2016 form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 4797 instructions 2016 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit 4797 instructions 2016 form on an Android device?

You can make any changes to PDF files, such as 4797 instructions 2016 form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IRS Instruction 4797?

IRS Instruction 4797 is a form used to report the sale of business property, including real estate and certain other assets.

Who is required to file IRS Instruction 4797?

Individuals, partnerships, corporations, and estates that have sold or exchanged business property are required to file IRS Instruction 4797.

How to fill out IRS Instruction 4797?

To fill out IRS Instruction 4797, gather details about the property sold, including date of sale, sales price, adjusted basis, and any related expenses. Then complete the form by following the instructions provided for each part.

What is the purpose of IRS Instruction 4797?

The purpose of IRS Instruction 4797 is to report gains or losses from the sale of business property and determine the tax consequences of those sales.

What information must be reported on IRS Instruction 4797?

Information that must be reported includes the description of the property, date of sale, sales price, costs associated with the sale, and any depreciation claimed on the property.

Fill out your 4797 instructions 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

4797 Instructions 2016 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.