What is the Difference Between the 1099-MISC and Other 1099 Form Types?

The Form 1099 series is a very strong tool, needed for IRS to make the taxpayer to complete an informational return.

The form comes in different variants, that is connected with earnings or payments type, you have made during the tax year. For better identification of payments type, each form has its own letter abbreviation.

In most cases, you are obliged to provide details about all taxable income, that is not connected with salary or any earnings received from any source, instead of employment. The 1099-MISC is necessary to provide miscellaneous earnings details with all funds you pay for work made by an organization or person, not hired by a company.

Remember, it’s important to insert in an income and payment in the samples you provide carefully, for them to coincide in all sources. Otherwise, the IRS will have questions, request additional information, and possibly add fines.

General Facts You Should Know About the 1099-MISC Form

This sample is one of the most frequently used tax samples — therefore you need to get familiar with its general details better.

So let’s answer some of the most frequent questions people ask when this sample.

Who should file the form?

The sample is sent by you to the party that is providing paid services.

The self-employed person or freelancer should complete the W-9 form correctly, as it includes details, used to fill out 1099-MISC. The minimal sum, necessary for reporting with this sample is $600. The facilities and job, the companies do for you annually are not reported with this sample, as in the majority of cases they are less than six hundred dollars.

This document includes details about any money spent in your business course (not individual expenses).

What Payments and Purchases are Reported?

The 1099-MISC tax form may cover a wide range of expenses — including those for materials, rents, healthcare, and healthcare spending that are related to a plan, award, prize, etc.

The template is also used by taxpayers to include in the sample the following spending:

- Gross proceeds and fees paid to an attorney. This includes funds issued to organizations that provide legal services.

- Fishing proceeds paid with cash. Since fishing boat proceeds are meant to be separate earnings (other than employment), they’re reported in a specific cell in the form 1099-MISC.

- Any dividends and tax-free spending.

- Payments to federal executive department made for vendors.

- The 1099-MISC helps business owners (as well as authorized representative or accountant) to include various types of income not covered by some other 1099 series forms.

- Additionally, any selling that cost more than $500, also reported with this sample.

Are there any Exceptions in the 1099-MISC Report?

Not all miscellaneous spending are included in this template.

The exclusions are:

- Any funds spent to pay for the services made by an LLC or a corporation.

- Storage, merchandise, or telephone expenses.

- Paying for the services of real estate agents or property managers.

- Money withdraws to tax-exempt companies and trusts.

- Credit card expenses or third-party transaction fees.

- Canceled debt that is technically treated as an income.

- Scholarships or grants.

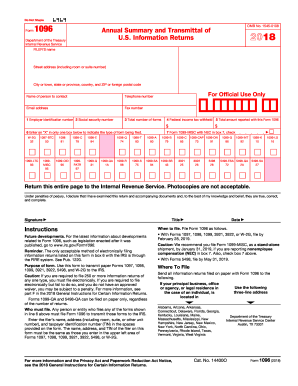

How Many Copies of the Form Should I Complete?

Company representative or accountants should complete five document copies:

- The first form goes to the IRS.

- The sample can easily be filled out and sent digitally. Those who need it on paper can use printing using the special blank option.

- The second template copy is sent to the Tax Department of State.

- Two more copies are to be sent to the independent contractor. One of them is needed just as a reference and the second one is issued with the Tax Return D, which is issued by the recipient.

- The last template remains in the company’s office for the sake of keeping track of all expenses and taxes you paid.

What are the Terms and Deadlines?

It’s necessary to send the template to the IRS for the 2018 tax year before the end of January 2019.

The same term is applicable for filing to your local tax department of state and payment receiver. It’s a general requirement for all information in the return documents to be sent to a governmental institution during the first month of any given year. It’s also important to file before the set deadlines.

The IRS allows taxpayers to complete their tax forms electronically in order for them to be received and processed faster. Filing electronically also makes it easier to share one completed copy between persons and institutions you file to. This helps save time and better automates the tax management process.

Will I be Obligated to Pay any Fines or Fines?

Be especially attentive when filing any form.

If you fail to correctly type in your payment data, name or Taxpayer Identification Number, the IRS will reserve the right to issue you $50 penalty for each incorrect sample — which can increase to $270.

If you made a mistake, then try to correct the form and send it again before the deadline.

If there are incorrect taxpayer details sent to the funds' receiver, then report a backup withholding.

Additional penalties are issued for filing the form late. Those who are one month late after the deadline will owe the IRS $30 per every sample. If the sample is issued later than one month after January 31st, every template will cost twice as much as one late by a month — $60.

A form filed later than August 1st or not issued at all costs $100 per every form. The maximum amount a company can owe for late templates filing differs depending on business type. Smaller companies cannot owe to IRS now the sum, that increases $500,000 and larger ones — $1,000,000.

Those who understand that some circumstances, like lacking a TIN or having a delay because of unforeseen circumstances beyond your control, should notify IRS about this problem to show their intention to pay what is owed.

If the IRS can prove the documents were purposely late or included with mistakes, then the fine for every template increases to $220.

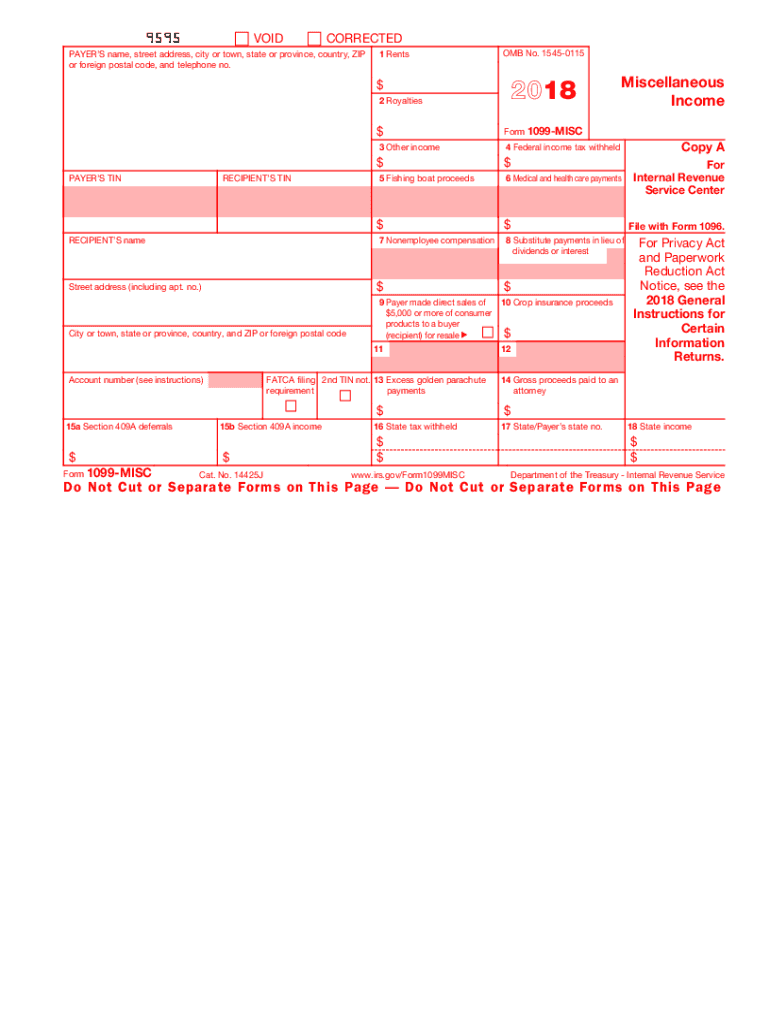

What Components Do the 1099-MISC Form Consists of?

First majority of business and tax documents are filed now in the digitally.

Filing the 1099-MISC tax form electronically is easy and straightforward. To prepare any supporting documents needed to complete a sample — you need to be aware of all the data it contains. It has two parts that represent the general contact, identification and tax data and payment details.

Let’s take a closer look at the boxes that you will be required to fill out in this form.

Informational Boxes

The left side of the form includes general details about both the payer and recipient:

- First, include the name of payer and the full postal address, postal code or ZIP and telephone number. It’s all included in one large box.

- Next is a box subdivided into two parts which include the ID numbers of both parties. This is convenient because the IRS identifiers are located together. Be attentive and use the proper formatting for this number, separating numerals with hyphens.

- The contact and individual details about the payment receiver consist of three boxes, that are separated by name, street, town or ZIP.

- Next is the cell with account numbers. There may be some case when you have several accounts and have to file several 1099-MISC samples to one receiver.

- The Foreign Account Tax Compliance Act box is placed near the account number and is used if the company filing the form reports foreign tax paid.

- The second TIN should not be included in the box is if you received a notification from IRS that the TIN of the other/another party is provided incorrectly.

- The bottom left of the form is made to provide information about section 409a income and deferrals.

Tax and Payment Details

The right-side cells, if to compare them with the left side, are smaller and have their own numbers for easier identification.

The numerous payments and taxes issued are included in this form:

- The first cell contains rental payments issued for office space to a real estate agent or property manager. Car rentals or other rentals for transport are also included. Any farmers whom a rent should also include the payment sum here. Additionally, coin-operated machines are also included in the form.

- The second box includes royalty payments, increasing over ten dollars. This may be a payment for the use of a trade name, patent, copyright, or trademark.

- The other income box under the third number comprises any payment not applicable to any other box on the form. Here you may report merchandise won on game shows, fair market value, sweepstakes, Indian gaming profits, etc. Here you may also include payments made to foreign agricultural workers who receive from you more than $600 a year.

- The fourth box is for including the sum of federal income tax withheld. It can be the backup withholding for a payment to an individual who failed to provide you with his/her TIN. You may use this cell to report any payments to Indian tribes — like withholding for net revenues from gaming activities they licensed.

- Payments for the sale of a catch, crew distributions and payments of more than $100 for the trip are reported in the fifth cell.

- Any payments that are not covered by a regular healthcare plan. This includes money paid for medical examinations, treatments, or medicine.

- The seventh cell is created to include the sum of money paid to a non-employee, who provided his/her services and are directly connected with your trade or business.

- The substitute payments in lieu of interest or dividends you receive are reported in the eighth cell.

- If the company purchased something that costs more than $5000, then this should be mentioned in the sample. But there is no requirement of providing the full sum you paid. Just check the box and include all details in the schedule C.

- Those who have an agricultural business need this form not only to report payments to workers but also provide crop insurance spending.

- The eleventh and twelfth cells contain instructions that may not mention in the latest update of the official IRS explanation.

- If you have any payment that is in excess of the regular golden parachute expenses, then include them in the thirteenth box.

- Box fourteen is used to report payments business has made to an attorney in relation to business purposes.

- Finally, at the bottom of the right part, the taxes paid to the state are itemized together with the player's number and state income.

Pay attention to all textual and numeric details you add to the sample and check all information carefully before you save any changes.

This way you will avoid penalties that can appear because due to any errors you make in the form. It’s not necessary to fill out every single cell. Just select those that are applicable in your particular case.

The informational part is obligatory for filling out — just provide payment details you need and omit other cells that are not related to your circumstances.

How do I Complete my 1099-MISC Electronically?

To easily fill out the template, it’s necessary to prepare all supporting documents, payment checks, and W-9, and information on the party that provided services during the tax year filed to you.

Next, you will need to read the form's instruction and fill out the needed cells. It’s more convenient to complete the sample digitally, because this will help you avoid handwritten mistakes, and the information you provide in the form will look neat and distinct. You can select any needed documents in the filler library or upload the template copy downloaded from the official IRS website.

When you complete the sample in electronic format, there is no need to fill out several copies. The template you completed can easily be shared with all governmental institutions and individuals that are providing their services to your business.