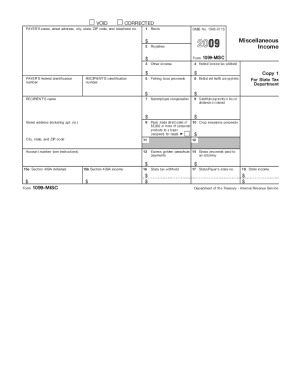

IRS 1099-MISC 2011 free printable template

FAQ about IRS 1099-MISC

What should I do if I realize I've made an error on an IRS 1099-MISC?

If you discover an error on your IRS 1099-MISC after filing, you will need to submit a corrected form. This involves completing a new IRS 1099-MISC with the accurate information, marking it as 'corrected' in the appropriate box. Make sure to check the IRS instructions for submitting corrected forms to ensure compliance.

How can I verify if my IRS 1099-MISC was received by the IRS?

To verify the receipt of your IRS 1099-MISC, you can check your e-filing service provider’s tracking features if you filed electronically. Alternatively, if you mailed the form, consider using certified mail and tracking services to confirm delivery. The IRS does not provide individual receipt confirmations, but you can monitor payment statuses accordingly.

What should I consider regarding data privacy when filing an IRS 1099-MISC?

When filing an IRS 1099-MISC, it's essential to protect sensitive information, such as Social Security numbers (SSNs) and taxpayer identification numbers (TINs). Ensure that your submission is done securely, using encrypted connections, and where applicable, utilize e-signature options that comply with IRS e-filing regulations to enhance data security.

What common mistakes should I watch out for when filing the IRS 1099-MISC?

Common mistakes when filing the IRS 1099-MISC include incorrect taxpayer identification numbers, not properly marking amended forms, and failing to complete all necessary fields. To avoid these errors, it's crucial to double-check the information entered and cross-reference against IRS guidelines before submission.

What are the special considerations for filing an IRS 1099-MISC for a nonresident payee?

When filing an IRS 1099-MISC for a nonresident payee, you must determine if the payment is subject to U.S. taxation. This may require the collection of a Form W-8BEN from the payee to establish their foreign status and, where applicable, the payment may be reportable under specific treaty benefits. Be aware of additional documentation requirements for nonresidents.

See what our users say