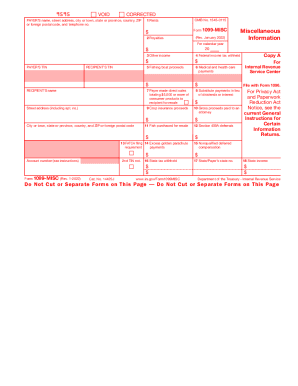

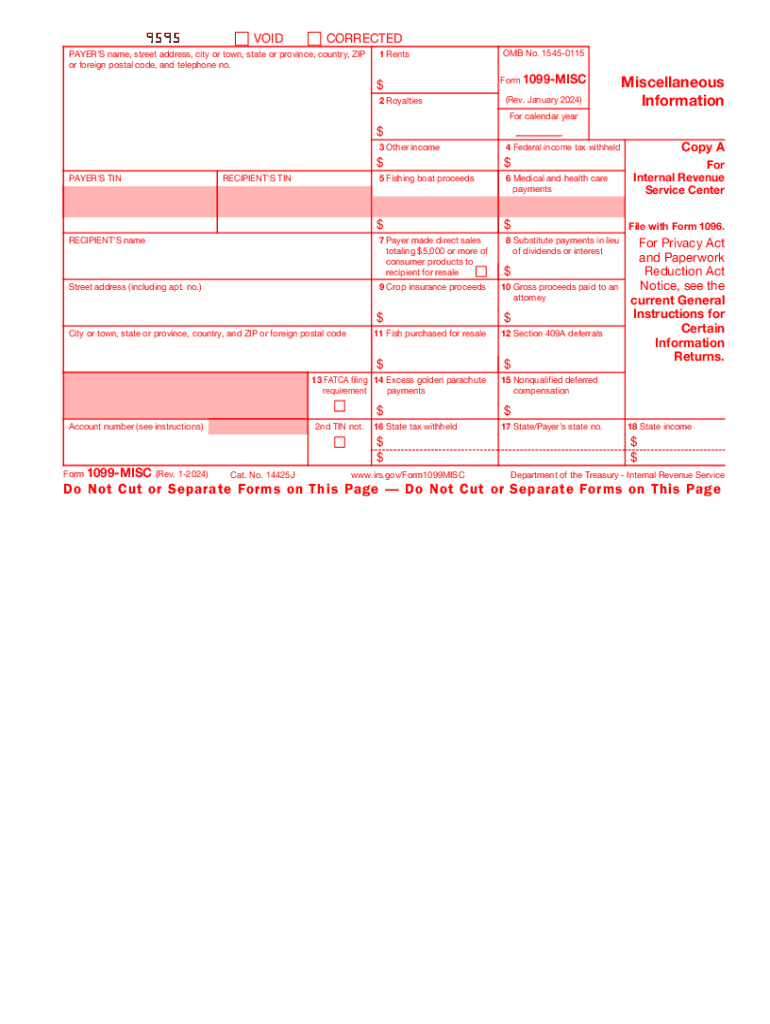

IRS 1099-MISC 2024 free printable template

Instructions and Help about 1099 form online

How to edit 1099 form online

How to fill out 1099 form online

Latest updates to 1099 form online

All You Need to Know About 1099 form online

What is 1099 form online?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1099-MISC

How can I correct mistakes made on a 1099 form online?

If you discover an error on your 1099 form online after submission, you can submit a corrected form electronically. Ensure you indicate that it's a corrected file when e-filing. Accurate correction is essential to avoid complications, so double-check the new information before resubmission. Also, keep in mind that amendments to previously submitted forms typically require you to notify the recipient of the corrections.

What should I do if my e-filed 1099 form is rejected?

If your 1099 form online submission is rejected, you will receive a notification detailing the reason. Common rejection codes can include issues like mismatched taxpayer identification numbers. Address the provided errors, and resubmit the corrected form promptly to ensure you meet necessary deadlines and avoid penalties.

Is e-signature acceptable for 1099 forms filed online?

Yes, e-signatures are generally accepted for 1099 forms filed online, provided the software you are using complies with IRS regulations. Using e-signatures can streamline the process, but ensure that the platform guarantees the data's security and privacy. Always verify that your submission adheres to current guidelines to maintain compliance.

What are some common mistakes to avoid when submitting 1099 forms online?

Common mistakes when submitting 1099 forms online include entering incorrect recipient details, using the wrong form type, and failing to account for all payments. To avoid these issues, ensure thorough review and validation of all entries before submission. Utilizing software that checks for common errors can also greatly reduce the likelihood of mistakes.

How can I verify the status of my submitted 1099 form online?

To verify the status of your 1099 form submitted online, check the submission portal of the e-filing service you used. Many platforms provide tracking capabilities to confirm receipt and processing status. If your form is pending review for an extended period, consider reaching out to customer support for assistance.

See what our users say