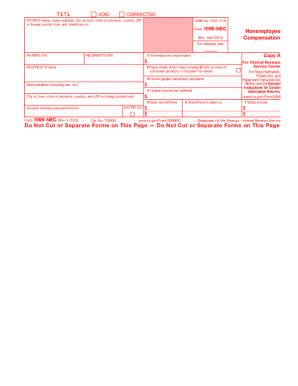

IRS 1099-NEC 2024 free printable template

Instructions and Help about IRS 1099-NEC - eFile

How to edit IRS 1099-NEC - eFile

How to fill out IRS 1099-NEC - eFile

Latest updates to IRS 1099-NEC - eFile

All You Need to Know About IRS 1099-NEC - eFile

What is IRS 1099-NEC - eFile?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

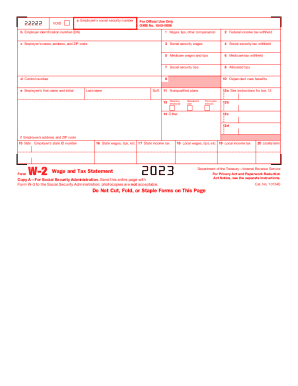

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-NEC

What should I do if I realize I've made a mistake on my submitted IRS 1099-NEC - eFile?

If you discover an error after submitting your IRS 1099-NEC - eFile, you can correct it by filing an amended return. Use Form 1099-NEC again with the correct information, and ensure to check the 'CORRECTED' box to indicate it is a correction. Keep in mind that timely correction is crucial to minimize any potential penalties.

How can I track the status of my e-filed IRS 1099-NEC - eFile?

To verify the status of your e-filed IRS 1099-NEC - eFile, you can use the IRS's online tracking tools or contact the IRS directly. Be mindful of common e-file rejection codes that may arise, and if your submission is rejected, you will need to correct and resubmit it promptly to avoid delays.

What record retention period applies to e-filed IRS 1099-NEC - eFile forms?

It is advisable to retain records related to your e-filed IRS 1099-NEC - eFile for at least three years after the filing date. This retention period allows for sufficient time should the IRS request information or if you face any audits. Ensure that records are stored securely to protect sensitive information.

Are there any special considerations when e-filing for foreign payees using the IRS 1099-NEC - eFile?

When e-filing for foreign payees with the IRS 1099-NEC - eFile, you must adhere to specific tax treaties that may apply, which can affect withholding requirements. Additionally, understanding tax obligations and regulations concerning nonresidents is essential to ensure compliance and avoid penalties.

What common errors should I be aware of when e-filing the IRS 1099-NEC - eFile?

Common errors when e-filing the IRS 1099-NEC - eFile include incorrect taxpayer identification numbers, mismatched names, and failing to indicate if the submission is a corrected form. To avoid these pitfalls, double-check all information and confirm it aligns with IRS records before submission.

See what our users say