- What is the Difference Between the 1099-MISC and Other 1099 Form Types?

- General Facts You Should Know About the 1099-MISC Tax Form

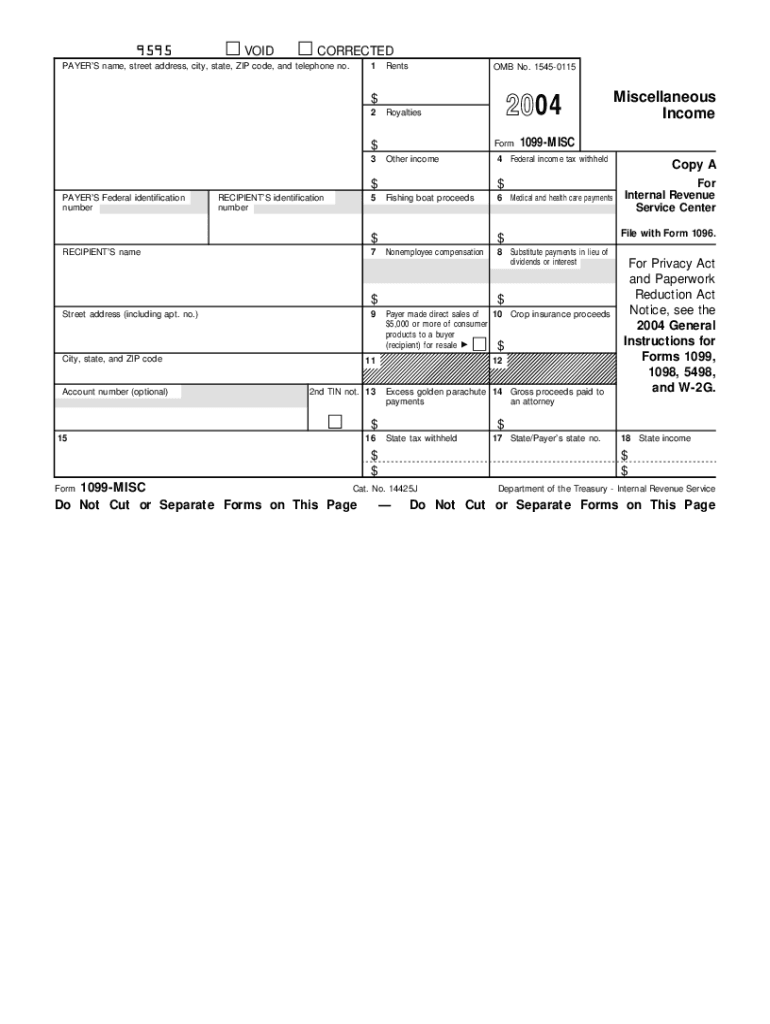

- What Components Does the 1099-MISC Form 2005 Contain?

- How to Fill Out 1099-MISC Form Online

- What is the 1099-MISC Form?

- Who Must File IRS Form 1099-MISC in 2005?

- What Payments and Purchases are Reported?

- Are there any Exceptions in the IRS form 1099-MISC?

- How Many Copies of the Printable 1099-MISC Form Should I Complete?

- When are 1099-MISC forms due to the IRS in 2005?

- What is the penalties amount for not issuing a 1099-MISC IRS Form?

- Informational Boxes

- Tax and Payment Details

What is the Difference Between the 1099-MISC and Other 1099 Form Types?

The Form 1099 series is a powerful tool for the IRS to make the taxpayer complete an informational return.

The form comes in different variants connected with the earnings or payment types you have made during the tax year. For better identification of payment classification, each form has its letter abbreviation.

In most cases, you are obliged to provide details about all taxable income that is not connected with salary or earnings received from any source instead of employment. The 1099-MISC form is necessary to provide miscellaneous earning details with all funds you pay for work made by an organization or person, not hired by a company.

Remember, it's essential to carefully insert an income and payment in the samples you provide for them to coincide in all sources. Otherwise, the IRS will have questions, request additional information, and possibly add fines.

General Facts You Should Know About the 1099-MISC Tax Form

This sample is one of the most frequently used tax reports – therefore, you need to get familiar with its general details better.

So let's answer some of the most frequent questions people ask.

What is the 1099-MISC Form?

The IRS Form 1099-MISC is a report you send to the party that provides paid services (independent contractor). The document includes details about any money spent on your business course, not personal expenses. In 2021 the title of Form 1099-MISC had changed from Miscellaneous Income to Miscellaneous Information.

Who Must File IRS Form 1099-MISC in 2005?

Form 1099-MISC reports any payments made to someone regarding your trade or business. The taxpayer should file Form 1099-MISC for each person they have paid at least $10 in royalties or broker payments to instead of dividends or tax-exempt interest, and at least $600 during the year. An independent contractor needs this form to report income.

What Payments and Purchases are Reported?

The 1099-MISC tax form may cover a wide range of expenses, including materials, rents, healthcare, and healthcare spending related to a plan, award, prize, etc.

Taxpayers also include the following spending:

- Gross proceeds and fees paid to an attorney. This includes funds issued to organizations that provide legal services.

- Fishing proceeds paid with cash. Since fishing boat proceeds are meant to be separate earnings (other than employment), they're reported in a specific field in the sample 1099-MISC form.

- Any dividends and tax-free spending.

- Payments to the federal executive department made for vendors.

- Various income types not covered by some other 1099 series forms.

Are there any Exceptions in the IRS form 1099-MISC?

Not all miscellaneous spending is included in the sample 1099-MISC form.

The exclusions are:

- Any funds spent to pay for the services made by an LLC or a corporation.

- Storage, merchandise, or telephone expenses.

- Payments for the services of real estate agents or property managers.

- Money withdraws to tax-exempt companies and trusts.

- Credit card expenses or third-party transaction fees.

- Canceled debt that is technically treated as an income.

- Scholarships or grants.

How Many Copies of the Printable 1099-MISC Form Should I Complete?

Company representatives or accountants should complete five document copies:

- The first form goes to the IRS. The sample can easily be filled out and sent digitally. Those who need it on paper can print using the particular blank option.

- The second copy is sent to the Tax Department of State.

- Two more copies are to be sent to the independent contractor. One of them is needed just as a reference, and the second one goes with the Tax Return D, which the recipient issues.

- The last template remains in the company's office for the sake of keeping track of all expenses and taxes you paid.

When are 1099-MISC forms due to the IRS in 2005?

The 1099-MISC tax form is typically due to the IRS on February 28, 2005 for paper filers and on March 31, 2005 for electronic filers.

These deadlines are also applicable for filing to the independent contractor. It's essential to file before the deadlines to avoid financial or legal consequences.

The IRS allows taxpayers to complete their tax forms electronically for fast and safe processing. Filing electronically also makes sharing one completed copy between several recipients and institutions easier. This helps automate the tax management process and save your time.

What is the penalties amount for not issuing a 1099-MISC IRS Form?

Be attentive when filling out any form, and be sure to meet deadlines. If a business is late to file Form 1099-MISC, the penalty ranges from $50 to $270 per late form. There is a $556,500 maximum penalty fine per year. If a taxpayer willfully ignores a requirement to submit a valid statement, they are subject to a minimum penalty of $550 per form or 10% of the income shown on the form, with no maximum.

If you made a mistake, try correcting the 1099-MISC Tax Form template and sending it again before the deadline. If incorrect taxpayer details are sent to the fund's receiver, report a backup withholding.

If you lack a TIN or delay because of unforeseen circumstances beyond your control, you should notify the IRS about this problem to show an intention to pay what is owed.

What Components Does the 1099-MISC Form 2005 Contain?

Nowadays, most business and tax documents are filed digitally. Filing 1099-MISC forms electronically is straightforward with the fillable online templates. To prepare any supporting documents and complete your report in minutes, you need to know all the data it contains. Our fillable 1099-MISC Form has two parts representing the general contact, identification, tax data, and payment details.

Let's take a closer look at the form's fields.

Informational Boxes

The left side of the form includes general details about both the payer and recipient:

- The first includes the payer's name and the full postal address, postal code or ZIP, and telephone number.

- The next box is divided into two parts, including the ID numbers of both parties. This is convenient because the IRS identifiers are located together. Be attentive and use the proper formatting for this number, separating numerals with hyphens.

- The contact and individual details about the payment receiver consist of three boxes separated by name, street, town, or ZIP.

- Next is the cell with account numbers. There may be cases when you have several accounts and file several 1099-MISC Form samples to one receiver.

- The Foreign Account Tax Compliance Act box is placed near the account number and is used if the company filing the form reports foreign tax paid.

- The second TIN should not be included in the box if you received a notification from IRS that the TIN of the other/another party is provided incorrectly.

- The bottom left of the form provides information about section 409a income and deferrals.

Tax and Payment Details

If you compare them with the left side, the right-side fields are smaller and have their numbers for easier identification.

The numerous payments and taxes are included in the 1099-MISC Form:

- The first field contains rental fees issued for office space to a real estate agent or property manager. Car rentals or other rentals for transport are also included. Additionally, coin-operated machines data should be added in the form.

- The second box includes royalty payments, increasing over ten dollars. They may be payments for using a trading name, patent, copyright, or trademark.

- Under the third number, the other income box comprises any payment not applicable to any other box on the form. Here you may report merchandise won on game shows, fair market value, sweepstakes, Indian gaming profits, etc. Here you may also include payments made to foreign agricultural workers who receive from you more than $600 a year.

- The fourth box is for including the sum of federal income tax withheld. It can be the backup withholding for a payment to an individual who failed to provide you with their TIN. You may use this field to report payments like withholding net revenues from licensed gaming activities.

- Payments for catch sales, crew distributions, and expenses of more than $100 for the trip should be inserted in the fifth cell.

- The sixth field is for costs not covered by a regular healthcare plan. This includes money paid for medical examinations, treatments, or medicine.

- The seventh cell is for money paid to a non-employee who provided their services and are directly connected with your trade or business.

- The substitute payments instead of interest or dividends you receive are reported in the eighth cell.

- The following field is for the company's expenses of more than $5000. There is no need to provide the total sum you paid; check the box and include all the details in Schedule C.

- Those with an agricultural business need this form to report payments to workers and provide crop insurance spending.

- The eleventh and twelfth fields contain instructions that may not mention in the latest update of the official IRS explanation.

- If you have any payment over the regular golden parachute expenses, include them in the thirteenth box.

- Box fourteen is used to report payments a business has made to an attorney.

- Finally, at the bottom of the right part, the taxes paid to the state are itemized together with the player's number and state income.

Pay attention to all textual and numeric details you add to the 1099-MISC Form online and check all information carefully before making any changes.

This way, you will avoid penalties that can appear due to any errors you make in the form. It's not necessary to fill out every single cell. Just select those that are applicable in your particular case.

The informational part is obligatory for filling out — provide payment details you need and omit other cells unrelated to your circumstances.

How to Fill Out 1099-MISC Form Online

Before completing the template, you must read the Form 1099-MISC instructions and prepare all supporting documents, payment checks, W-9, and information on the party that provided services during the tax year.

Once everything is collected, you can start filling out a 1099-MISC Form online using our quick step-by-step guide:

- Click Get Form at the top of the page to open the fillable 1099-MISC Form in the editor.

- Fill out the required fillable fields with our simple editing tools.

- Add text, numbers, and checkmarks following the navigation tips provided.

- Click Done when finished to save the completed document.

- Use the ‘Send to IRS’ option to submit the online report directly to the IRS.

Note: We’ll keep you updated via email when your report has been submitted and approved.

That’s how easy it is to prepare your tax returns online. Finally, you can download the 1099-MISC Form in PDF format or email it directly to the recipient.

Filling out a 1099-MISC Form online is convenient and helps avoid any handwritten mistakes. There is no need to print and fill out the paper copy and start over if you make a handwritten error. With our web templates, simply go back to your template at any time and edit it in just a few clicks.

Additionally, you can choose from 40 million fillable documents and forms in the pdfFiller online library or upload the template downloaded from the official IRS website.