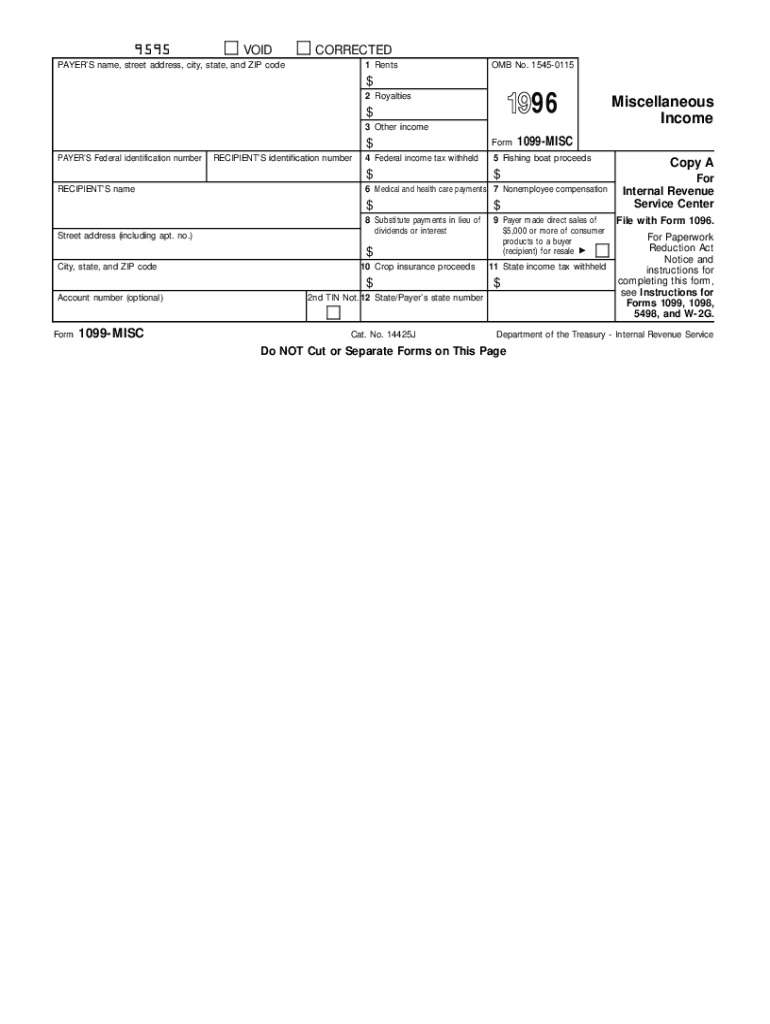

IRS 1099-MISC 1996 free printable template

Instructions and Help about IRS 1099-MISC

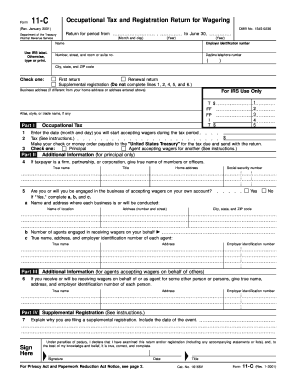

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

About IRS 1099-MISC 1996 previous version

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-MISC

What should I do if I realize I made a mistake on my 1996 1099 form after filing?

If you discover an error on your 1996 1099 form after submission, you should file a corrected return with the appropriate information. This involves completing a new 1099 form, marking it as 'Corrected,' and submitting it according to the instructions for corrections. Be sure to inform the recipient of the changes so that they can adjust their records accordingly.

How can I verify that my 1996 1099 form was received and processed by the IRS?

To verify receipt and processing of your 1996 1099 form, you can check the IRS’s 'Where's My Refund?' tool or contact the IRS directly for inquiry. Maintain a copy of your submission for your records, and consider following up if you haven't received an acknowledgment after a reasonable time.

Are e-signatures acceptable for submitting my 1996 1099 form?

E-signatures are generally acceptable for submitting a 1996 1099 form as long as they comply with the IRS electronic filing requirements. It’s important to ensure that your e-signature solution is compliant with the IRS guidelines to avoid issues with the submission process.

What common errors should I watch out for when submitting my 1996 1099 form?

Common errors when submitting a 1996 1099 form include incorrect taxpayer identification numbers, mismatched names, and failing to report all required payments. To minimize errors, double-check each entry and consider using tax preparation software that can highlight discrepancies.

What steps should I take if I receive an IRS notice regarding my 1996 1099 form?

If you receive an IRS notice concerning your 1996 1099 form, carefully read the notice to understand the issue. Gather all relevant documentation and respond promptly, providing the requested information or clarification to resolve the matter efficiently.

See what our users say