Get the free UNCONDITIONAL PERSONAL GUARANTY

Show details

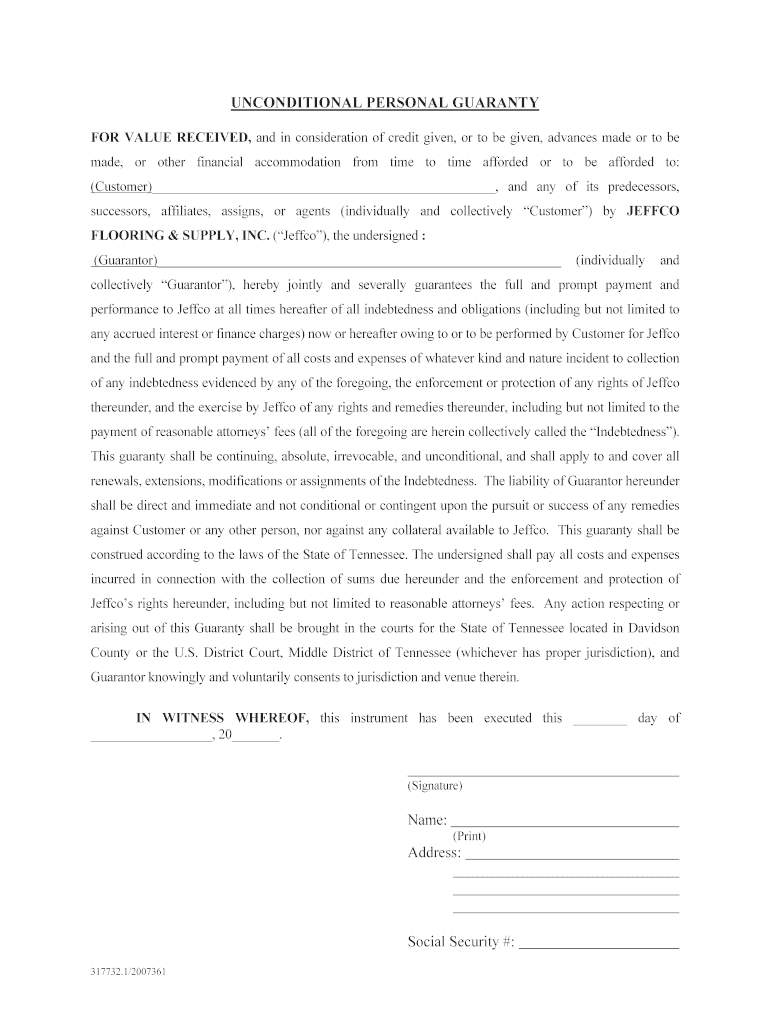

UNCONDITIONAL PERSONAL GUARANTY FOR VALUE RECEIVED, and in consideration of credit given, or to be given, advances made or to be made, or other financial accommodation from time to time afforded or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unconditional personal guaranty

Edit your unconditional personal guaranty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unconditional personal guaranty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unconditional personal guaranty online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unconditional personal guaranty. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unconditional personal guaranty

How to fill out unconditional personal guaranty

01

Step 1: Gather all necessary information and documents required for filling out the unconditional personal guaranty.

02

Step 2: Read through the guaranty carefully to understand your obligations and responsibilities as a guarantor.

03

Step 3: Fill out the personal information section accurately, including your full name, address, contact details, and social security number.

04

Step 4: Provide details about the debtor or the person/entity you are guaranteeing, including their name, address, and contact information.

05

Step 5: Specify the amount and type of debt being guaranteed, including the original principal amount, interest rates, and repayment terms.

06

Step 6: Review any additional terms and conditions specified in the guaranty, such as events of default or collateral requirements.

07

Step 7: Sign and date the unconditional personal guaranty with your full legal signature.

08

Step 8: Make copies of the filled-out guaranty for your records.

09

Step 9: Submit the completed unconditional personal guaranty to the appropriate party or institution.

10

Step 10: Keep a copy of the submitted guaranty for your reference and future correspondence.

Who needs unconditional personal guaranty?

01

Lenders: Lenders often require unconditional personal guaranties as an additional layer of security when extending loans to individuals or businesses.

02

Business Owners: Individuals who own or manage businesses might be required to provide an unconditional personal guaranty to secure financing for their company.

03

Entrepreneurs: Startups and entrepreneurs seeking funding from investors or lenders might need to provide a personal guaranty to secure the necessary capital.

04

Contractors: Contractors working on large projects may be asked to offer an unconditional personal guaranty to assure the completion of work and repayment of any outstanding obligations.

05

Landlords: Landlords may request an unconditional personal guaranty from tenants to ensure rent payment obligations are met.

06

Partners: Business partners involved in a partnership agreement may be asked to provide personal guaranties to secure loans or lines of credit for the partnership.

07

Individual Borrowers: Some lenders may require individual borrowers to provide a personal guaranty to mitigate the risk of default.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get unconditional personal guaranty?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific unconditional personal guaranty and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in unconditional personal guaranty without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your unconditional personal guaranty, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out unconditional personal guaranty on an Android device?

Use the pdfFiller app for Android to finish your unconditional personal guaranty. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is unconditional personal guaranty?

An unconditional personal guaranty is a legal document in which an individual agrees to be personally responsible for the debt or obligation of another party.

Who is required to file unconditional personal guaranty?

Individuals who are willing to guarantee a loan or obligation on behalf of another party may be required to file an unconditional personal guaranty.

How to fill out unconditional personal guaranty?

To fill out an unconditional personal guaranty, the individual must provide their personal information, details of the obligation being guaranteed, and sign the document in front of a witness or notary public.

What is the purpose of unconditional personal guaranty?

The purpose of an unconditional personal guaranty is to provide a guarantee to the lender or creditor that the debt or obligation will be paid, even if the primary borrower defaults.

What information must be reported on unconditional personal guaranty?

The unconditional personal guaranty must include the guarantor's full name, contact information, details of the loan or obligation being guaranteed, and any additional terms or conditions agreed upon.

Fill out your unconditional personal guaranty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unconditional Personal Guaranty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.