About CA FTB previous version

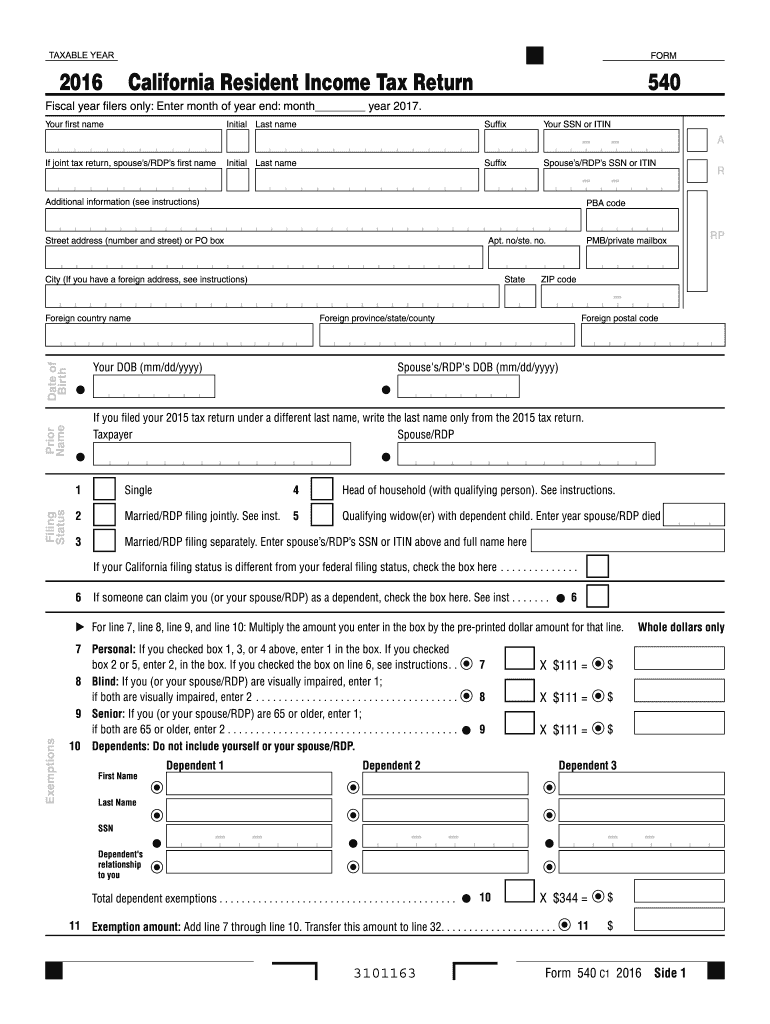

What is CA FTB 540?

CA FTB 540 is the California Resident Income Tax Return form that residents use to report their income and calculate their state taxes. This form allows taxpayers to claim deductions, credits, and report various sources of income, ensuring compliance with California tax laws. Each year, the form may undergo revisions, so it's essential to use the appropriate version for the tax year in question.

What is the purpose of this form?

The purpose of CA FTB 540 is to facilitate the reporting of income and calculation of state taxes owed by California residents. It serves as an official declaration of earnings and claims for deductions or credits during the tax year. By completing this form, individuals fulfill their obligation to the state and contribute to public services funded by tax revenue.

Who needs the form?

Any California resident who earns income during the tax year must use CA FTB 540 to file their income tax return. This applies to individuals who have a control over their income sources, whether from wages, business profits, or other taxable income. If your income exceeds the filing threshold set by the California FTB, you are required to complete and submit this form.

When am I exempt from filling out this form?

You may be exempt from filing CA FTB 540 if your income is below the state’s minimum filing threshold, or if you are a non-resident. Additionally, specific categories like certain government assistance recipients or individuals without taxable income may also qualify for exemption. It is advisable to check the FTB guidelines for the most accurate determination of your filing requirements.

Components of the form

CA FTB 540 consists of several key components including sections for personal information, income reporting, deductions, credits, and signature. Each section must be completed accurately to ensure proper tax calculation. Important lines include those for total income, adjusted gross income, and total tax due or refund expected.

Due date

The due date for filing CA FTB 540 typically aligns with the federal tax return deadline, usually April 15th of each year. If the due date falls on a weekend or holiday, it is extended to the next business day. It is essential to file on time to avoid penalties and interest on unpaid taxes.

What payments and purchases are reported?

CA FTB 540 requires the reporting of various payments, including wages, interest, dividends, and capital gains. Deductions for business expenses and certain personal expenses can also be claimed. Additionally, taxpayers report purchases subject to state tax within the income reporting section, ensuring compliance with California tax regulations.

How many copies of the form should I complete?

Typically, you need to submit one copy of CA FTB 540 to the California Franchise Tax Board. However, retain at least one copy for your personal records. If you are filing jointly with a spouse, both signatures are required on the same form, but only a single submission is necessary.

What are the penalties for not issuing the form?

Failure to file CA FTB 540 by the due date can result in penalties and interest accrued on any taxes owed. The penalty usually starts at 5% of the unpaid tax amount for the first month, increasing by 1% for each additional month until the tax is paid. Continuous non-filing can also lead to further legal actions by the state.

What information do you need when you file the form?

When filing CA FTB 540, you need various personal details including your name, address, Social Security number, and information regarding your income sources. Have documents such as W-2 forms, 1099 statements, and prior year tax returns ready for reference. Additional information may include details of deductions and credits you plan to claim, ensuring that all figures are accurate.

Is the form accompanied by other forms?

CA FTB 540 may require the submission of additional forms or schedules depending on your individual tax situation. For instance, if claiming specific credits or deductions, you may need to include supporting schedules or forms, such as CA FTB 3506 for the property tax exemption. Always check the FTB guidelines to ensure proper form submission.

Where do I send the form?

Completed CA FTB 540 forms should be sent to the address designated by the California Franchise Tax Board, which can vary based on whether you are expecting a refund or are making a payment. Refer to the current filing instructions or FTB website for the correct mailing address. It is crucial for timely processing to ensure forms are sent to the correct location.