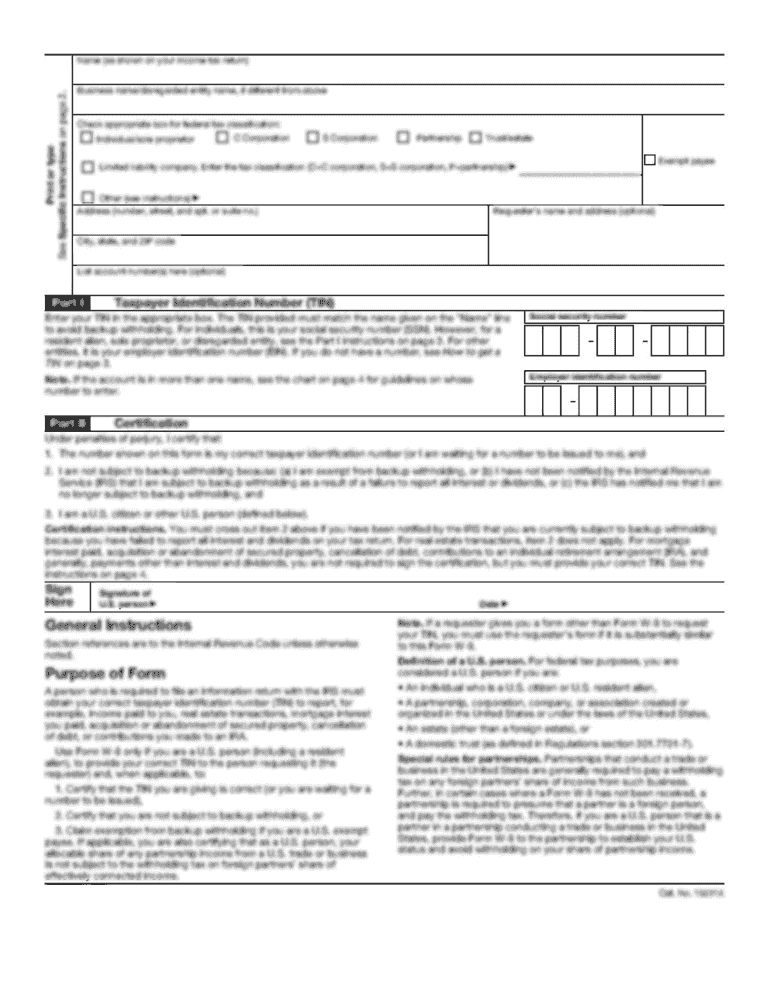

OR Form OR-TM 2016 free printable template

Show details

Clear form2016 Form ORT

Page 1 of 1, 150555001 (Rev. 1016)Office use only08541601010000Oregon Department of RevenueTriCounty Metropolitan Transportation District

Reemployment Tax

Submit original form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR Form OR-TM

Edit your OR Form OR-TM form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Form OR-TM form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR Form OR-TM online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OR Form OR-TM. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Form OR-TM Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR Form OR-TM

How to fill out OR Form OR-TM

01

Start by downloading the OR Form OR-TM from the appropriate website or obtaining a physical copy.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide your vehicle information, including the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the reason for filing the OR Form OR-TM, such as requesting a title or registration.

05

Include any supporting documents required, such as proof of ownership or previous registration.

06

Review the completed form for accuracy and completeness.

07

Submit the form along with any required fees to the designated office or agency.

Who needs OR Form OR-TM?

01

Individuals registering a vehicle for the first time.

02

People changing ownership of a vehicle.

03

Anyone updating vehicle registration details.

04

Individuals applying for a duplicate title or registration.

Fill

form

: Try Risk Free

People Also Ask about

How do I amend my Oregon OQ form?

You must also amend your OQ or OA if there is an adjustment to the total wages on the Form 132 Employee Detail Report. This can be done in Frances Online if you filed electronically. If you filed using paper forms, you must also submit an OQ/OA - AMENDED. Download the Amended 132 Form.

How do I process payroll in Oregon?

Here are your basic steps for running payroll in Oregon. Step 1: Set up your business as an employer. Step 2: Register with Oregon. Step 3: Create your payroll process. Step 4: Have employees fill out relevant forms. Step 5: Review and approve timesheets. Step 6: Calculate employee gross pay and taxes.

What is the Oregon transit tax rate for 2022?

The Tri-County Metropolitan Transportation District (Tri-Met) tax rate is to increase to 0.7937%, from 0.7837%, and the Lane County Mass Transit District (LTD) tax rate is to increase to 0.77%, from 0.76%, the department said on its website.

Who is exempt from Oregon state transit tax?

For employees If you are an Oregon resident who only works in Oregon, the statewide transit tax has already been withheld from your pay and you don't need to file Form OR-STI, even if it's not reported on the Form W-2 you received from your employer.

Is Oregon transit tax paid by employer?

This tax isn't related to the Lane or TriMet transit payroll taxes. Transit payroll taxes are imposed on the employer based on the amount of payroll. The statewide transit tax is imposed on the wages of each employee, but the employer is responsible for withholding, reporting, and remitting the statewide transit tax.

Do employees pay TriMet tax?

The transit tax is imposed directly on the employer. The tax is figured only on the amount of gross payroll for services performed within the TriMet or Lane Transit Districts.

Is Oregon transit tax the same as TriMet tax?

This tax isn't related to the Lane or TriMet transit payroll taxes. Transit payroll taxes are imposed on the employer based on the amount of payroll. The statewide transit tax is imposed on the wages of each employee, but the employer is responsible for withholding, reporting, and remitting the statewide transit tax.

Do I have to pay Oregon transit tax?

Oregon residents that work for an out-of-state employer not doing business within the state will be required to report and pay the tax when you file your personal income taxes. Optionally, they can ask their out-of-state employer to withhold the tax from their wages as a courtesy—similar to income tax withholding.

Who is subject to Oregon TriMet tax?

People who must pay the self-employment tax include: Self-employed individuals, sole proprietors, independent contractors, members of a partnership, and persons who have net self-employment earnings greater than $400 from doing business or providing services within the TriMet District.

Can I file Oregon form OQ online?

Filing and forms Choose a quarterly report filing method: Frances Online electronic filing. Combined Payroll Tax Reports Form OQ. Interactive voice response system, call 503-378-3981.

What is the TriMet tax rate for 2022?

Taxes that provide operating revenue for TriMet are administered and collected by the Oregon Department of Revenue. Effective January 1, 2022, the tax rate increased to 0.7937%% of the wages paid by an employer and the net earnings from self-employment for services performed within the TriMet District boundary.

What is Oregon Form OQ?

Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

What is the Oregon transit tax rate?

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Oregon employers must withhold 0.10% (0.001) from each employee's gross pay.

Is Oregon transit tax the same as TriMet tax?

Self-employed individuals should use the new rate when first reporting earnings for 2022. The Mass-Transit (TriMet) Tax is paid to the Oregon Department of Revenue, and businesses will need to use an EIN number obtained when registering their businesses with the Oregon Secretary of State.

Who has to pay TriMet tax in Oregon?

The tax rate is 0.007837 (. 7837 of 1 percent). Who must file and pay this tax? Anyone who has self-employment earnings from business or service activities carried on in the TriMet District must pay this tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the OR Form OR-TM in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your OR Form OR-TM in minutes.

Can I create an electronic signature for signing my OR Form OR-TM in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your OR Form OR-TM right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit OR Form OR-TM on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share OR Form OR-TM from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

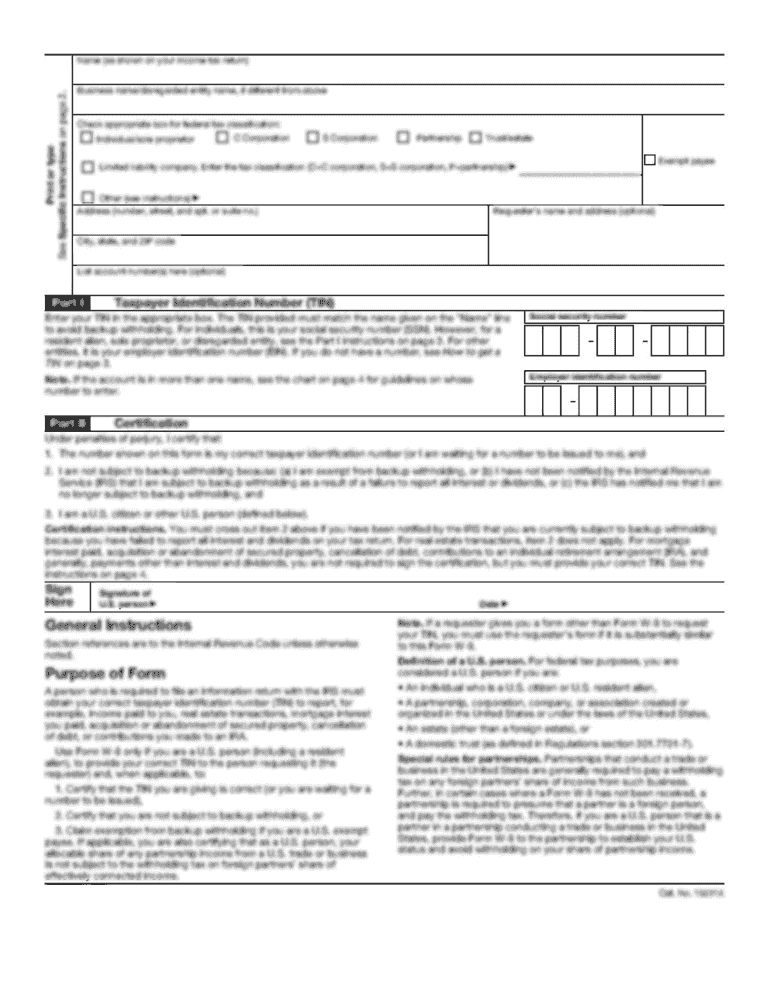

What is OR Form OR-TM?

OR Form OR-TM is a tax form used in the state of Oregon for reporting certain types of business income and expenses.

Who is required to file OR Form OR-TM?

Individuals and businesses that earn income from activities subject to Oregon taxation, including sole proprietors, partnerships, and S-corporations, are required to file OR Form OR-TM.

How to fill out OR Form OR-TM?

To fill out OR Form OR-TM, taxpayers must provide their personal or business information, report income and expenses, and calculate any taxes owed. Instructions are provided with the form to guide filers through the process.

What is the purpose of OR Form OR-TM?

The purpose of OR Form OR-TM is to report business income and expenses to the state of Oregon for tax assessment and compliance purposes.

What information must be reported on OR Form OR-TM?

On OR Form OR-TM, filers must report their gross income, deductible expenses, and any credits or adjustments to calculate their taxable income for the state of Oregon.

Fill out your OR Form OR-TM online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Form OR-TM is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.