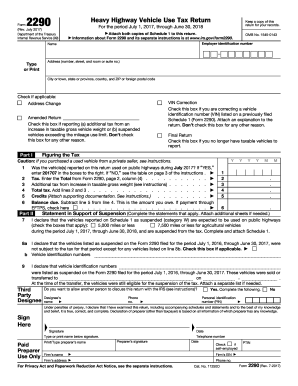

HI DoT G-49 2016 free printable template

Show details

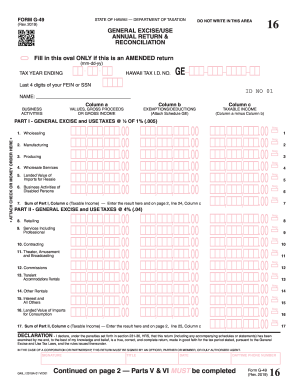

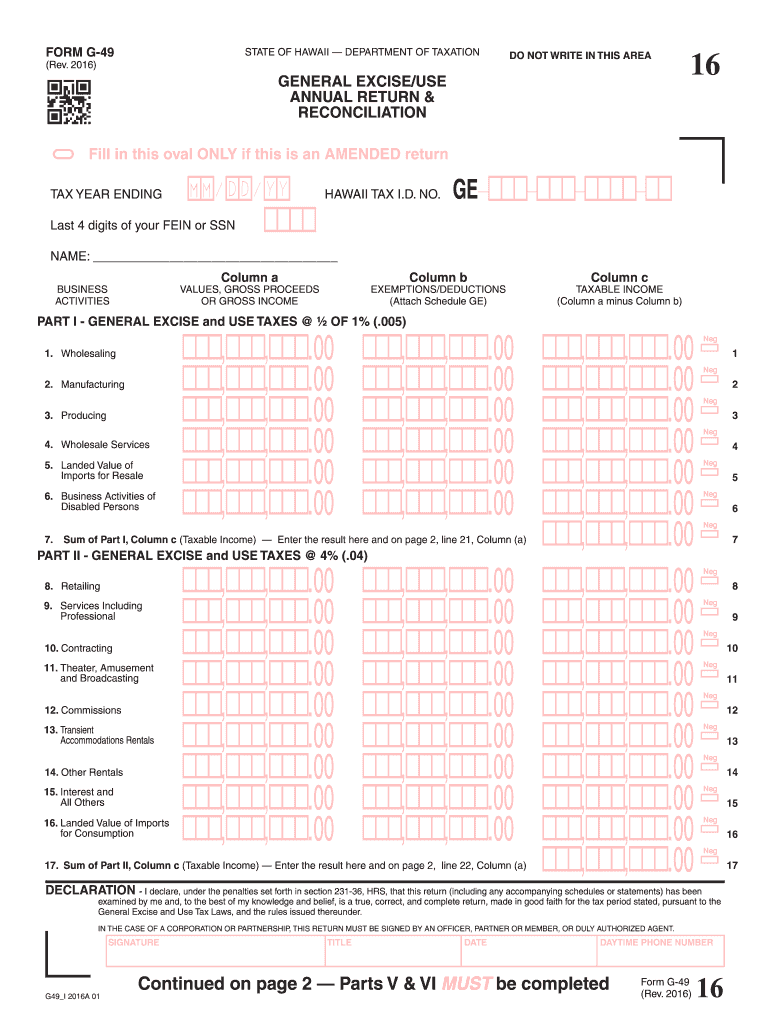

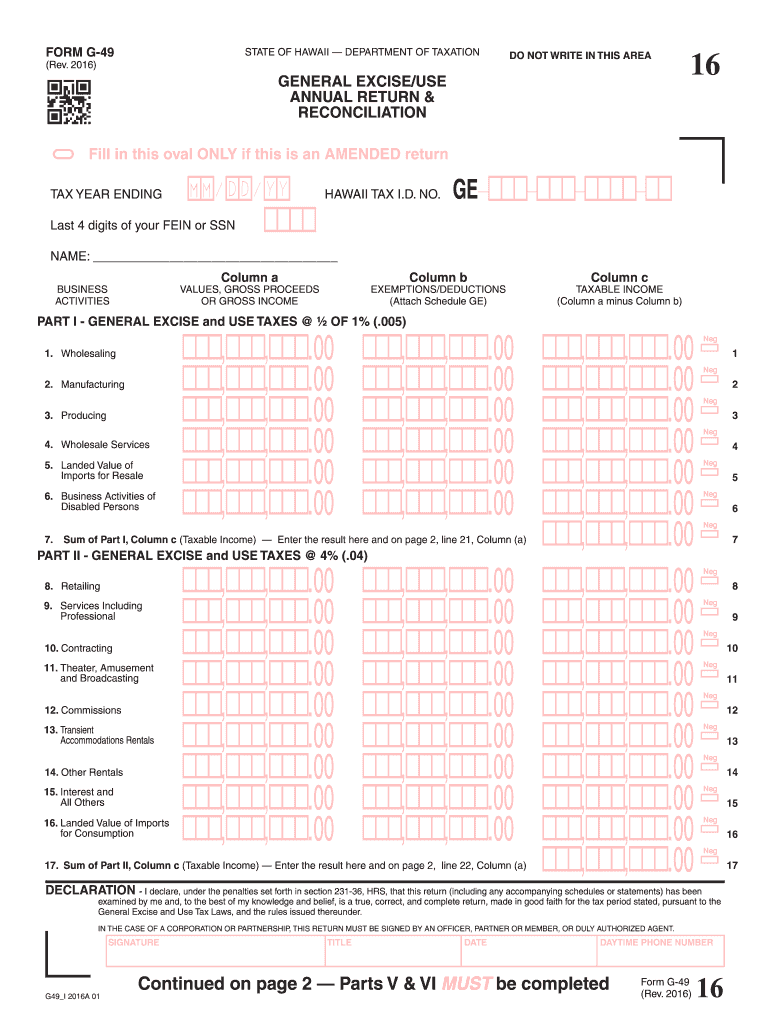

SIGNATURE G49I 2016A 01 TITLE DATE DAYTIME PHONE NUMBER Continued on page 2 Parts V VI MUST be completed Form G-49 Page 2 of 2 Name Hawaii Tax I. FORM G-49 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA Rev. 2016 GENERAL EXCISE/USE ANNUAL RETURN RECONCILIATION Fill in this oval ONLY if this is an AMENDED return mm/dd/yy TAX YEAR ENDING HAWAII TAX I. Write GE the filing period and your Hawaii Tax I. D. No. on your check or money order. Mail your check or money order...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign g 49 2016 form

Edit your g 49 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your g 49 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing g 49 2016 form online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit g 49 2016 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT G-49 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out g 49 2016 form

How to fill out HI DoT G-49

01

Obtain the HI DoT G-49 form from the relevant website or office.

02

Provide your full name and contact information at the top of the form.

03

Indicate the type of application you are submitting.

04

Fill out the required fields with accurate information regarding your business or personal details.

05

Attach any necessary documentation as specified in the form instructions.

06

Review the form for accuracy and completeness.

07

Submit the form either online or at the designated office.

Who needs HI DoT G-49?

01

Individuals or businesses applying for a license or permit related to transportation in Hawaii.

02

Anyone seeking to report changes or updates to their transportation-related information.

03

Parties involved in vehicle registration or transportation regulation compliance.

Instructions and Help about g 49 2016 form

Fill

form

: Try Risk Free

People Also Ask about

What is the G-49 tax form for?

Form G-49 - All filers must file an annual return and reconciliation (Form G-49) after the close of the taxable year. Form G-49 is a summary of your activity for the entire year.

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

Do you pay G49?

Form G49 is designed to give you credit for all of the taxes you paid, so if your gross income number is smaller than as expected, you may even get a refund. But if you made more in gross receipts than what you reported all year, then you might owe some more GE Tax.

What is a G-49 form?

The G-49 is the annual or so called "reconciliation" form which is filed annually. The G-49 is used to report annual sales and correct any errors or differences between your periodic reporting on G-45 and your finalized annual sales.

Where can I get Hawaii GE tax license forms?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify g 49 2016 form without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your g 49 2016 form into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the g 49 2016 form electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the g 49 2016 form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your g 49 2016 form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is HI DoT G-49?

HI DoT G-49 is a form used by the Hawaii Department of Transportation for reporting information related to construction projects and expenditures.

Who is required to file HI DoT G-49?

Any contractor or entity involved in construction projects that receive state funding or are subject to oversight by the Hawaii Department of Transportation is required to file HI DoT G-49.

How to fill out HI DoT G-49?

To fill out HI DoT G-49, individuals should provide detailed project information, including project name, contractor details, budget allocations, and a summary of expenditures, ensuring that all required fields are accurately completed.

What is the purpose of HI DoT G-49?

The purpose of HI DoT G-49 is to monitor and track the financial aspects of construction projects, ensuring accountability and transparency in the use of state funds.

What information must be reported on HI DoT G-49?

HI DoT G-49 must report information including project details, contractor information, budget amounts, actual expenditures, and any relevant changes to the project's scope or budget.

Fill out your g 49 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

G 49 2016 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.