Get the free IMPORTER SECURITY FILING (10+2)

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign importer security filing 102

Edit your importer security filing 102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your importer security filing 102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit importer security filing 102 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit importer security filing 102. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out importer security filing 102

How to fill out importer security filing 102

01

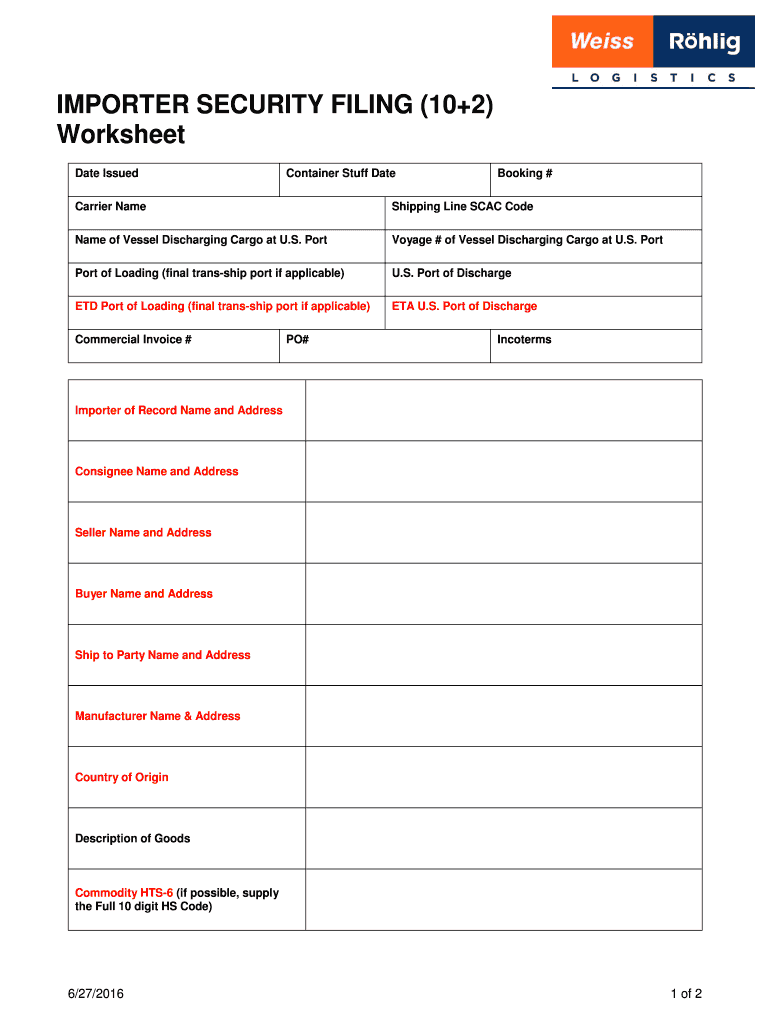

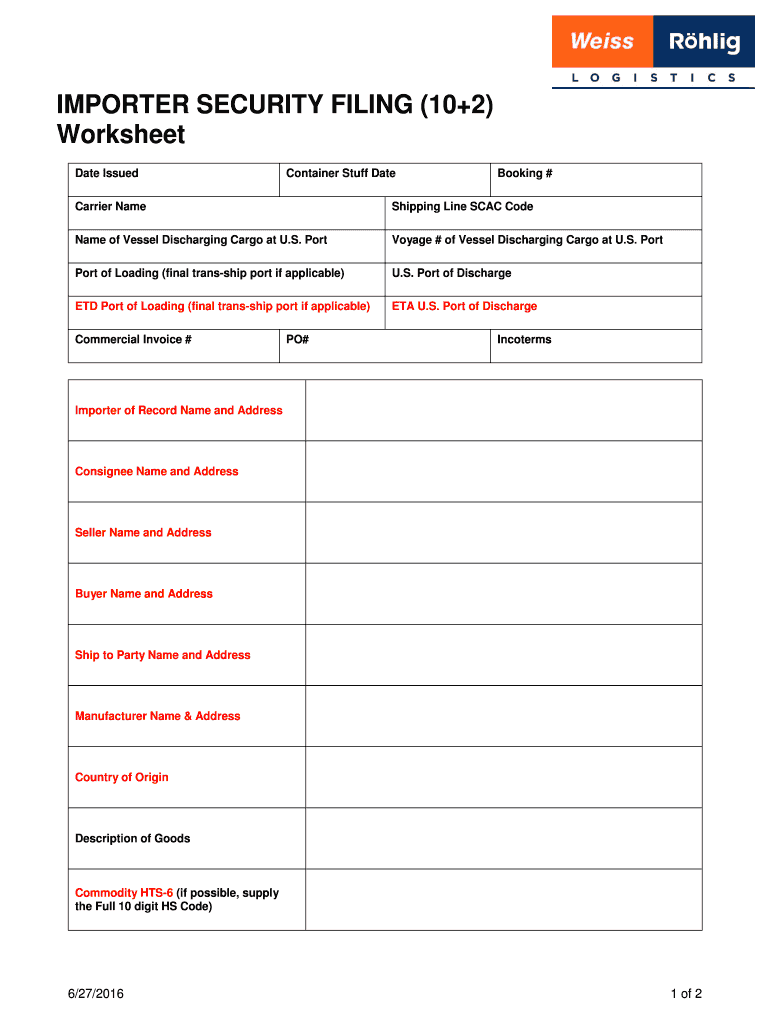

Begin by obtaining the necessary information and documents required for filing the Importer Security Filing (ISF) 102 form.

02

Ensure that you have the importer's name and address, consignee's name and address, and the buyer or owner's name and address.

03

Gather information about the seller or shipper, including their name and address.

04

Include details about the vessel or aircraft, such as the name, voyage number, and estimated arrival date at the first US port.

05

Provide information about the bill of lading or airway bill number and the country of origin of the goods.

06

Fill out the required information about the packing and shipping of the goods, including container numbers, seal numbers, and the number of packages.

07

If applicable, provide information about the merchandise being shipped, including descriptions, quantities, and weights.

08

Review the completed form for accuracy and completeness, ensuring that all relevant information is included.

09

Submit the completed ISF 102 form to the Customs and Border Protection (CBP) at least 24 hours before the goods are loaded onto the vessel or aircraft.

10

Keep a copy of the filed form for your records and ensure that the information provided is accurate and up to date.

Who needs importer security filing 102?

01

Importers or their agents who bring goods into the United States by vessel or aircraft are required to submit the Importer Security Filing (ISF) 102 form.

02

It is mandatory for anyone who imports merchandise into the US to file the ISF 102 form, regardless of the value or quantity of the goods.

03

Whether you are a commercial importer or an individual bringing personal goods, you need to comply with the ISF 102 filing requirement.

04

It is essential for importers to fulfill this requirement to ensure compliance with US customs regulations and maintain smooth operations during the import process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in importer security filing 102 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing importer security filing 102 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the importer security filing 102 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign importer security filing 102 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit importer security filing 102 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like importer security filing 102. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is importer security filing 102?

Importer Security Filing (ISF) 102 is an electronic filing that must be submitted to US Customs and Border Protection (CBP) at least 24 hours before goods are loaded onto a vessel bound for the United States.

Who is required to file importer security filing 102?

The importer of record or their authorized agent is required to file Importer Security Filing (ISF) 102.

How to fill out importer security filing 102?

Importer Security Filing (ISF) 102 can be filled out electronically through the Automated Broker Interface (ABI) or through the online portal of CBP.

What is the purpose of importer security filing 102?

The purpose of Importer Security Filing (ISF) 102 is to improve security measures by providing CBP with advance information about the goods being imported into the United States.

What information must be reported on importer security filing 102?

Importer Security Filing (ISF) 102 requires information such as bill of lading number, shipper name and address, consignee name and address, and detailed description of the goods.

Fill out your importer security filing 102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Importer Security Filing 102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.