NJ Form A-1 2015 free printable template

Get, Create, Make and Sign new jersey appeal 2015

Uncompromising security for your PDF editing and eSignature needs

NJ Form A-1 Form Versions

How to fill out new jersey appeal 2015

How to fill out NJ Form A-1

Who needs NJ Form A-1?

Instructions and Help about new jersey appeal 2015

Five visitors Joe from how to form an LLC org, and today we're going to form an LLC in the state of New Jersey now the first thing that you want to do is if you're watching this on YouTube you want to click on the link in the description, so you can get on the same page as us and this is a free guide to form an LLC in New Jersey so what we're going to do is go down to the New Jersey LLC search just below with a box outline is right on the bottom there and the number one reason why an LLC will get rejected at the state level is because the person who applied for the LLC had the same name as another LLC that's already registered, so you want to go in here and just make sure that the name that you choose has not been taken, so you use one with this online button and business entity name search this is name you just type in anything right here hit continue, and it will give you the results so let's now that we've let say that we have our name, and we're ready to go to the next step if you don't know your name hit pause, but we'll go step one go to New Jersey LLC formation website now New Jersey you guys are lucky where your state has with the times when you can do it online you don't have to do a paper filing any more like 35 of the other states, so you just say it please select corporation type, and you just hit New Jersey don't mess tech limited liability company and type in your name it's a bit business name and there you're off the state will guide you through the rest of the process all you have to do is as you can see inter filing details sign your filing and what it will do is probably an electronic signature pay the filing fee as we see on our website step two is paid one hundred and twenty-five dollar filing fee, and you'll receive your LLC formation from stay within 10 to 15 business days now here's the thing though that you have to do that other states don't have to do all new LLC's in the state of New Jersey are required to filled out what is called a business registration application in order to register with the New Jersey Division of Revenue and the filing fee is $125 for every member so if you have two people it's 250 and keeps going out 125 for every member, but this form looks a little's right on our website as well, and it's a PDF document and what you do is after you receive your LLC in the mail you'll just go through this form it's really long, but you're going to have to file this form back to the state and just say exactly these are all 1 are called Na ICS numbers way at the top here which is a six-digit code to identify your industry, and it basically is just pointless stuff that the state wants, but you're going to have to fill this all out and that's it that you submit this back to the state, and it's $125 for every member like we said and your LLC is official now while you're waiting for your LLC to come back from the state it's probably a good idea if you applied for an IIN number or what is called a tax ID number now you...

People Also Ask about

How does the NJ Homestead rebate work?

What is the income limit for the homestead rebate in NJ?

How much will my NJ Homestead rebate be?

At what age do you stop paying property taxes in New Jersey?

Who is eligible for the New Jersey Homestead Rebate?

How is the NJ Homestead rebate calculated?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

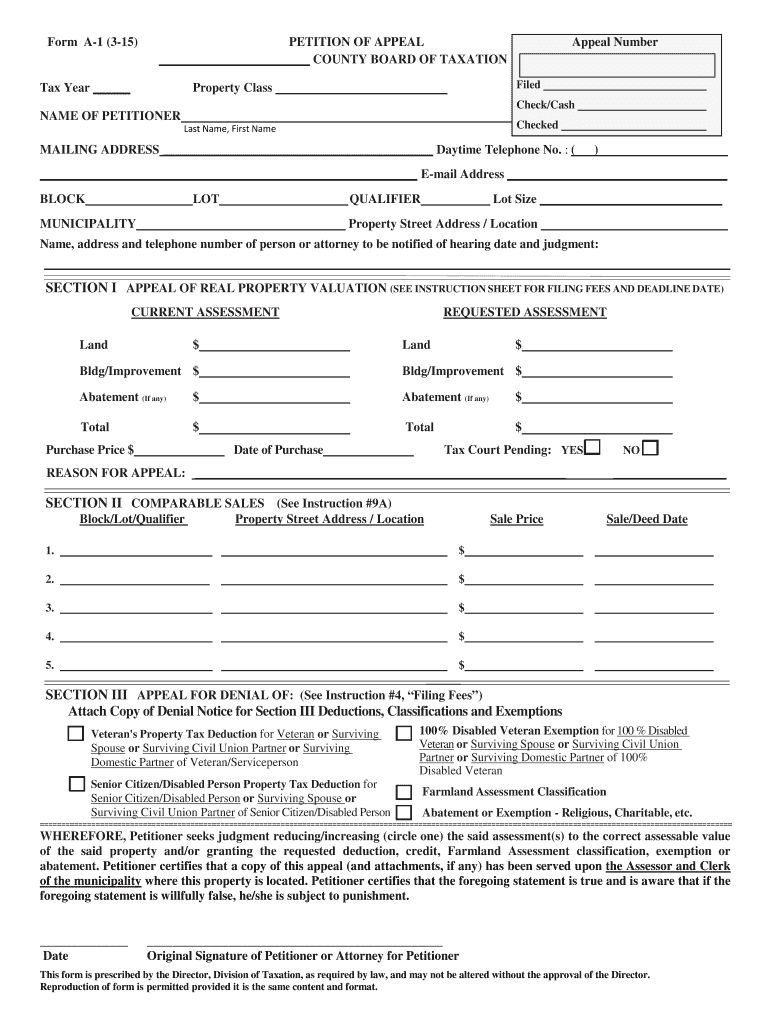

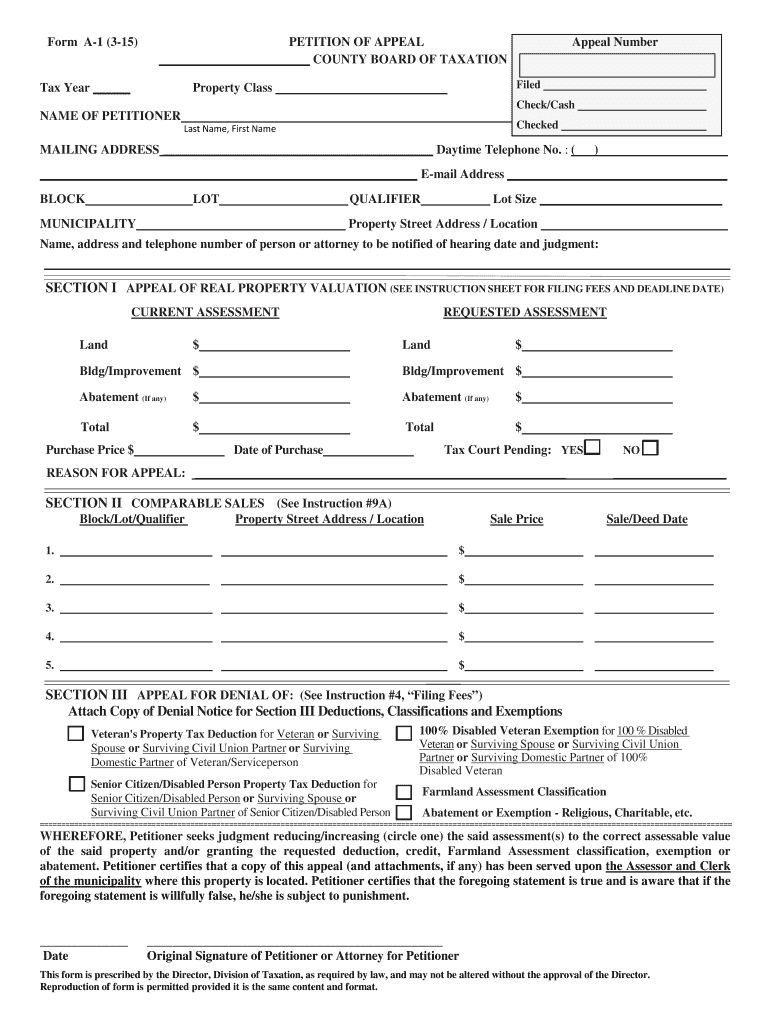

What is NJ Form A-1?

Who is required to file NJ Form A-1?

How to fill out NJ Form A-1?

What is the purpose of NJ Form A-1?

What information must be reported on NJ Form A-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.