Get the free Westpac Self-Funding Instalments Product Disclosure Statement. This document is a Pr...

Show details

Westpac Refunding Installments Supplementary Product Disclosure Statement Date: 29 April 2016 to the Product Disclosure Statement dated 1 July 2013 Issued by Westpac Banking Corporation ABN 33 007

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign westpac self-funding instalments product

Edit your westpac self-funding instalments product form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your westpac self-funding instalments product form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing westpac self-funding instalments product online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit westpac self-funding instalments product. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out westpac self-funding instalments product

How to fill out westpac self-funding instalments product

01

To fill out Westpac self-funding instalments product, follow these steps:

02

Visit the Westpac website and navigate to the self-funding instalments product page.

03

Read and understand the product information and terms and conditions.

04

Determine the number of units or quantity of the underlying asset you wish to buy.

05

Check the current market price of the underlying asset.

06

Calculate the required upfront payment by multiplying the number of units with the market price.

07

Confirm your eligibility to participate in the self-funding instalments program.

08

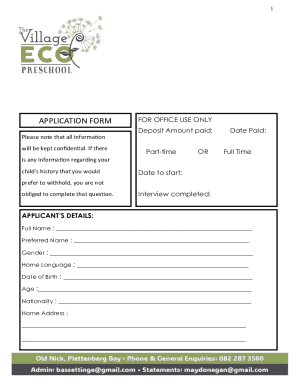

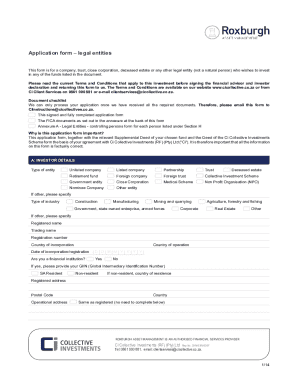

Complete the application form available on the website.

09

Provide accurate personal and financial details as requested in the form.

10

Review the form and ensure all information is correct.

11

Submit the completed form and wait for approval from Westpac.

12

Once approved, make the upfront payment to secure the self-funding instalments.

13

Monitor your investment and manage the ongoing payments as per the terms.

14

Seek professional advice if needed.

Who needs westpac self-funding instalments product?

01

Westpac self-funding instalments product is suitable for individuals who:

02

- Want to gain exposure to a specific underlying asset without purchasing it outright.

03

- Have some knowledge of investment products and are comfortable with market risks.

04

- Seek the potential for capital growth and income through investing.

05

- Are looking for a flexible investment option that allows for buying and selling of units.

06

- Are willing to commit to ongoing payments and monitor the performance of the investment.

07

- Are eligible and meet the criteria set by Westpac for participating in the self-funding instalments program.

08

It is advisable to consider your financial goals, risk tolerance, and seek professional advice before deciding to invest in Westpac self-funding instalments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit westpac self-funding instalments product on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing westpac self-funding instalments product right away.

How do I fill out the westpac self-funding instalments product form on my smartphone?

Use the pdfFiller mobile app to complete and sign westpac self-funding instalments product on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete westpac self-funding instalments product on an Android device?

Use the pdfFiller mobile app to complete your westpac self-funding instalments product on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is westpac self-funding instalments product?

Westpac Self-funding Instalments (SFI) are a type of investment product offered by Westpac that allow investors to borrow money to invest in shares or managed funds.

Who is required to file westpac self-funding instalments product?

Individuals or entities who have invested in Westpac Self-funding Instalments are required to file the necessary documentation for tax reporting purposes.

How to fill out westpac self-funding instalments product?

To fill out Westpac Self-funding Instalments product, investors need to provide information about their investments, including the amount borrowed, the assets purchased, and any income generated.

What is the purpose of westpac self-funding instalments product?

The purpose of Westpac Self-funding Instalments product is to allow investors to leverage their investments by borrowing money to invest in shares or managed funds.

What information must be reported on westpac self-funding instalments product?

Investors must report the amount borrowed, the assets purchased, any income generated, and any capital gains or losses on their Westpac Self-funding Instalments product.

Fill out your westpac self-funding instalments product online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Westpac Self-Funding Instalments Product is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.