Get the free sro notice of trust acquisition

Show details

28 Feb 2017 ... In addition to consolidating a number of forms, the SRO has also made the decision to cease the use of Land Tax Trust Form 09 (Notice of disposition of an interest in land). As such,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sro notice of trust

Edit your sro notice of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sro notice of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sro notice of trust online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sro notice of trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

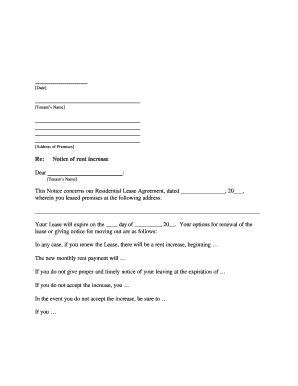

How to fill out sro notice of trust

How to fill out notice of trust acquisition

01

Obtain a copy of the notice of trust acquisition form.

02

Read the instructions carefully to understand the requirements and guidelines for filling out the form.

03

Provide the necessary information about the trust acquisition, including the name of the trustee, the date of acquisition, and the details of the trust being acquired.

04

Ensure that all the required fields are filled out accurately and completely.

05

Review the completed form for any errors or missing information.

06

Sign and date the notice of trust acquisition form.

07

Submit the form to the appropriate authority or entity as specified in the instructions.

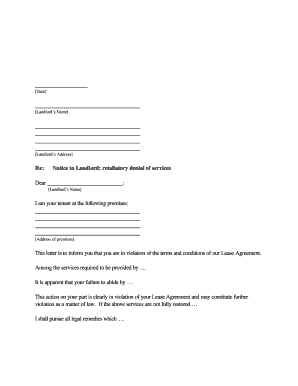

Who needs notice of trust acquisition?

01

Individuals or organizations acquiring a trust or becoming a trustee may need a notice of trust acquisition.

02

Real estate agents or brokers involved in trust transactions may also require this document.

03

Financial institutions or legal professionals handling trust acquisitions must have a notice of trust acquisition on file.

04

Government agencies or regulatory bodies may request this form for compliance and record-keeping purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a trust?

While trusts are highly structured, they do not protect your assets from creditors seeking restitution. In fact, creditors can file a claim against the beneficiaries of the estate should they learn of the person's passing.

What does it mean for land to be taken into trust?

A land trust is a legal entity that takes ownership of, or authority over, a piece of property at the request of the property owner. Land trusts are living trusts that allow for the management of property while the owner is alive.

What does it mean to put land into trust?

Trust land is territory, whereby one party agrees to hold title to the property for the benefit of another party. Placing tribal land into a trust is the process where the Department of the Interior acquires the title to a land and holds it for the benefit of a tribe or individual tribal members.

What are the disadvantages of putting land in a trust?

However, we hope this article has been helpful in pointing out land trust disadvantages, including the loss of rights and exemptions. Redemption rights can be jeopardized in case of foreclosure. Homestead bankruptcy protection and tax benefits are lost. Lastly, you lose secondary market loan options.

How do I put land into a trust?

You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

What assets Cannot be placed in a trust?

What assets cannot be placed in a trust? Retirement assets. While you can transfer ownership of your retirement accounts into your trust, estate planning experts usually don't recommend it. Health savings accounts (HSAs) Assets held in other countries. Vehicles. Cash.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sro notice of trust without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sro notice of trust, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit sro notice of trust in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing sro notice of trust and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit sro notice of trust on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign sro notice of trust. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

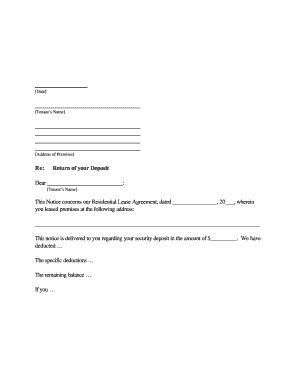

What is notice of trust acquisition?

A notice of trust acquisition is a legal document that must be filed to notify the relevant authorities about the acquisition of a trust.

Who is required to file notice of trust acquisition?

Any individual or entity that acquires a trust is required to file a notice of trust acquisition.

How to fill out notice of trust acquisition?

The notice of trust acquisition can be filled out by providing information about the trust, the acquiring party, and other relevant details. It is recommended to consult with a legal professional for accurate completion.

What is the purpose of notice of trust acquisition?

The purpose of the notice of trust acquisition is to inform the authorities and other interested parties about the change in ownership of a trust.

What information must be reported on notice of trust acquisition?

The notice of trust acquisition typically requires information about the trust, the acquiring party, the date of acquisition, and any other relevant details.

Fill out your sro notice of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sro Notice Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.