Get the free This deed of Trust made on this 15th of October 2010 by Mrs

Show details

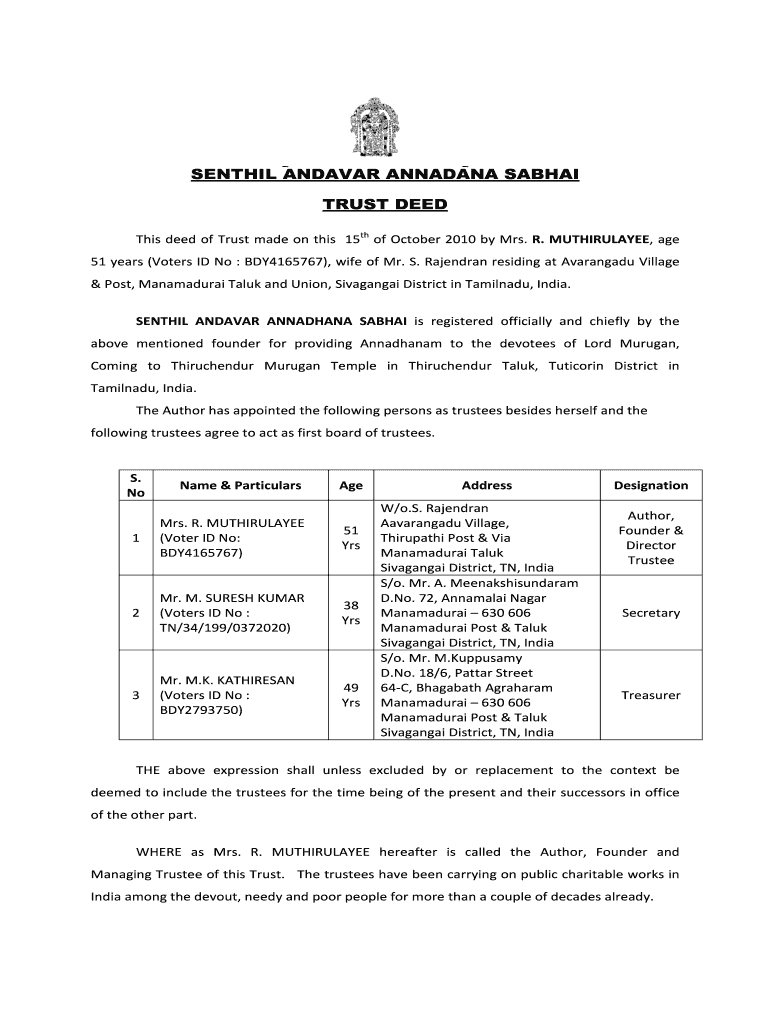

ENTAIL KANDAHAR KANNADA SAB HAI TRUST DEED This deed of Trust made on this 15th of October 2010 by Mrs. R. MUTHIRULAYEE, age 51 years (Voters ID No : BDY4165767), wife of Mr. S. Rajendra residing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign this deed of trust

Edit your this deed of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this deed of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing this deed of trust online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit this deed of trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out this deed of trust

How to fill out this deed of trust

01

Read the instructions: Begin by thoroughly reading the instructions provided with the deed of trust form.

02

Gather necessary information: Collect all the information required to fill out the form, including names, addresses, and loan details.

03

Identify the parties involved: Determine the borrower and lender, as well as any additional parties, such as trustees or beneficiaries.

04

Fill in the initial details: Enter the date of the deed of trust, the state and county where it will be recorded, and any other relevant information at the top of the form.

05

Describe the property: Provide a detailed description of the property being used as collateral, including legal descriptions, addresses, and any encumbrances or liens.

06

State the loan details: Specify the loan amount, interest rate, repayment terms, and any other relevant financial terms.

07

Include borrower and lender details: Enter the full legal names, addresses, and contact information of the borrower(s) and lender(s).

08

Add trustee and beneficiary information: If applicable, include the names, addresses, and contact information of the trustee(s) and beneficiary(ies).

09

Sign and notarize: Make sure all required parties sign the deed of trust in the presence of a notary public. Get the document notarized.

10

Record the deed of trust: File the completed and notarized deed of trust with the appropriate county recorder's office.

Who needs this deed of trust?

01

Real estate buyers: Anyone purchasing a property using financing from a private lender may require a deed of trust as part of the loan agreement.

02

Private lenders: Individuals or institutions providing loans secured by real estate may use a deed of trust to protect their interests in the property.

03

Homeowners seeking refinancing: Those looking to refinance their mortgage or take out a home equity loan may need to fill out a new deed of trust to reflect the updated terms.

04

Property investors: Investors who provide financing for real estate transactions often use a deed of trust to secure their investment.

05

Contractors or builders: Individuals or companies providing construction financing may utilize a deed of trust to secure their loan and protect their interests in the property being built.

06

Trustees or beneficiaries: Those who are designated as trustees or beneficiaries in a trust agreement may require a deed of trust to document their involvement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my this deed of trust directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your this deed of trust as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit this deed of trust on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share this deed of trust on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete this deed of trust on an Android device?

Complete your this deed of trust and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is this deed of trust?

A deed of trust is a legal document that transfers the title of a property to a trustee as security for a loan.

Who is required to file this deed of trust?

The borrower is required to file the deed of trust.

How to fill out this deed of trust?

The deed of trust must be completed with the property details, borrower information, lender information, and signatures of all parties involved.

What is the purpose of this deed of trust?

The purpose of a deed of trust is to provide security for a loan by transferring title to a trustee.

What information must be reported on this deed of trust?

The deed of trust must include property details, borrower information, lender information, and signatures of all parties involved.

Fill out your this deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Deed Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.